Recently we evaluated the reported holdings of institutional investors using data from Sharadar. (As a reminder, institutional investors in control of over $100 million are required to report their holdings to the SEC every quarter. This information is made public normally 45 days later in what are called 13F filings).

Simple trading strategies that buy the most invested stocks by institutional investors generally do poorly. We tried to identify active investors (as opposed to passive investors who might be replicating a stock market index) by filtering for those holding no more than 10 positions. Although these investors cashed in on the tech boom in 2020-2021, following these low-diversified active investors did not do great either.

The signal-to-noise ratio from institutional trading data seems quite low. Finding alpha is far from trivial. Others have called the problem garbage-in garbarge-out. But why are 13F filings almost worthless? We can think of a couple of reasons.

- The reporting is delayed. If a fund manager decides to make a stock purchase beginning of July (and keeps holding), this position is made public a further 45 days after the end of the third quarter, so mid November. By that time, if the manager was right, the stock price may have already moved.

- 13F filings are a popular source of information for many investors out there. If it is reported that a reputed investor bought a stock, the stock may rise immediately. A recent study suggests that there is little evidence of long-term benefit from copycatting (Brown and Schwarz 2020).

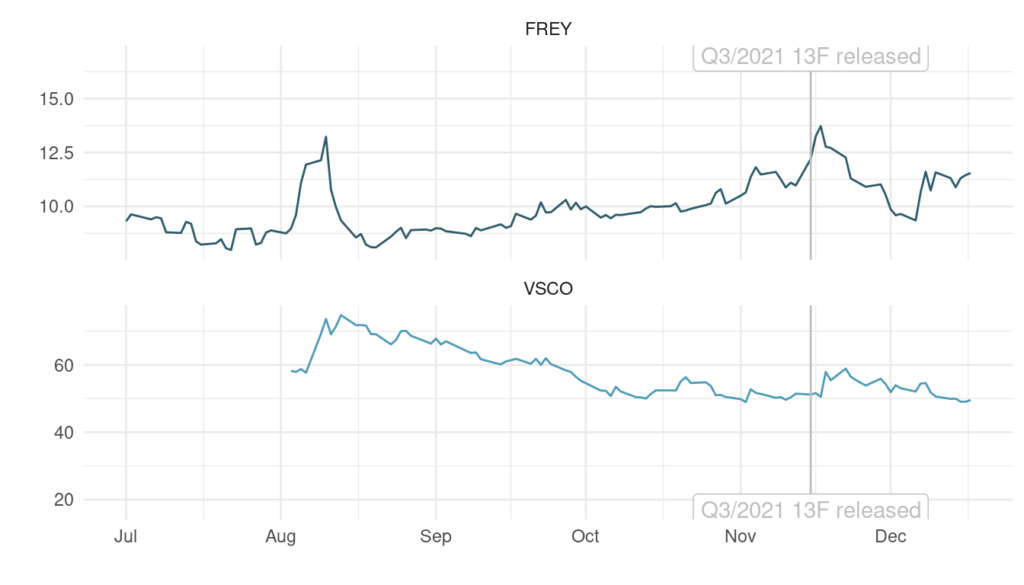

Let’s see these two points in action. As of Q3/2021, David Einhorn (Greenlight Capital, the man who started shorting tech in 2020) reported two new positions in FREYR Battery (FREY, position worth $6.9M) and in Victoria’s Secret & Co (VSCO, position worth $3.6M). We don’t know when the trades were entered exactly, just at some point in the mentioned quarter.

In the next chart we show the two stocks’ prices since July 2021. The date of the 13F release is indicated. In both stocks we see a positive price impact after the release. However, both stocks closed lower a month later.

Making money by copying institutional investors is a tough challenge. But it’s not time to give up yet.

Only The Best Investors Beat The Market

As of Q3 2021, 5,715 investors filed a 13F. Five years earlier we counted 4,055. Of these, only 3,009 (74%) are still around today.

