Ever since I started this website I’ve been focused on systematic trading. I’ve talked about how to build and backtest quantitative trading strategies and its advantages.

I’ve also said that I like to combine quantitative analysis with fundamentals and I have had some success doing so.

Going forward, I’d love to do more deeper research into individual companies. I enjoy providing my views on why I think a particular stock makes a good investment. This is not just from a quantitative stand point but from fundamentals as well.

With that said, I’d like to share this first write up for Genius Sports (DMYD).

Genius Sports (DMYD)

Genius Sports is affecting a merger with dMYD Technology Group II ticker symbol DMYD. Following the merger Genius is likely to trade on the NYSE under the ticker GENI.

I don’t like a lot of SPACs but Genius Sports looks to be an interesting business and has not been the target of rampant speculation. The company operates as part of a duopoly in the high growth sports betting industry.

What does the company do?

According to the website, “Genius is the official data, technology and commercial partner that powers the global ecosystem connecting sports, betting and media.”

Basically, Genius collects live sports data. Things like number of field goals and passes. It distributes it to firms across three segments; sports, data and streaming (mostly sportsbooks), and media.

For example:

- Sports companies use Genius data to analyse matches, scout players and improve team performance. In 2020, this segment made up 11% of forecast revenue.

- Betting platforms like Flutter use Genius to price their sportsbooks. This allows them to deliver competitive in-play betting. In 2020, this segment made up the bulk (74%) of forecast revenue.

- Media companies use Genius data to engage and entertain customers. They also use the data to run ads and sell tickets. In 2020, this segment made up 15% of forecast revenue. Since 2008, the Group’s LiveStats solutions have been used at over 500,000 games across basketball, volleyball, soccer and football.

This trifecta gives Genius Sports a lot of options with which to drive the business forward:

By entering into long-term contracts with various players, Genius is able to derive guaranteed revenues. It can then introduce upsell opportunities to further drive income.

Growth Strategies

Genius also seeks to grow by expanding into new markets and new sports. A key strategy is to capitalise on long tail sports events. These events are still followed by gamblers. But they come with lower costs than events from higher tier games.

In the past month alone, Genius has signed up or extended agreements with the following firms:

- Major League Rugby

- WynnBET

- Australian National Basketball League

- Microgame SPA

- Lega Volley

- Malaysian Football League

As of March 2020, the company boasted:

- 650+ long term partnerships with sports and sportsbooks

- 400+ sports partnerships including NBA, NCAA, FIBA, FIFA and the Premier League.

- 1,500 employees across 6 continents

- $110m invested in scalable proprietary technology

UPDATE: on 2nd April 2021, it was announced that Genius had agreed an exclusive deal with the NFL. This deal is worth $120 million annualy for six years. This could well be a game changer. It’s an exciting development and only solidifies my conviction in this company.

Sector Growth

Sports betting is undoubtedly the most lucrative source of revenue for Genius. This is an industry with tremendous opportunity.

