Interest rates are low, taxes are low and the stock market is firing on all cylinders.

The current bull market is already the longest in history and just a few percent away from being the largest in history.

But bull markets cannot last forever. Some time in the not too distant future a bear market will hit and many investors will be unprepared.

In this article we look at 10 different strategies that traders might use to navigate a market downturn.

Remember that the average bear market (defined by a peak to trough decline of at least 20%) lasts about a year and loses around 30% on average.

1. Short Sell Stocks

A logical way to play any bear market is to simply go short stocks. After 11 years of upward price action there is no shortage of overvalued securities to target.

Large cap technology stocks have seen some of the biggest gains recently with numerous big name companies hitting price-to-earning ratios over 30.

Microsoft is currently trading at a P/E of 31, Google is 32 and AMD has an enterprise value to EBITDA of 100 times.

Apple’s market cap is approaching $1.4 trillion which makes it larger than the entire Taiwan stock exchange and almost on a par with the GDP of Australia.

No stock can go up forever and all these companies will be hit hard by a bear market. The question is when and how much higher can these companies go before the next downturn hits?

Many are saying that there is no reason for stocks to drop with interest rates so low and no major problems in the economy. That might be true but you have to remember that markets look ahead, a long way ahead. As Stanley Druckenmiller puts it:

Never, ever invest in the present…you have to visualize the situation 18 months from now, and whatever that is, that’s where the price will be, not where it is today.

Stanley Druckenmiller

So at what point is the Fed going to turn off the spigot? They can’t leave it too late or inflation will get out of control. And what if something totally unexpected happens?

For those looking for more short selling ideas, Identifying Overvalued Equity is a useful academic paper that looks at one strategy for identifying overvalued securities.

2. Move Into Safe Havens

Another strategy for a bear market is to move into safe haven assets. These are assets that typically don’t move very much but usually go up when markets enter panic mode.

This strategy is less aggressive than short selling stocks outright which can backfire if you get your timing wrong.

The important thing here is to choose assets that have a very low risk, practically zero risk of ruin. For me, the main ones are:

- US Treasuries

- US Dollar

- Swiss Franc

- Japanese Yen

Gold is often touted as a safe haven as well but I don’t think it truly is one.

It can act as a good diversifier against geopolitical risk and against inflation but it doesn’t always hold value during a crash. Remember that it actually went down in 2008 when markets turned sour.

Now it could go up this time because of the threat of inflation. I’m just not sure it is a true safe haven. Either way a small amount should probably be included in a portfolio for diversification purposes.

3. Hedging Strategies

Hedging strategies are another play to consider when you don’t want to totally remove your exposure to risk assets.

This is often a good idea since it’s impossible to time the market with any precision but you can put some short-term hedges in place when markets are becoming unbalanced.

There are several different ways to hedge against a portfolio of equities and each one has its own advantages and disadvantages.

For example:

- Buying put options

- Shorting futures contracts

- Shorting individual stocks

- Buying inverse ETFs

Buying put options can give you a good amount of leverage with which to offset a long portfolio and it doesn’t require too much margin. However, it can be a complex strategy and costly due to options premiums.

There are also various different options strategies that you can consider which can get complex if you have never used options before.

Shorting index futures such as the S&P 500 E-Mini can work well. You can calculate a position size that will offset the amount of risk you’re happy with and it’s not too difficult to do.

However, small accounts may find this difficult because the minimum trade size could be too large for the portfolio, because of the leverage involved. Some investors also won’t be able to access futures trading.

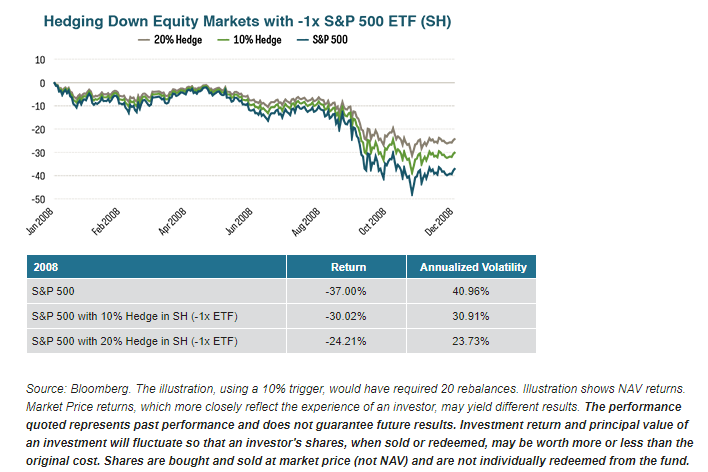

Inverse ETFs such as the ProShares Short S&P 500 ETF (SH) can also provide a good way to offset equity risk. The downside here is that these ETFs suffer from time decay.

