The financial sector took a battering in the 2008 crash which led to at least two major headwinds for financial stocks:

- Financial companies became highly regulated. New laws came in that prevented banks and other institutions from making the big profits they were used to.

- Quantitative easing caused interest rates to drop to record lows. Although low rates are not the end of the world for financials the banking sector generally makes more money when interest rates go up.

It’s for these reasons that financials have not been able to make the kind of mouth watering returns that they did before the crisis.

However, financials are far from being market laggards.

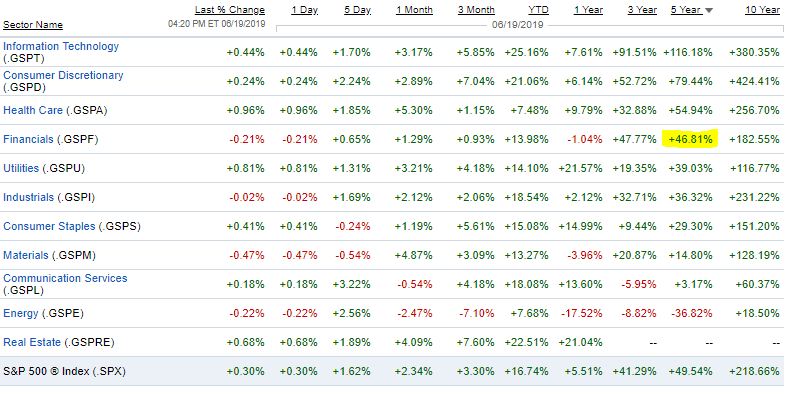

Over the past five years, financials have returned +46.81% putting the sector behind only technology, consumer discretionary and healthcare:

Despite these decent figures I always have trouble pulling the trigger on a financial stock.

I previously thought this was due to my inherent distrust of the sector but as it turns out, my skepticism has some legs to it.

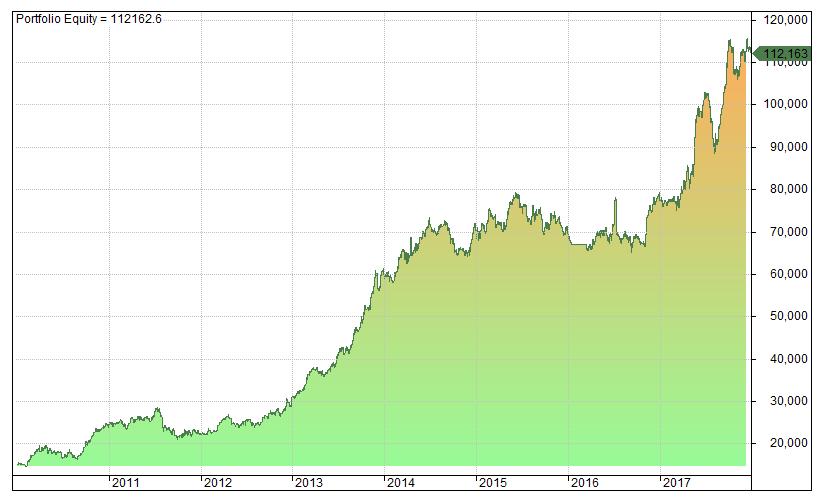

The following chart shows the backtest results for a momentum system I’m working on based on a selection of US small cap stocks:

The chart above translates to an annualized return of 28.64%, a maximum drawdown of -26.21% with a win rate of 41.61%.

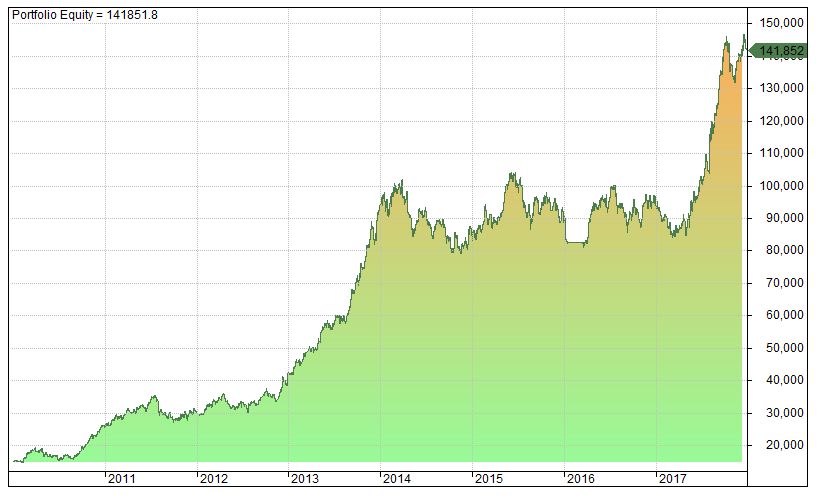

Now you can see what happens when I take the same momentum system but exclude all financial stocks from the test:

Annualized return has risen dramatically to 32.48%, maximum drawdown has dropped to -23.32% while win rate has dropped to 40.8%.

Excluding financial stocks we ended up with a final equity of $141,852 whereas previously we had finished on $112,163.

And this is without including years 2008 and 2009 which saw many financials go to zero.

Greenblatt Ignores Bank Stocks Too

Joel Greenblatt’s Magic Formula is one other well known strategy that ignores financial and utility shares. From my own analysis I think there are good reasons why.

Both these sectors tend to produce steady, slow returns.

It’s rare to see a banking stock jump twenty or thirty per cent for example but that can be the norm for some biotechs.

From a trend following perspective, grabbing a few of these big winners can make a big difference to your final profits.

Healthcare and technology stocks are risky of course but with that risk comes the opportunity for greater reward.

Financials (and utility stocks) on the other hand do not have the same assymetric risk to reward.

If anything, risk is skewed to the downside in banking since bank stocks are often highly leveraged. This is what we saw play out in the 2008 crash.

No More Bank Stocks For Me

I will be avoiding financial stocks in my momentum trading unless I find new evidence to the contrary.

Tomorrow’s momentum pick is not a bank (surprise surprise) but MODN.

Model N Inc is a technology stock breaking out to new highs and also saw some insider buying last week. This is NOT a tip but I will be going long in the morning.

Charts produced with Amibroker using data from Norgate.