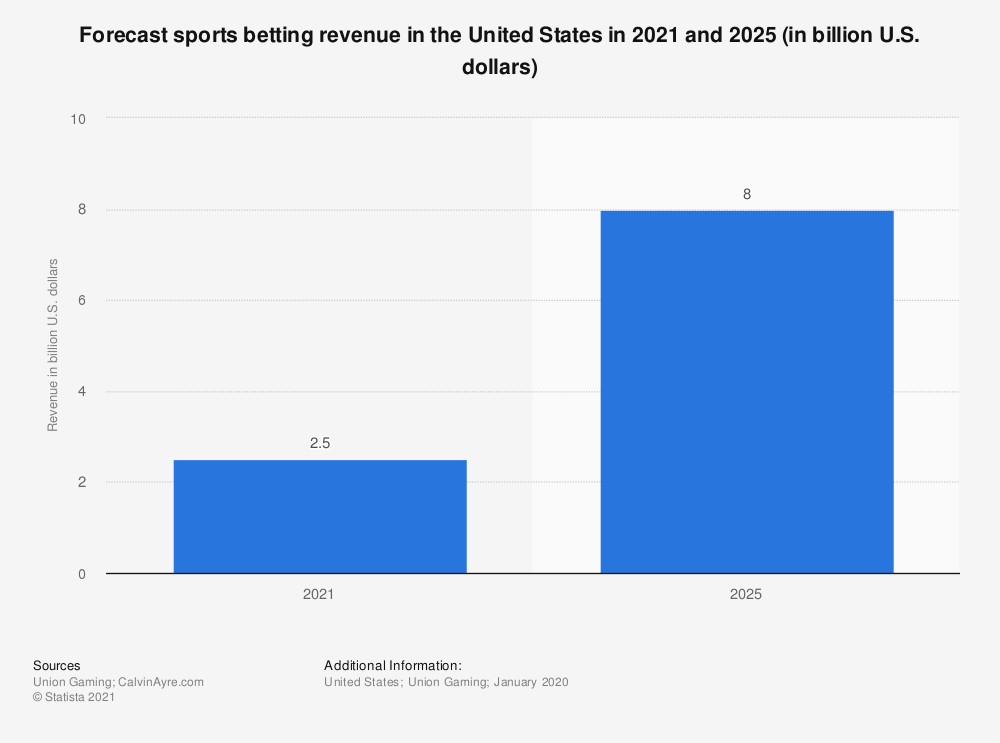

With the loosening of gambling regulations, sports betting revenue in the USA is expected to grow around 33% per year. That would take it to $8 billion by 2025 according to Statista. This figure could increase further depending on how many more US states legalize gambling operations.

Many states are facing up to the costs of the pandemic so it’s not fanciful to suggest more states will jump on board as means of generating additional revenue.

Genius sports group is also focused on expanding in emerging markets and is present in over 150 countries.

As the world comes out of the pandemic, the sports industry could experience a period of renewed growth. So many sporting events having been cancelled or played without crowds. People are excited for sports to get back to normal. This could drive more demand for sports betting and more demand for Genius.

TAM

According to a 2018 report from Research And Markets, the total addressable market for sports analytics should reach $4.5 billion by 2024. This represents a compounded growth rate of 43.5%.

If Genius captures one tenth of that, the company will be pulling in $450 million by 2024. That’s a growth of 32% on 2020 forecast revenues. A 15 x multiple on that figure would put the market cap around $6.75 billion. That’s more than double the current valuation.

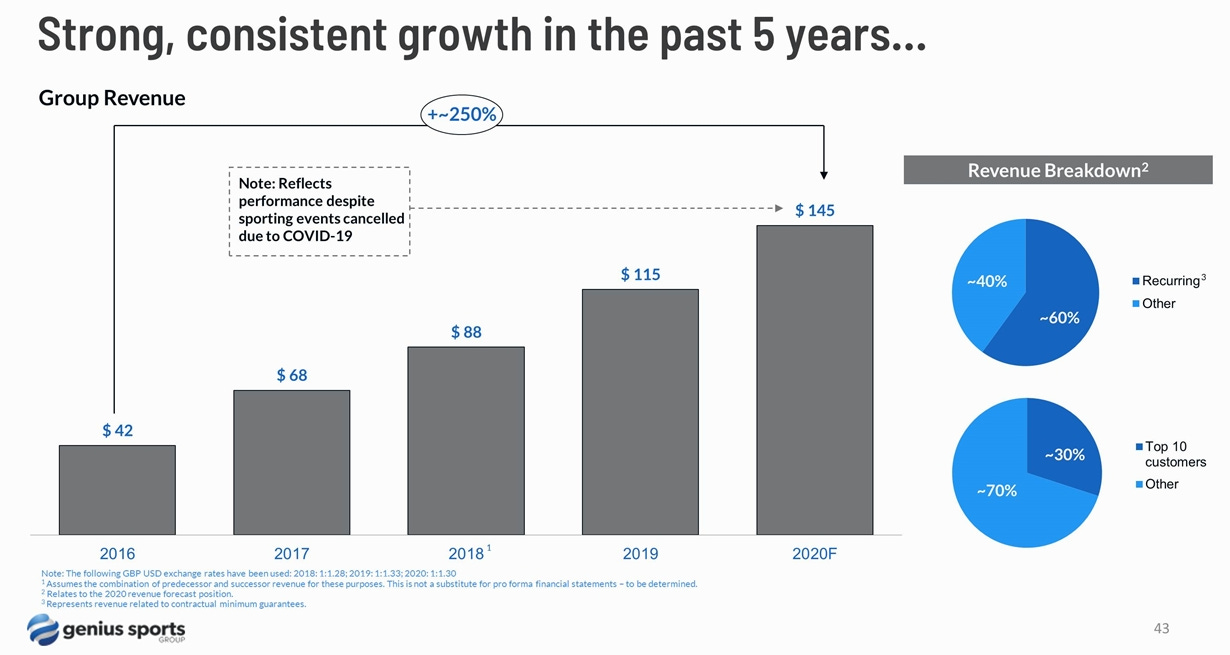

Another positive is that the company was able to grow revenue by 26% in 2020. This is despite the cancellation of numerous sporting events due to the pandemic. It’s worth noting that these 2020 figures are forecast figures, not actuals, because the financial year is not yet finalised.

