Do professional traders use stop losses?

On the whole, they do.

But there’s a lot of conflicting information circulating that makes this an interesting topic to discuss.

Recently I saw a YouTube video explaining that professional traders don’t use stop losses because doing so alerts market makers and algorithms to where their orders are.

This is mostly nonsense especially in liquid markets with thick order books.

The fact is most traders need to use stop losses to protect themselves from huge risk.

But it’s also true that many professional traders don’t use stop losses.

But it’s not for the reasons you’d expect.

Following are some of the reasons why traders trade without a stop loss.

#1. Because they’re reckless

Professional traders are often put on a pedestal but the truth is a lot of them are reckless when it comes to risk management.

When I worked on a prop desk I learned that many traders avoided stops.

I have come across traders who are so confident in their opinions that they do not think a stop loss is necessary.

I’ve even witnessed pro traders aggressively average-in to trades in order to get out of their losing positions at a tiny profit or break-even.

Many traders I have met are stubborn and reluctant to take even a small loss on a trade if they think their opinion is correct.

There is no doubt that this is reckless behavior and it exists among pro traders and retail traders alike. But traders who work like this usually don’t stay in business for long.

Most successful traders I know use stop losses whether it is a fixed stop loss or a trailing stop loss.

#2. Because they have a hedge

A common reason why a professional trader won’t use a stop loss is because he is hedged with some other trade.

This is particularly prevalent with certain types of trading such as spread trading, stat arbitrage or high frequency trading.

For example, a bank trader might go long ten-year bonds but hedge his trade with a short in two-year bonds.

A fund might go long AAPL but keep a hedge in place with SPX puts.

There are numerous ways to build a hedge which eliminates the need for a fixed stop loss. Trading without a stop loss is possible because risk is minimized in other ways.

#3. Because they use mental stops

One of the main reasons professional traders don’t use hard stop losses is because they use mental stops instead.

The advantage of this is that you don’t have to ‘give away’ where your stop loss is by placing it in the market.

This strategy is only possible if you are focused on the market the whole time you have a trade on.

The moment you look away from the chart, there’s a chance that the market will drop below the level you wanted to get out and you will have messed up your risk management.

The influence of algorithms also means that sharp moves and flash crashes can occur faster than a human trader can react. That’s what makes this a dangerous strategy.

A better approach is to use statistics to build the best stop loss strategy applicable to your system.

#4. Because they’re not using leverage

Some professional traders actually don’t use much leverage which means they can size their positions small enough so that a fixed stop loss is not usually necessary.

For example, consider a stock trader who puts 5% of his $100,000 portfolio into Apple.

Assuming two-to-one leverage, Apple would have to go to zero for this trader to lose only $10,000. Clearly that is not going to happen any time soon.

If you size your position small enough you can get away without a stop loss and instead exit trades according to your rules.

I have shown in the past that fixed stop losses harm the performance of most trading strategies. Therefore it’s better to size your positions small and exit your trades using your own system logic or by trailing stop.

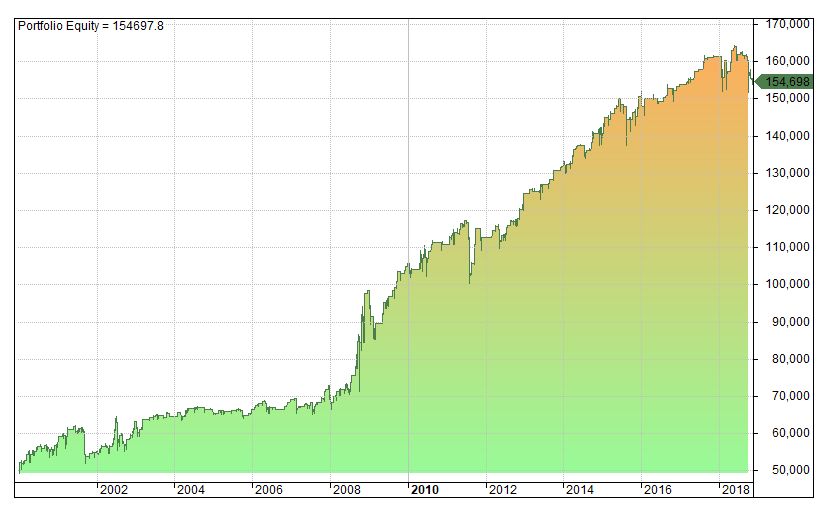

For example, the following equity curve is for a simple RSI system on SPY with no stops:

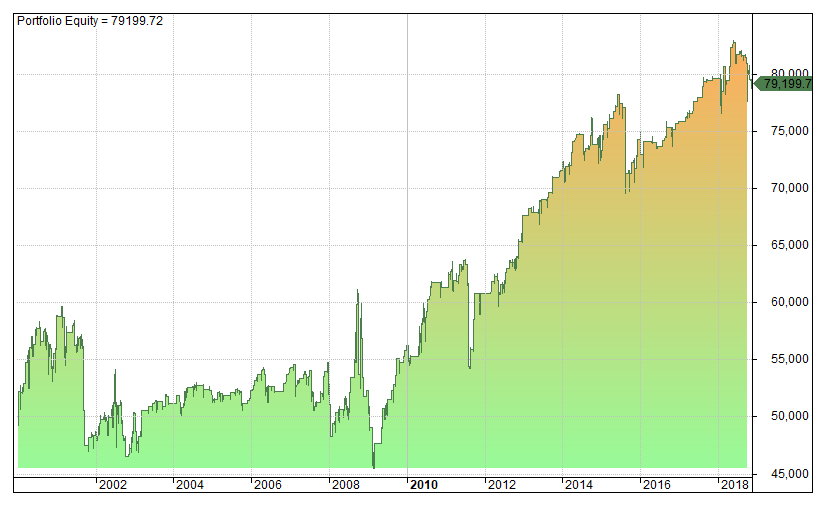

Now observe the same system but this one includes a 3% fixed stop loss to cut short losing trades:

In this example, the net profit has almost halved by using a fixed stop loss.

Trading a conservative size is the approach we usually take with the strategies on our program, although experienced traders can add leverage if they wish.

#5. Because they trade options

Of course, lots of professional traders don’t use stops because they trade options.

Buying options give you the ability to define your risk from the start so that you know the maximum amount you will lose on a trade if you’re wrong.

However, this isn’t always true if you sell options.

‘Naked’ selling of call or put options can expose you to theoretically unlimited risk and get you in a lot of trouble quickly.

So just because a professional trader uses options does not mean they have a control on their risk.

Final Thoughts

The idea that professional traders don’t use stop losses is a dangerous myth that should be ignored.

There will always be reckless traders but the fact is if you trade with leverage you expose yourself to a huge amount of risk. Trading without a stop loss is one of the biggest mistakes that new traders make.

The use of leverage means you could lose more money than is in your trading account so you always need to have a hard stop loss in place to protect yourself from a devastating loss.

Getting stopped out is painful and it is always better to exit your trades according to your strategy rules if you can.

The key is to size your positions small enough so that your hard stop loss is hit only on rare occasions.

Great article!

Honest! Which is soooo important and sadly rare.

Thank you

What a load of rubbish! If a professional trader entered a position with no stop loss they would be sacked immediately. They wouldn’t even be able to say goodbye to their colleagues. Please stop sharing false information.

You obviously never worked at an investment bank.

Anything can happen to a stock between market close and next day open, during which time the stop loss order is inactive. Although it is helpful to day traders, the only way the stop loss order

can remain active 24 hours a day is if you have accounts with world wide brokers, such as Interactive Brokers, on two or three exchanges. Without such trading privileges, unfortunately for swing traders or investors, you can be damned even if you use the stop loss, and will

quickly endure losses without one. Untrained traders will lose money; the method trader,

meanwhile, has been replaced by autonomous trading tools. Sometimes the worst thing for a new trader is to enjoy success, because he will not realize it was by sheer luck; feeling invincible he moves on to larger positions and then takes serious losses that deter him from real investing.

I feel you are being a little pessimistic here. It’s true that stop losses become inactive overnight but that is no reason to maintain multiple brokerage accounts or avoid swing trading altogether. Successful swing trading can be achieved with conservative risk management even with the issues of overnight risk. Thanks for your comment.

Warren has it right. Optimism is a scourge when trading; in fact, the ideal is to be emotionless.

Since stops are inactive until the stop can be converted to a market order, the stop can be “blown through” when the instrument gaps. Your stop order will be filled at the prevailing post-gap price. Granted, you can use Put Options for CYA, but that requires a different set of skills.

Just my most humble opinion.

Great article, by the way.

I understand what you are saying. My own approach (extensive backtesting) allows me to plan for the scenario of overnight price gaps. Therefore they are not a surprise or a major issue for me. But it depends on the strategy and approach. Thanks for your comment.

Hi Joe,

Thanks for the article.

Can you explain a bit more this: “The key is to size your positions small enough so that your hard stop loss is hit only on rare occasions.” ?

Much appreciated.

Usually, hard stop loss is the least optimal exit. Better to exit by trading logic or profit target. A smaller position size means that the hard stop loss can be moved further away so that it is hit less regularly. By spreading risk across multiple positions it is possible to maintain same level of exposure but with lower risk per trade.

For example, instead of one large position at a 20% position size, a trader could initiate 10 individual positions at 2% position size. The level of exposure is the same but each position is smaller allowing the stop loss to be moved further away.

SIR m ek Bignner Trader Hun,Mujhe Treding K liya kya Baath Dhyan Rakhana hogi

You are assuming that hypothetical Joe Q Trader has 10 ideas worth investing in of equal quality.

I am on board with risk management as a guiding principle but would find it challenging to enter into to 10

Identical positions simultaneously for several reasons.

Hypothetically adding 20% to a given portfolio;

1. If I were to consider allocating 20% addition into 10 new investment ideas right now I would find it overly burdensome

2. Not all ideas are created equal. Due to cost per unit, momentum, geopolitical risk or any other Infiniti of factors some ideas are objectively better than others

3. There can be success with intelligent risk management and hedging. One man’s trash is another man’s gold. Hint: one is wrong

4. If you buy a bargain then you sell a bargain 👀👀