They are designed for one-day holding periods and can lose value during market volatility.

However, they can do a reasonable job if you don’t hold them too long and don’t have access to other choices. The other benefit is that you know the maximum that you can lose by going long these securities.

4. Mean Reversion Trading Systems

A common misconception about bear markets is that long-only trading strategies all lose money and only short strategies perform well.

However, this doesn’t have to be the case and this was clearly shown in the 2008 bear market.

During sustained down trends you get periods of falling share prices but you also get moments of upward movement as well.

These are often known as relief rallies, short squeezes or they might be called a dead cat bounce.

When the market rallies during a bear market the movement is often sharp and short in duration which turn out to be good conditions for a mean reversion type strategy.

Mean reversion strategies are essentially liquidity providers, they step in during times of market panic and get rewarded for taking on risk.

So long as the stock is not in terminal decline, it can pay off to buy into heavily oversold names. These can bounce back on any positive news and when short sellers take profits.

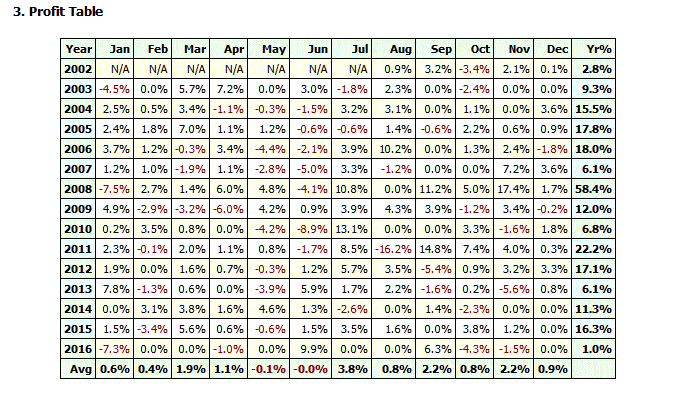

As an example, one mean reversion strategy on our program recorded a backtest return of 58.4% in 2008 trading SPY and TLT long only:

Mean reversion strategies have had a poor couple of years when compared to momentum systems but it won’t be long before they begin to have some success again.

5. Trend Following Futures

Trend following strategies have been around since (at least) the days of Richard Dennis and the Turtle Traders.

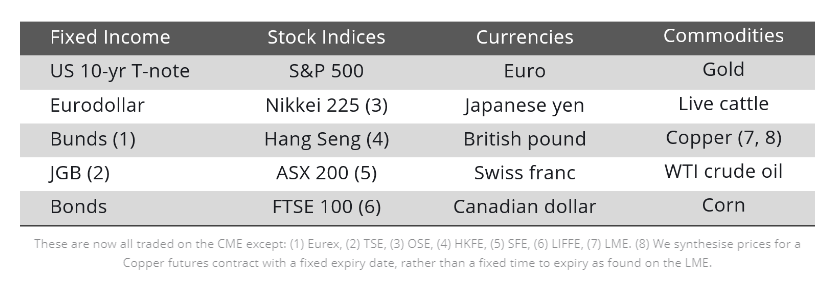

The strategy involves buying up trends and shorting down trends across a broad selection of different futures contracts. In this way you can take bets on uncorrelated assets hoping that at least one or two will enter big trends.

Typically, trend followers break up their portfolios into four or maybe five asset types. Below is the mix used by one of the pioneers in quant trend following Winton Capital:

Trend following in futures gained a lot of popularity after the crash of 2008 because it significantly outperformed while most other hedge funds and investing strategies lost money.

However, the strategy has not done as well in recent years as volatility has dropped and stocks have delivered strong gains. But when stocks drop, it could come to the fore once again.

6. Long-Short Models

Long-short strategies are another good option since they can perform not only in bear markets but also range-bound markets and even bull markets.

Good performance in a raging bull market is obviously difficult when all stocks are going up but it can be achieved if your stock selection is really on point.

The key to a good long-short model during a bear market is to pick high quality stocks on the long side (that people will gravitate to during a crisis) and low quality stocks on the short side.

High quality stocks may include big blue chips, utility stocks and dividend payers whereas low quality stocks are businesses of a speculative nature.

Stocks that have a lot of debt without profitability or with sky-high price to earnings ratios can be highly dependent on market swings and investor sentiment so these stocks can get hit hard in a bear.

Stocks facing structural headwinds/long term systemic declines will struggle too. For example, climate change headwinds are weighing heavily on energy stocks right now.

Quantitative ways to approach a long-short model include using technical indicators or factors.

For example:

- Relative strength

- Historical volatility

- Momentum

- Return on equity

- Book value

- Earnings quality

- Profitability

- Short interest

These are all factors that investors have used in the past to separate out stocks. This paper from Blackrock discusses one strategy based on earnings quality.