Competition

There are two main players in this market, Genius and Sports Radar. This gives us a kind of duopoly. There are smaller players such asIMGArena and Stats Perform but they are unlikely to pose a major threat.. They could potentially be acquisition targets. Genius is not afraid of enter into acquistions and purchased scoreboard company Sportzcast Inc in December 2020.

Sports Radar may also go public via SPAC (possibly HZON) at a value of around $10 billion. This could be a good stock to investigate as well. It’s backed by some well known figures including Michael Jordan.

I think the listing of Sports Radar could actually give a boost to Genius since it would raise the profile of both companies. I see no reason why both companies can’t exist together. There have been many other successful duopolies like Visa and Mastercard or Pepsi and Coca-Cola.

The fact that Genius has a dominant position with locked-in contracts gives the company competitive advantages. It also posesses some network effects. Sports betting is also an addictive product that means demand for Genius’ data is unlikely to go away soon.

Margins

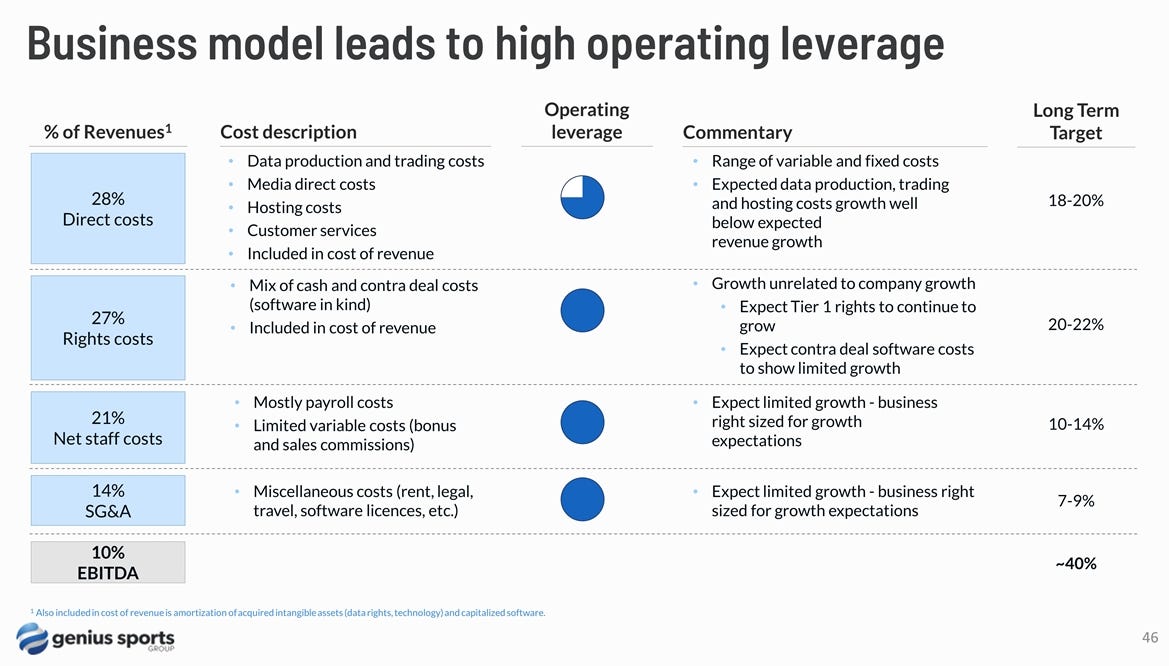

According to documentation, Genius Sports is currently operating a 10% EBITDA margin. However, it hopes to achieve a long term target of 40%. Costs are fairly evenly distributed between direct costs (including data production, technology and hosting), rights costs (the cost to be able to collect data from sports events) and payroll costs.

As mentioned, a key strategy for Genius is to bring on board new deals with lower tier sports teams. This will help to reduce the rights costs to sporting events.

Overall, business costs are not directly related to growth. This means future growth should not lead to diminishing margins. The company does have significant costs but I’d say it’s more of a cash-cow than a cash-drain.

Valuation

At the time of writing DMYD stock (dmy technology group inc ii) had a market price of $16. With 167.7 million shares outstanding at completion of the merger, Genius is therefore valued around $2.68 billion. When the proposed business combination is completed the company should then have zero debt on the balance sheet and $150 million in cash.

