In February of last year I started a project called Zero To One Million.

The goal was to show that anyone can go from zero to one million dollars by investing a regular amount into one or two quality stocks each month. It was also to prove that stock picking is possible and you don’t have to follow the crowd into index funds.

In this post, I’ll provide a quarterly update for how the portfolio has been doing, what stocks I have bought and how we have navigated the last few months of volatility.

What Happened In Q1 2020?

As you will know the first few months of 2020 were off the scale in terms of news flow and market volatility. The coronavirus pandemic caused devastation to global economies and at one point, the S&P 500 was down over -30%.

It has since reversed some of those losses thanks to government stimulus and renewed optimism from investors. However, by the end of March, the market was still down -24%.

Market Drop Was On The Cards

At this point I will mention that (as noted in a previous update) I had been predicting some kind of market downturn for a while and I cautioned against investing large sums in January.

Obviously, I had no idea that we would see a global pandemic or such a sharp bear market.

But I did feel that markets were becoming overbought and exuberant. That’s why I sold some of my Apple position and raised extra cash in order to buy stocks when a drop took place.

Needless to say, the market crash was a double edged sword. Many of our positions went into the red but it also provided an excellent opportunity to buy stocks at cheap prices.

What We Bought In Q1

The ZTM strategy involves buying one or two high quality stocks each month and holding for a long period of time. The strategy is based partly on a quantitative system and partly on a checklist made up of 8 rules.

Although the idea is to buy just a couple of stocks each month, because of the market volatility in March I did end up buying several more stocks than usual and I also sold a couple of positions (at a loss) which I felt were not worth holding any longer.

This was quite expensive and was more activity than I hoped for. However, in the end I was quite happy with how the portfolio survived the market carnage and I was pleased to pick up some great companies at discount prices.

During Q1 I was able to enter new positions in Nike (NKE), Tesla (TSLA), Visa (V), Mastercard (MA) and Ansys (ANSS) and I was able to secure some decent prices.

For example, I was able to buy Nike at a price of $67.04, Tesla at $484.73 and Visa at $165.85. I also topped up our Apple position at a price of $236.52.

These are all high quality stocks that I have had on my watchlist for some time. They fit the ZTM rules and I was happy to purchase them at discount prices.

(The one exception here is Tesla which I previously was unsure of. However, I have changed my tune on this stock as I feel the company is benefitting from popularity in China and building an incredibly strong brand. I would like to write a longer post in the future to talk about my thoughts on this.)

Of course, although I was able to pick up some bargains it wasn’t all plain sailing. Many of the stocks in our portfolio moved into the red and I decided to take a loss on some of our previous holdings including EWU, BA and NEM. Although I bought these positions to hold indefinitely, I felt that the cash could be better distributed to other opportunities.

Performance Update

Q1 was a rare and extremely active period for the ZTM portfolio where we were able to raise some additional capital and purchase several new stocks during the market rout. We also exited some positions in order to distribute cash to better quality companies.

Let’s take a look at what damage was done by the virus and what the portfolio currently looks like:

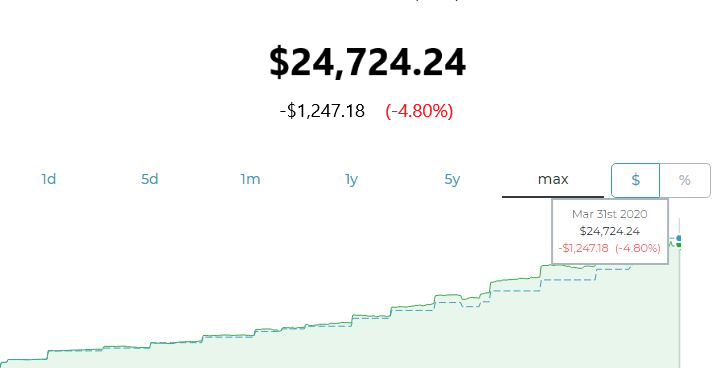

We started this project in February 2019 at zero and as of 31 March 2020 our total capital stood at $24,724.24 for a total return of -4.80%.

By comparison, if we had invested the same amount into the S&P 500 ETF each month (since Feb 2019) our account would now be $23,003.11 for a total return of -11.43%.

So we have managed to do better than our benchmark return and have managed to introduce several quality companies into the portfolio.

The sharp rebound taking place in April means that our portfolio has now turned green. However, details of that performance will be saved for the next update.

In the end, the portfolio has come through the crisis so far intact and in a strong position. We also still have some cash available if markets end up retreating back to their lows next month.

If you would like to learn more about the Zero To One Million portfolio I have detailed the full strategy here.