Some investors believe that lower price stocks produce better investment returns than higher priced stocks. It’s always tempting to look at stocks trading under $10 in the hope of finding a ten or twenty bagger.

In some ways this makes sense. Higher priced stocks are often larger and more mature businesses that grow more slowly. Low priced stocks are often smaller, faster growing companies.

However, this is not always the case. Some higher priced stocks are fast growing and some lower priced stocks are slow growing.

Since the stock price is a remnant of a company’s IPO there need not be any direct relationship between stock price and market capitalization.

In other words, a small company does not necessarily come to market with a low share price. It all depends on how the company is valued at IPO and how many shares are issued.

For example, ITIC has a market cap of only $258M but a share price of $135. And GE has a market cap of $55 billion and a share price of $6.

All that being said, there are some studies that suggest lower priced shares offer better returns than higher priced stocks so let’s take a closer look.

Do Low Priced Stocks Produce Better Returns?

To investigate this phenomenon I developed two portfolio strategies and backtested them on historical data.

In the first portfolio we will buy the 20 lowest priced companies in the S&P 500 index and rebalance it each year. In the second portfolio we will do the same but with the 20 highest priced companies

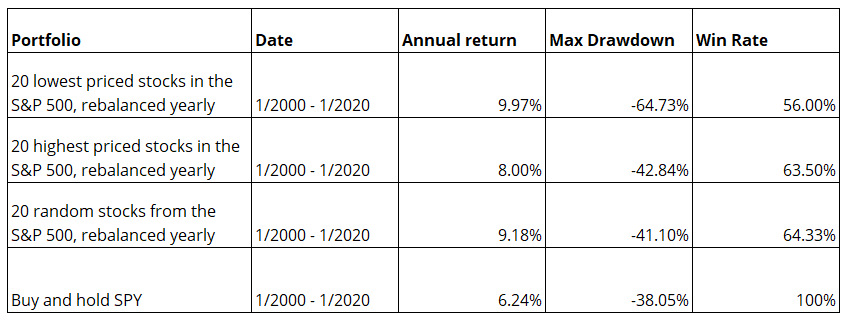

As you will see from the table below, buying the 20 lowest priced stocks in the S&P 500 outperformed buying the 20 highest priced stocks.

Low priced shares produced an annual return of 9.97% to the 8% of the higher priced shares. The low priced portfolio also beat the buy and hold return and the return from buying 20 random stocks each year (6.24% and 9.18% respectively).

However, the low priced stocks did produce a much larger drawdown approaching 65%. That would be hard for most investors to stomach.

Results From 1958 For Low Priced Stocks

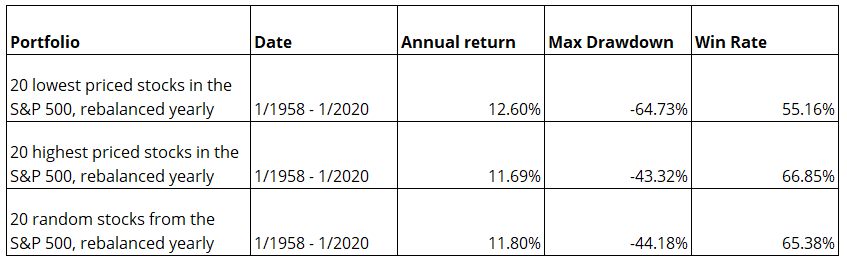

If we go further back, all the way to 1958 in fact, you can see that the lower priced stocks still have the edge on the higher priced stocks, now with an annualised return of 12.60%. However, the drawdown is still higher at 65%:

Interestingly, you can see that buying 20 different random stocks each year also puts in a strong performance with a 11.8% annualised return and a drawdown of 44.2%.

So overall it seems that lower priced shares do produce slightly better returns than high priced shares in the S&P 500.

But what about in other market universes, like the S&P 1500 and Russell 3000 which contain a much larger concentration of small cap shares?

