Keep reading to find out some interesting observations on US stocks and ticker symbols.

I was looking at a trading system that shorts small cap stocks and I noticed that the best performers (those that dropped the most) had ticker symbols consisting of four characters or more. Conversely, the worst performers (those that did not fall) had ticker symbols consisting of three characters or less.

Thus, my hunch was that short trades might be more successful in the small-cap, penny stock universe when applied to ticker symbols with four characters rather than three, or two.

Why could this be?

Maybe because four character symbols are more associated with newer stocks. Companies without much history of earnings perhaps.

Unfortunately, I soon realised that testing this theory would be nigh on impossible given the naming conventions and changes that are frequently applied to US stocks.

To put it in simple terms, stock symbols change frequently and keeping track is tough.

For example, a stock symbol can change if:

• The stock merges with another company

• Changes it’s name

• Is delisted

• Has filed financial statements late or gone bankrupt

If you look back through the data you will see that ticker symbols are often taken over or altered.

For example, today, the stock symbol $WM belongs to Waste Management Inc. But prior to 2008, $WM symbol was allocated to Washington Mutual, the bank that collapsed in the credit crisis.

These changes happen often.

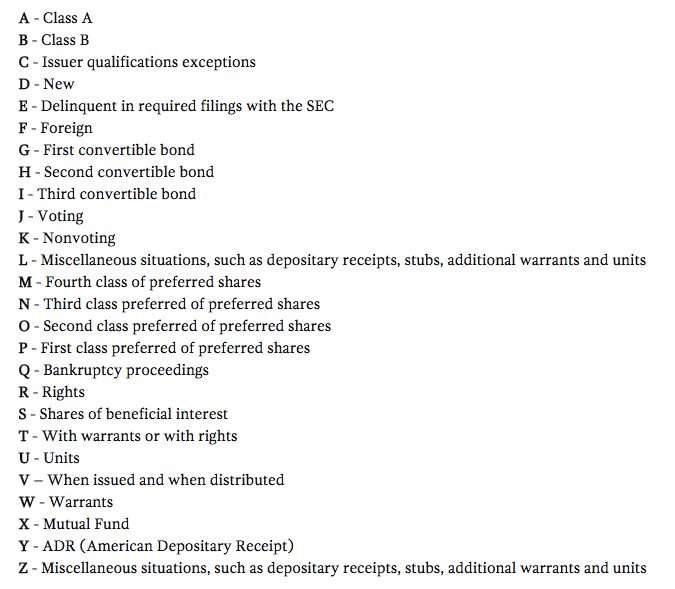

Sometimes, a letter is added on to the end of a four character Nasdaq stock symbol in order to communicate extra information.

For example, the letter ‘Q’ means the stock is in bankruptcy proceedings and the letter ‘E’ means the stock is late on the filing of it’s SEC financial statements. Below is a full list of the fifth symbols that can be added to a stock which I pulled from Investopedia:

Some interesting observations on US stocks

So, testing based on the number of characters in a symbol is full of difficulties and will have to wait. But at this point I was on a roll and had some more ideas related to stock symbols and company names that I thought might be interesting.

For example, I wondered whether companies containing certain words might perform better than other companies. I wondered if companies with connotations to dubious states or tax havens might perform poorly. I wondered whether the length of a company name affected performance.

Following are some of the tests and observations that I came up with:

#1. Performance by first letter of stock symbol

For this first test, I looked at the total return for every stock in the S&P 1500 universe over the last six years and noted the performance based on the first letter of the stock symbol.

(The only requirement was that the stock must have opened over $0.25 per share and traded over 250,000 shares.)

As you can see from the below table, stock symbols beginning in ‘Q’ or ‘U’, based on average percentage change per symbol, performed best. Stock symbols beginning with the letter ‘X’ performed worst.

[table id=7 /]

#2. Performance based on words in the company name

For test two, I wondered if there was any relationship between the words included in a company name and that company’s performance.

For example, I’m often more sceptical when looking at a company whose name includes the words loans, or cash, or Bahamas, or credit. Maybe that is just my own stereotyping. But all words have connotations and some words cause alarm bells. Thus, my hypothesis is that a successful company should have a successful name.