Some investment funds might have changed their name, but many others have gone under due to disappointing returns. Anyone remember Bill Hwang with Archegos Capital? (As a side note, Archegos has never filed a 13F).

To make money in the markets by mimicking the pros, you first need to identify those who are consistently successful.

Retail traders already engage in selective mimicry of institutional trading according to this paper by Polat 2020. Considering that there are traders who can consistently beat the market, the goal is to find them.

In our approach, we first looked at data between 2013 and 2018 to look for institutional investors that did best according to their reported holdings. We then ranked them by the consistency of their positive returns.

Lastly, we compare the current data with data since 2019 to see if previous top investors have continued to shine and what return one might have made following their picks.

Because we do not know the exact date of purchase (and price), we simply take the realized return from mid-quarter through mid-quarter the following year.

Note that due to the reporting delay, this return is out of reach for someone relying on the 13F files for replication.

Finding The World’s Most Consistent Hedge Funds

Let’s go straight to the ranking.

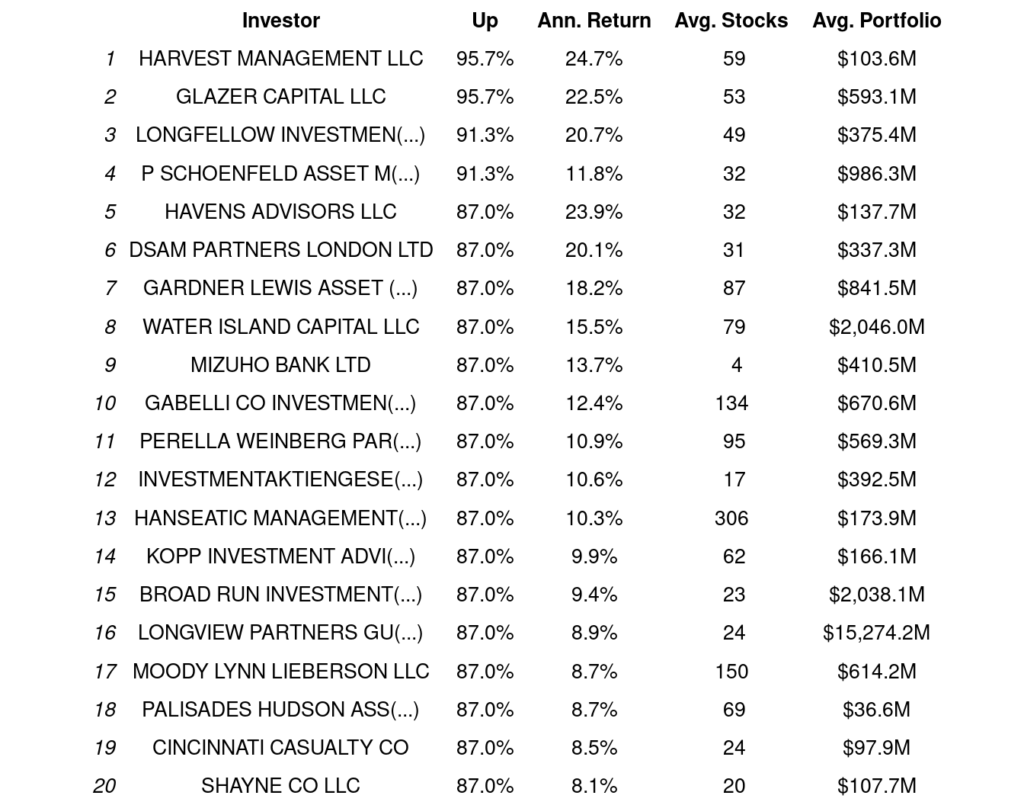

In third place, we have LONGFELLOW INVESTMENT MANAGEMENT CO LLC, a Boston based investment management firm.

Their stock picks closed higher in 91% of the quarters (they only had two quarters out of 23 with negative returns). Their average quarterly return was 4.8% (or 20.7% annualized). On average they reported 49 stock positions for a mean total value of $375M.