In The S&P 1500

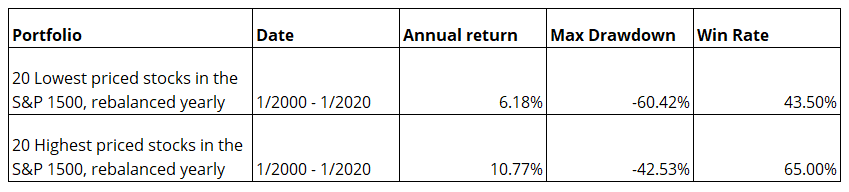

As the table below shows, low priced securities produced significantly lower returns than high priced stocks in the S&P 1500. The drawdown was also significantly higher at 60% and the win rate lower at 44%:

In The Russell 3000

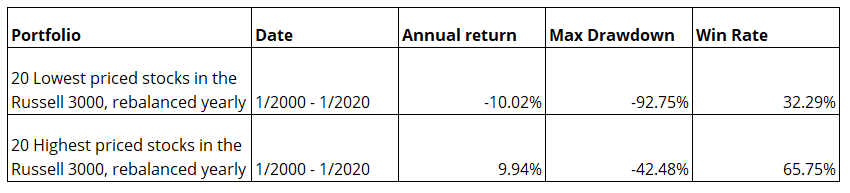

And in the Russell 3000, holding lower priced companies appears to be a losing strategy with the portfolio losing over 80% of its value.

This is telling since the Russell 3000 has a much higher concentration of smaller cap stocks and low priced securities than the S&P 500 and S&P 1500:

Bearing in mind that many of the high priced stocks in the Russell 3000 test will be the same high priced stocks in the S&P 500 and 1500, it’s clear that low priced stocks in the Russell 3000 are much more volatile and the strategy is seriously flawed.

Yearly Returns In The S&P 500

Unlike in the Russell 3000, buying low priced securities from the S&P 500 looks reasonably good on paper, albeit with a high drawdown.

But if we dig a little deeper you will see that there are also some potential issues to be aware of.

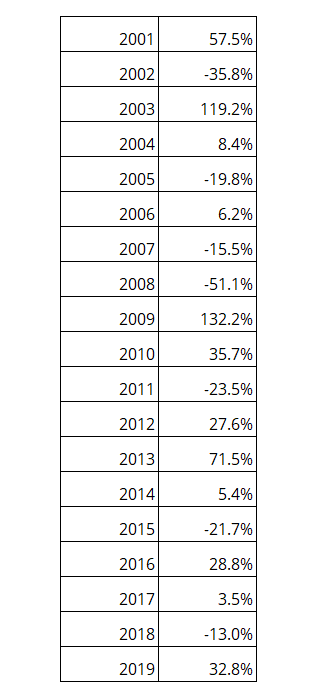

The table below shows returns by year and you can see that some of the biggest profits come just after big down years in markets. 2009, for example, saw a whopping 132% return.

So buying low priced stocks after a market crash looks like a good strategy.

However, is it possible that these stocks benefited from bailouts by the Federal Reserve? If we did not see such intervention then some of the lower priced shares may not have recovered.

Conclusions

It’s true that small cap and micro cap stocks have a chance of providing spectacular returns if you catch the right ones. Their smaller size means that they can grow faster than large cap stocks.

However, discriminating on price alone is a flawed strategy since some small cap stocks have a high share price and some large cap stocks have a low share price.

Moreover, we have shown that there are numerous low priced stocks (particularly in the Russell 3000) that are big losers.

That’s not to say you should avoid low priced stocks. It’s just that you need to do more analysis on these securities before putting any money to work.

There are some good stocks trading under $10 a share but there are an equal number of no-hopers too.

Before jumping into a low priced share make sure to think about other important factors like market cap, momentum, earnings and debt.

Notes

The data used for this analysis comes from Norgate Data and includes historical constituents and delisted stocks so as to minimize survivorship-bias. Data also includes dividends and is adjusted for splits and corporate actions. We used the original closing price (pre-split) in order to accurately define low priced stocks as they would have traded at the time.

How about Short 20 lowest priced Russell 3000 stocks and long 20 highest priced Russell 3000 stocks ? Could be more market neutral and smooth out volatility?

It does not seem to be a worthwhile strategy since the short side loses money after transaction costs. Plus, some of the low priced stocks are not shortable.