This valuation means the company is currently trading around 18 times 2020 revenues and 14 times next years revenues. That compares with DraftKings (DKNG) currently trading at 35 times revenue. Evolution Gaming (EVVTY) is currently trading at 32 times revenue.

Meanwhile, analytics company DataDog (DDOG) trades at 40 times revenue and Alteryx (AYX) trades at 11 times revenue.

18 times revenue for Genius sounds expensive. But it’s important to consider the rate of growth and the prospect of increased margins in future years. Let us consider two scenarios.

- Genius grows revenues at 20% per year for 10 years and then trades at a multiple of 11 times revenue. This would be in line with data analytics companies today. Under this scenario, Genius would be worth around $9.5 billion in 10 years time. This equates to a 13.4% annualised return.

- Genius grows revenues at 25% per year for 10 years then trades at a multiple of 15 times revenue. Under this scenario, Genius would be worth $19.5 billion. This would give an investor a 22% annual return.

These scenarios are hopefully somewhat conservative. Genius is still a small company with potential to reinvest it’s own revenues and be richly priced by other investors.

I have a feeling that Genius could turn out to be a steady compounder. It would be nice to get Genius for closer to $12 or $14 a share but I doubt the stock will trade back to those levels.

Risks

The form F-4 details a number of risk factors with the company that are worth considering.

- gambling regulations could be introduced in any of the company’s markets. This would cause a drop in demand for the company’s services. Genius is a global company and you never know what is going to happen to gambling markets in foreign countries.

- Investors should also consider the possibility of reputational risk with its data. For example, if Genius is unable to delivery data quickly enough or if it delivers data containing errors it could lead to reputational risk. This would result in a loss of confidence. The company has got into legal disputes in the past and last month sued competitor Sports Radar.

- A third risk is that sports betting (and sport in general) doesn’t produce the kind of growth investors are expecting. This might lead to a de-rating of the valuation multiple.

- It’s mentioned as a positive that Genius was able to grow revenues in 2020 despite COVID-19 shuttering sports events. However, the fact is that 2020 was a record year for sports betting with many bored gamblers holding stimulus checks stuck at home. Therefore, Genius should have grown revenues in 2020 (and it did). I sense that expectations for sports betting companies are already very high.

- Another risk is that sports teams begin to charge more for collecting their data and Genius is unable to improve it’s margins as expected.

- There is also a risk that the company performs well but the initial price paid for the stock is not low enough to generate an adequate market return. A rise in bond yields could also cause a lowering of valuation multiples for growth stocks across the board. This would impact Genius Sports and other high multiple names.

Bottom Line

Every investment comes with risk. But Genius Sports Group stands in front of multiple tailwinds thanks to the relaxing of regulations in the US sports betting industry and the rise of big data.

The company is uniquely placed with a niche service, sticky revenue and operates in a near duopoly. Using somewhat conservative metrics I showed that Genius could outperform the market over the next ten years. I’m also optimistic the stock will outperform those projections.

Finding quality companies at reasonable prices is not easy in today’s market but I feel that Genius has some favorable qualities and the valuation is reasonable. I initiated a decent size position at $16.03 per share and feel like this is a good buy under $20. I think this could turn out to be a steady grower and I intend to hold for the long haul.

Further reading:

Genius Sports

Investor Presentation

Webcast

Thanks for the analysis Joe. Have you done (or could you point me to) a similar dive into SportRadar?

Hi Tom. Haven’t done any analysis yet. Can’t really value it until the SPAC has been agreed. Here’s an article I found: https://seekingalpha.com/article/4410998-adding-to-horizon-acquisitions-ii-on-deal-rumors

What sort of discount did the PIPE investors get? Not sure what is meant by redemptions from the trust. Does this mean SPAC investors withdrawing their capital if they dont like the deal? Looks like plenty of growth in the US and Far East. I think I will look at Sports Radar and maybe its worth splitting investment across both. Interesting article and like the sector right now.

Hey Joe, great stuff. Love the in-depth look at the co, although it’s a crowded market with the likes of Morningstar and countless other banks churning this stuff out. Still, always good to get a fresh take. What’s the co’s LTM EBITDA (ideally not adjusted) FCF situation and profits. Those points are kind of where I start when I’m trying to get my head around an investment prospect. Can’t seem to see that unless I’m missing something.

(Also it’s Sportradar not Sports Radar)