October was a fairly busy month. I published a new class to Marwood Research and made three more stock investments for our long term portfolio.

As I mentioned in a previous post, this portfolio is part of a project called Zero To One Million where I am attempting to get to $1 million in equity by investing a small amount into the stock market each month.

This is a strategy that is part quant, part discretionary. I hope to release more details about this process at the end of the month.

For now, I will reveal what stocks I bought in October and the reasons why.

What Happened In October?

Compared to September (where I only purchased one stock) October was a hive of activity.

The market experienced a mini dip at the start of the month so I used that opportunity to enter a new position in EWU and top up positions in GOOG and AMZN.

Backing Britain

The first investment I made in October was a long position in EWU, the iShares MSCI United Kingdom ETF which I purchased at a price of $30.15.

The UK market has been a poor performer the last few years with all the uncertainty created by Brexit so this is a trade I have been eyeing for some time.

When price dipped to $30 I decided it would make a good entry point for two reasons:

- Although the risk of Brexit is real I felt that most of the negativity was priced in. The UK still has potential to be a vibrant economy and I can see the country doing better than most people envisage. Plus, many UK listed companies are multinationals that are not strongly dependent on the UK economy anyway.

- $30 is a strong price level that has provided multiple points of support since at least 2012. Most importantly, at $30 the ETF also pays a very nice dividend of around 4.9%.

As you can see from the chart, $30.15 proved to be an excellent entry point and the ETF has gained around 9% since purchase:

Topping Up AMZN & GOOG

The mini dip in October also gave me the opportunity to top up my positions in Google and Amazon.

Both companies look well priced but they also have a high quant score, huge competitive advantages and I am bullish on both of them for the long term.

I discussed some of my reasons for owning Amazon in September and I feel that Jeff Bezos is still making good moves preparing AMZN for the long term. I topped up my investment with a purchase at $1,767 a share which proved to be a decent entry.

One thing that caught my attention regarding Google was a study that showed the average American would pay $18,000 a year to use the Google search engine, discussed in this video with Stanley Druckenmiller.

Google charges next to nothing for many of its services so, for me, this highlights the scope Google has to raise prices on some of its products.

The company is already doing well but it could do even better if it raised prices on some services for example Google Cloud. I increased my position in Google at a price of $1214 a share.

Of course, there are still risks with both companies especially if Elizabeth Warren gets into power. Warren has said she wants to break up companies like Facebook, Google and Amazon because they have too much of a monopoly.

I don’t know if that will happen but I will continue to diversify the portfolio in the coming months.

October Performance Update

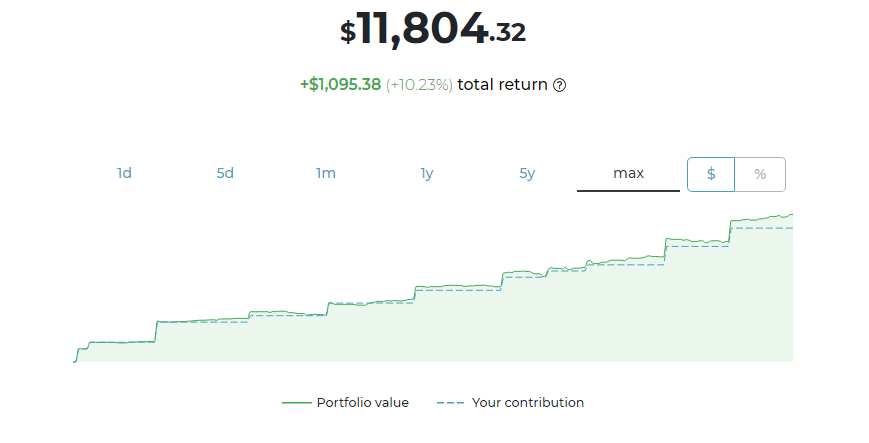

We are still a long way from $1 million but the portfolio equity now stands at $11,804.32 which equates to a 10.23% total return since February.

This is significantly better than our benchmark return (monthly investing in SPY) which is 5.98%.

The goal of this project is to prove that anyone can become a millionaire by investing a regular amount into the stock market and so far I’m pleased with how it’s going.

In fact, the portfolio is going so well that I suspect we will get a decent pullback very soon. Because of this, I am thinking of re-balancing some positions.

However, I am not worried too much because this is a long term portfolio and I’m willing to sit through short-term weakness.

Brilliant combination of technicals & fundamentals to spot value in the EWU stock at $30. I look forward to tracking your journey to £1m

Thank you. I hope to hear from you again.

Very nice, I wonder as being and expat how can I invest in the uk market as I am classed as a non residen. Do you have some article on this topic ? thanks

You don’t have to be a UK resident to buy UK shares or ETFs. You just need a broker that covers them.