I have just published a new class called Analysis Of Entry Signals.

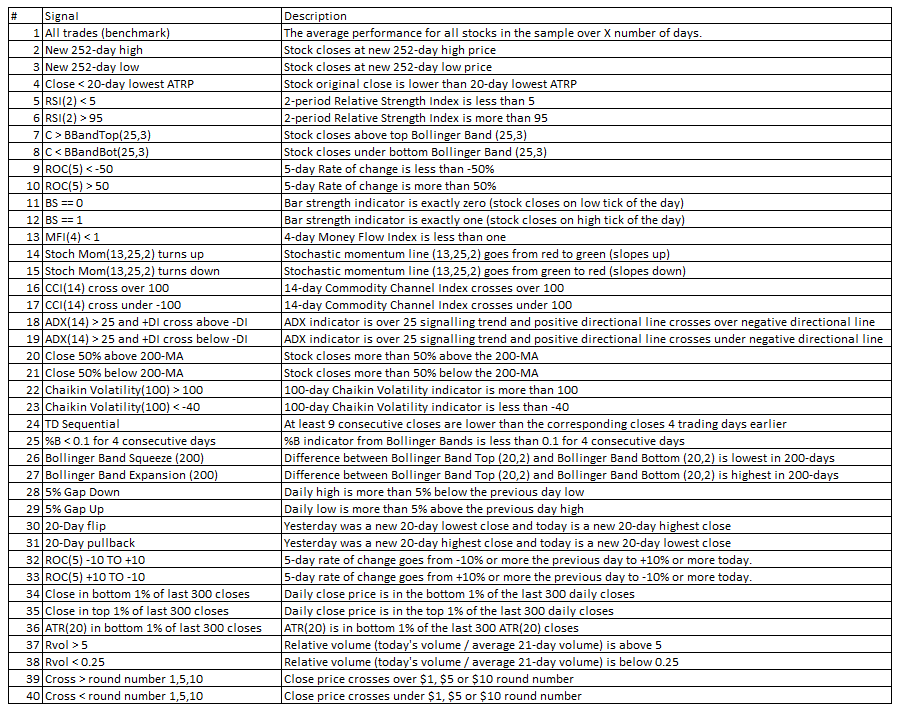

This is a 1-hour class where I take 40 different trading signals and analyse their profit potential on US stocks over different time horizons, spanning 2-days to two years.

The idea behind this class is to analyse a large amount of historical data to find out which entry signals work and which do not.

I have been wanting to do this analysis for some time as I want a more scientific method for filtering out opportunties. This research provides many interesting insights that can be used to better understand the market.

Signals Tested

In total, I test 40 different trading signals including:

- New Highs

- New Lows

- ADX Indicator

- Moving Averages

- RVol (relative volume)

- Bollinger Band squeeze

- Money Flow Index

- Gaps

- Chaikin Volatility

- Rate-of-Change

- and more…

The analysis covers more than 12,000 US stocks between January 1999 to January 2021 including delisted stocks and transaction costs. Altogether, over 20 million historical trades are analysed.

The idea is to use large sample sizes to find consistent, reliable entry signals and discover what is working in today’s stock markets.

What You Will Learn

The analysis is designed to uncover market truths, discover small edges and point you in the right direction for future research.

We are analysing nothing but the pure profit potential of various indicators to see what works and what doesn’t.

This analysis does not show a complete trading strategy nor does it go into any detail about the indicators themselves or how to calculate them.

Rather, the research provides insights which could be the starting point for a more sophisticated investment strategy.

Alternatively, the signals can be used as an initial screening tool for filtering down large numbers of opportunities to a more manageable number, ready for human analysis.

For example, one of the trading signals we tested is a cross over a round number such as $1, $5 or $10.

Many traders suggest that round numbers act as important levels of interest and when these numbers are breached, good trading opportunities arrive.

We found that the signal produced a loss of -0.21% over two days suggesting it is not a reliable trading pattern with short holding lengths.

The performance did improve over 50 and 250 days where we recorded an average profit per trade of 2.9% and 16.24% respectively.

How To Access This Research

For access to this research please sign up for the class. Alternatively, you can enrol in our all-access package to gain access to all of our classes, strategies and code.

Putting together this class has been informative and I intend to do more analysis in the future including analysis of fundamental signals. Thank you for your support!