Thus, I loaded up data for all US stocks (over 70,000 securities back to 1985) and I analysed the performance of stocks containing specific words. The below table shows some performance metrics of this test:

[table id=9 /]

As you can see from this table, stocks whose company name included the keyword ‘micro’ produced the most profit per day ($16.69 per day from a $10,000 investment) and had the highest average % change per symbol (13.28%).

Stocks whose company name included the word ‘internet’, ‘music’ or ‘debt’ fared less well. Stocks witht the keyword ‘music’ produced an average loss of -$11.86 per day while stocks with the keyword ‘internet’ produced an average loss of -$8.56 per day. Again, this is based on one $10,000 buy and hold investment.

Stocks whose company name included the word ‘loan’ had the least probability of losing more than 90% in value (3.4%), as only one stock out of 29 dropped that much. The next best was ‘credit’ and then ‘drug’ with probabilities of 9% and 10.5% respectively.

Stocks whose company names included the keyword ‘debt’ had the highest probability of losing more than 90% in value, however, there was only one company in this category.

The next worst keyword was cash (a probability of 50% of losing more than 90% in value) and ‘internet’ (a probability of 47.6%).

Why could this be?

I have not looked at the significance of these results (if there is any) but there could be some fundamental reasons behind these results when one considers the importance and relevance of the words involved.

As I said earlier, successful companies have successful, unique names. Apple, Coca-Cola, Facebook, Google, Citigroup.

Companies with generic names that include certain ‘keywords’ may be doing themselves a disservice and maybe this is a reflection of the averageness or lack of creativity of the company and it’s management.

Moreover, a small cap stock or penny stock may give itself a name containing certain buzz words in order to appeal to unsophisticated investors. It is not surprising therefore that companies with such names fail to perform and this a good reason to be critical of them in my view.

And if you think this is unjustified, just take a look into the OTC market and see the names of the many ‘hype-driven’ penny stocks.

#3. Performance by length of company name

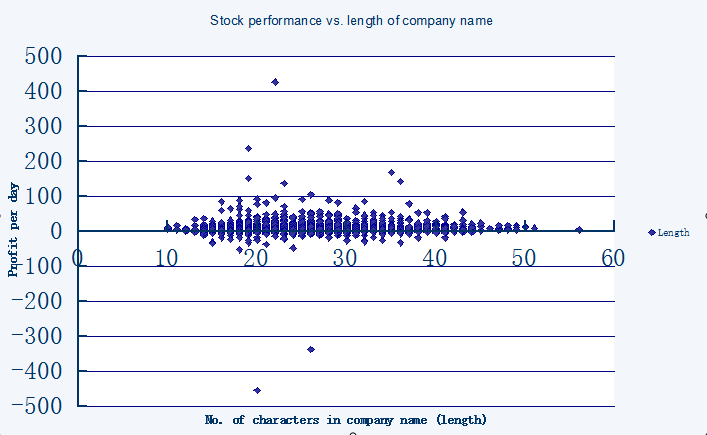

For the final test, I looked at the performance of US stocks in the S&P 1500 over the last fifteen years and I compared that performance to the length of the company name. My idea was that companies with shorter, more concise names might be better performers.

As you can see from the chart, there is not much of a relationship. But, performance does seem to be better for companies with names that are between 15 and 30 characters.

Round-up

So what can we make of all this?

Well, I think the evidence is fairly clear.

Avoid stocks with long, elongated names. Especially if they include buzz words like ‘internet’ ‘cash’ or ‘future’. Whatever anyone says, words are important and the name and brand of a business speaks volumes about its ability to survive and thrive.

Go for uniquely named stocks. Stocks with short company names. Memorable names.

And stocks with ticker symbols that begin with the letters Q or U).

All simulations in this article produced with Amibroker using data from Norgate Premium Data.

This data includes delisted securities/historical constituents and is checked regularly for accuracy.

Interesting idea but too many variables IMO. Very thin relationships if any