Second is GLAZER CAPITAL LLC, an investment management firm/hedge fund founded by Paul J. Glazer. Their picks were up in 96% of quarters with an average quarterly return of 5.2% (22.5% annualized). They held on average 53 positions for an average portfolio value of $593M.

In first place we have HARVEST MANAGEMENT LLC, an asset management firm/hedge fund. Their stocks were up in 96% of quarters delivering quarterly mean returns of 5.7% (24.7% annualized). They had a mean of 59 stock positions in an average portfolio of $104M.

The full top-20 list is shown below:

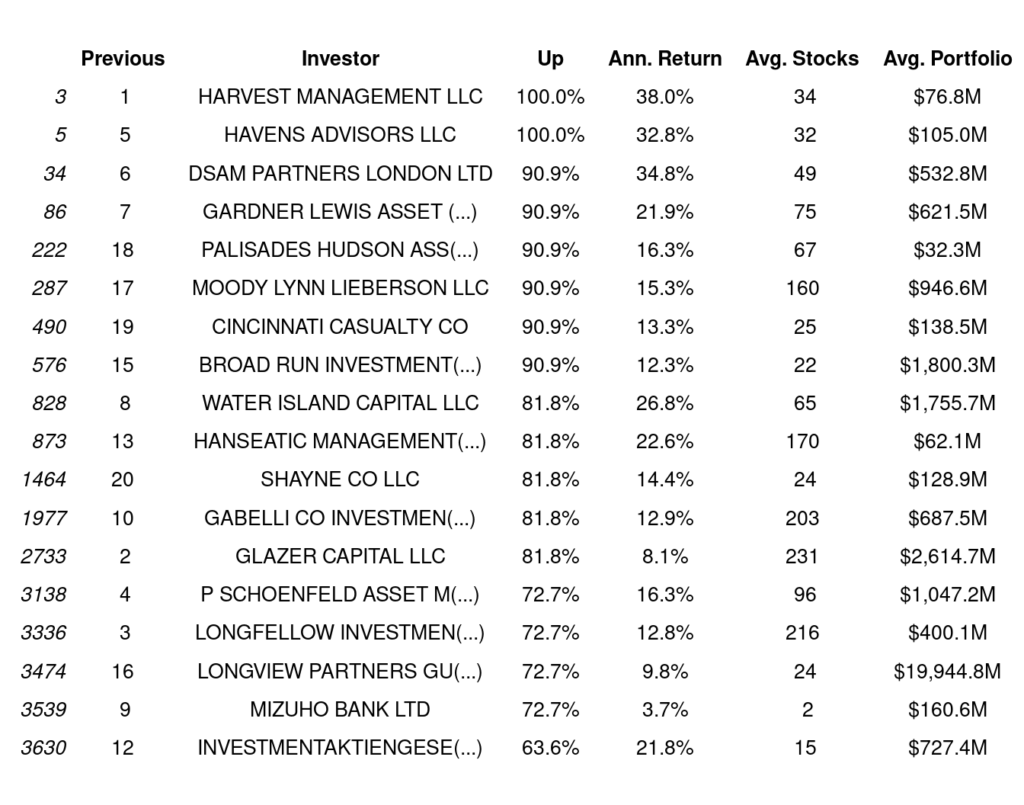

This list can be thought of as our in-sample optimization on the performance of hedge funds. The question is do these hedge funds continue to beat the market (out of sample)?

The answer is: some, but not all.

HARVEST MANAGEMENT LLC, (previous number one) defends its place in the top three. Also, HAVENS ADVISORS LLC kept its fifth position. On the other hand, previous second placed GLAZER CAPITAL LLC fell to rank 2,733 (of 4,228).

Meanwhile, LONGFELLOW INVESTMENT (previously ranked third) is now ranked 3,336.

