It was November 2008 and I was a graduate futures trader for a trading house in the UK. I’d been trading full time for only a couple of months.

The credit crunch was in full force and every day presented new challenges and headaches.

Until Lehman Brothers collapsed I had been doing well. Trading a small account, I was happily bringing in a reasonable £300 a day.

Then, everything changed. People thought the financial system might collapse and the markets went into chaos. The FTSE 100 would drop massively in the space of a couple of minutes.

Then, it would reverse almost as fast, for no other reason than traders being too scared to hold on to their shorts.

Some days were good.

The increase in volatility meant you could make large amounts of money trading with just a one lot. Some days were not so easy and soon I was overtrading, trying to pick every crash and rally like a mad professor.

Making Money In Your Sleep

I came into the office one morning at the usual time, 6:50AM. But before I could get to my desk the office manager called out to me. He had a concerned look on his face:

“Joe, did you put a position on overnight?”

What was he talking about?

We were day traders. We never held positions over night (at least not without permission) and I certainly didn’t put any trades on before leaving.

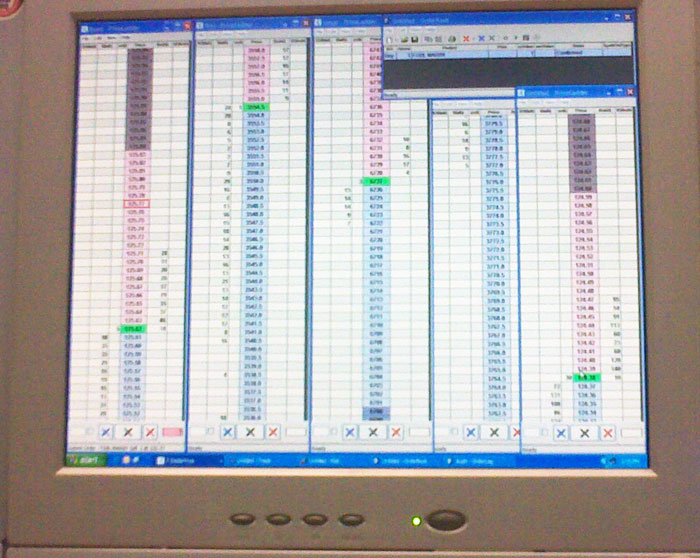

Quickly, I switched on my screens and sure enough I had a live long position on the FTSE 100 future.

At first I couldn’t work it out but then I realised.

The night before I was short the FTSE and in my haste I’d left a stop loss order in the market about 20 ticks away from the action.

I’d closed the short trade at the market but completely forgotten about my stop loss order.

Sometime during the night the stop order had filled leaving me with an open long position in the FTSE 100. I had an open long position without any stop loss or protection and I had no idea.

I felt sick. I couldn’t believe I’d been so reckless.

Then I checked the pre-market futures. They were all up. The spread bettors were calling for the market to open up by 1% percent.

Easy Money

A few moments later the market opened for real and sure enough I was up over £1000 from a trade I didn’t even mean to put on.

I’d made around 100 ticks in my sleep.

For once, my nasty habit of overtrading had actually resulted in a profit. My carelessness had produced one of the best trades of my fledgling career.

I looked at the chart and sold straight away on the open, not wanting to push my luck any further.

Then the FTSE started to drop as usual and I decided to sell another lot.

The open turned out to be the high of the day and I made another £600 on the way down.

Selling rallies was a good strategy back then. In fact, it was probably the only strategy back then. If you tried shorting any move down you usually got chopped up.

Still, it wasn’t a good feeling. I’d been reckless and had got lucky.

Needless to say, my managers didn’t see the funny side of it either.

The money had a distinct bittersweet feeling and I vowed never again to leave the office without checking all my open orders.

Excellent post! I always enjoy reading about the experiences of other. Mistakes are more informative than successes. It’s a good reminder that we are all human and trading can be tough. Thanks for sharing your personal insight.

Thanks DrG, yeah I plan to do a few more of these 🙂