The idea is that you first sort stocks based on earnings quality (itself comprised of several metrics such as ROE and cash flow) then go long the 30% of stocks with the highest score and short the 30% with the lowest score.

Factor investing is all about holding a large number of stocks so that you can capture the small edge that is present in that particular factor.

By holding an equal number of long and short positions you can maintain an overall neutral exposure to the market.

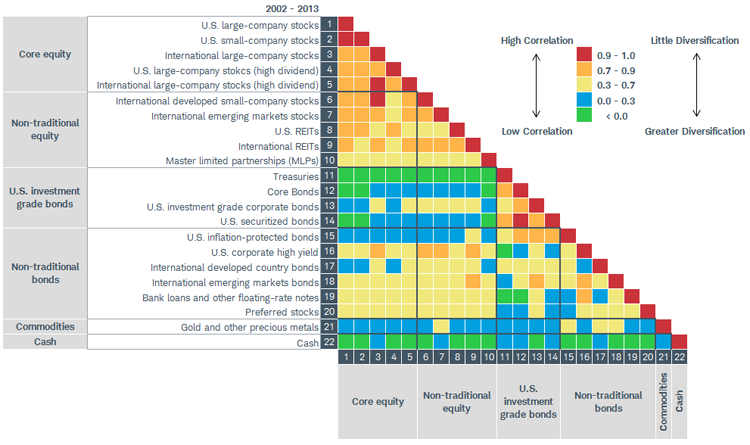

An alternative to using factors is to look at historical correlations and implement a pairs trading strategy.

This is where you track two similar symbols and buy one and short the other when the correlations move out of sync. This is often based on standard deviations away from the average correlation.

For an idea of how this is done you can take a look at the paper Pairs Trading: Performance Of A Relative Value Arbitrage Rule.

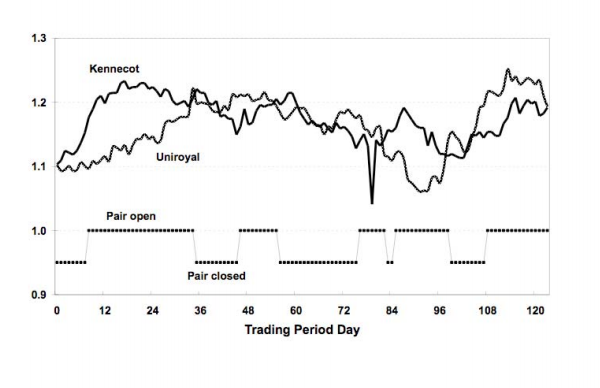

The following graphic shows an old example of a pair trade:

7. Volatility Trading

It’s not always easy to predict the duration of a bear market or the stocks that will face the biggest losses.

Sometimes it’s easier to trade the volatility itself, which is historically mean reverting (although there is also evidence of clustering during market breakdowns).

Most VIX ETFs were not around the last time we had a significant market crisis and they are likely to play a much larger role for traders the next time round.

Volatility strategies typically come in three different flavours; long volatility, short volatility and term structure trades.

The latter is all about identifying opportunities in the pricing of VIX futures and cash products (contango and backwardation). Such movements are likely to get even more out of sync during a market downturn.

Going short volatility works well when the VIX has spiked to a high level and you can see a calming influence on the cards (for example, a central bank announcement). On the other hand, shorting volatility ETFs when the market is rampant is dangerous.

Going long volatility works well when the VIX has been low for a long time and you can see a bearish catalyst ahead. However, the time decay can be so vicious that your timing needs to be spot on.

8. Value Strategies

There is an interesting paper on the SSRN website called Value Bubbles which looks at how value investing strategies perform over different market periods.

The authors found that value strategies are about three times more potent after a period of negative market return, implying that the best time to buy value stocks is during or towards the end of a bear market or correction.

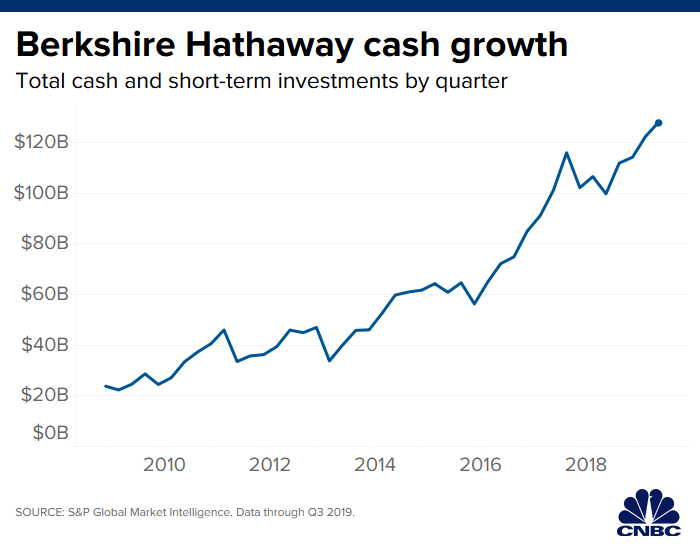

This makes intuitive sense and might explain why Warren Buffett is currently sitting on so much cash right now (about $130 billion).