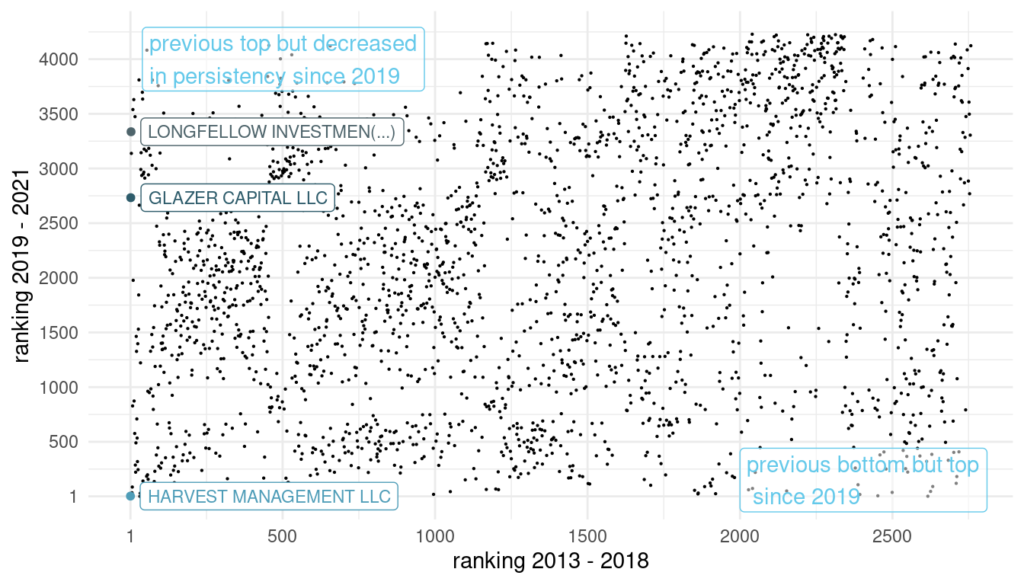

The scatter plot below shows that the overall picture contains a lot of randomness. There is no correlation between hedge fund performance between 2013-2018 and 2019-2021:

How To Make Money Copying Hedge Funds?

In our study of top-ranking institutional investors, we found mixed results regarding the persistence of their performance. Some continue to do well, but most could not continue their streak of positive returns. However, this does not yet mean that copying (previously) successful investors could not be a profitable strategy.

The immediate trading of institutional holdings cannot be replicated as the delay in releasing the data is too long. We need to hope that momentum will continue even after institutional investors have placed a position.

How would a strategy that invests in the stock holdings of these (2013-2018 top) institutional investors perform since 2019? We consider the top-10 picks (by position value) for each of the top-20 investors for each quarter and plot the equity below:

We receive a cumulative return of 71.2% since March 2019 (21.6% annualized). Not a bad result for such a rudimentary analysis, however no better than the return from the S&P 500 which was 78.14% (22.56% annualized).

Final Thoughts

Extracting alpha-generating information from institutional trading data is tough. The issues are the reporting delay and not knowing which investors are actually sharp, i.e. have the skills to beat the market.

We should also be wary for the hot hand fallacy. A hedge fund can do well for a long time (due to luck) then become worse than average in the following years.

13F filings are widely used and we believe that incorporating the information into an investment process is valuable. However, building a trading strategy solely upon 13F filings might not be the best path.

Fortunately there are many different ways to beat the market and we encourage you to do your own research. In our next article we will move away from institutional data and look at something further afield.

Notes: All data sourced from Sharadar. Simulations produced in R, Excel and Amibroker.

Hi Joe,

interesting article. Just curious… Did you include Renaissance Technologies in your sample of analyzed hedge funds? Their Medallion fund should be outperforming market long-term but I am not sure if they have to file a 13F.

Yes, Renaissance Technologies file quite long 13F’s (on average more than 3000 stock positions!). They were identified as a top-ranking investor in the presented approach, so their picks were used in the strategy. Their top-holdings as of September 2021 were NVO, TEAM, and VRSN. You can find this information in the official SEC reporting, or on websites like Whale Wisdom.

because you cannot find a systematically consistent winning investors in a systematic way… well you cannot copy it. Better to understand WHAT and HOW the fund is investing and replicating it on your personal scale/volatility preferences.

Ok.