When markets drop, that will be the time to deploy capital and pick up high quality companies on sale.

The strategy shown in the paper is to go long high book-to-market stocks when the monthly return on the market is negative.

Specifically, you measure the monthly return on the CRSP value weighted index then go long the highest book-to-market stocks whenever the monthly return is negative (and short the lowest book-to-market stocks). Then hold for six months.

9. Calendar Anomalies

There are numerous seasonal or calendar type anomalies. Many of them are short-term so there’s little reason why they would stop working during a bear market.

Some of them involve going short which means they can take advantage of market losses too. I covered quite a few of these anomalies on my post about stock market strategies.

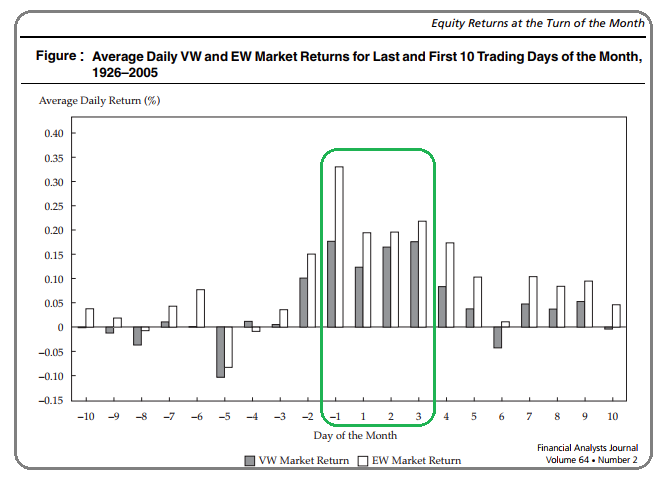

The turn of the month effect and small cap effect in January are fairly strong anomalies that have stood the test of time and work fairly well. The turn of the month effect could get even stronger in a bear market since stocks would be theoretically coming off a lower base.

The website Quantpedia lists several other anomalies that they believe could act as a crisis hedge.

They include:

- Shorting stocks on expiration day

- Shorting stocks on the last day/last hour of the month

- Intraday currency seasonality

- 12 month seasonal reversals

Options expiry days are always interesting to watch. I did test one similar strategy and it worked well in the backtest but I haven’t reviewed it recently.

According to Quantpedia, a strategy that shorts stocks during the last hour of the month returns about 20 basis points per trade, with little volatility.

This is one of those short-term edges that, if true, could easily be enhanced through leverage.

10. New Edges

When a bear market does hit, previous market patterns will disappear and strategies that were working will stop working.

However, the good news is that new patterns and new edges will emerge and these edges are likely to be more profitable because there will be more panic and less price efficiency.

To fully take advantage of this traders may need to shorten their time horizons and consider moving into day trading strategies.

System traders should consider settling for smaller samples of data but look for strategies with a bigger edge and a rational explanation for why they appear to be working. There is less data in a bear market but that doesn’t mean edges cannot be found.

The trading of news is also worth keeping in mind during a bear market as news tends to have a bigger impact during market panics.

In 2008, for example, there were numerous times when the market rallied higher after a news release or piece of government intervention. Ultimately, these spikes provided great opportunities for traders to short the rallies in the longer term down-trend.

You can also bet that if a bear market does hit, central banks will do all they can to stem the fallout. So a successful strategy might be to go long in the run up to central bank announcements and short after the news is priced in.

Or just be ready to avoid shorting when central banks are scheduled to meet.

This Time Will Be Different

In this post I have talked about a selection of strategies that might be used to navigate the next bear market.

Some of these strategies have been selected because they have shown to be profitable in past crises.

For example, trend following futures, mean reversion in stocks, they did well in 2008 and other bear markets before it.

However, that doesn’t mean they will automatically do well in the next bear market. We don’t yet know what will be the drivers of the next downturn.

We don’t know what the leading stocks will be or the extent or duration of the price drop.

A bear market consisting of a rapid 25% drop then rebound (similar to what happened in 1987) is much different to a prolonged downturn lasting two or three years (such as was seen in the 1970s).

However, I’m sure many of the strategies on this page will be successful during the next bear. Hopefully, they’ve given you a few ideas even if you still plan to sit on your hands and ride out the storm.

I read your content. Very nice. Your content is very informative. The content you are writing about is very important about trading strategies. I also run a website that works like yours. If you want to know more about trading strategy visit my website.