Previously, we looked at retail trading data and found that negative retail sentiment was a better buy signal than postive retail sentiment.

If it is profitable to do the opposite of what retail traders are doing, an obvious next step is to look into institutional investor holdings. Institutional investors are obliged to report their holdings on a quarterly basis to the SEC, if they control over $100 million. This information can be found in the Form 13F.

There we could find out, for example, that Berkshire’s position in Coca-Cola is worth close to $21 billion or that Cathy Wood’s ARK Investment reduced its position in Tesla by 27% in the third quarter of 2021.

Of course, the 13F filings being public, means that this information will not go unnoticed in the investing world.

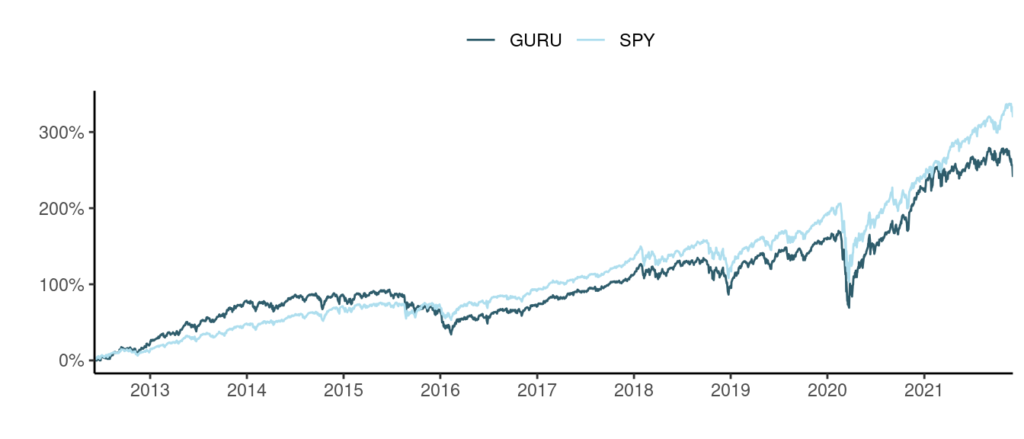

One practical example of how this information is used is the Solactive Guru Index which includes the stocks most preferred by hedge funds. There exists an ETF on it, ticker symbol GURU.

Unfortunatly, while GURU had a strong start after inception in 2012, it could not keep up with the broad market (as measured by the S&P 500 ETF, ticker SPY) since 2015.

Is Institutional Interest Good or Bad?

The GURU ETF hasn’t performed as well as hoped. But the question remains do stocks with high institutional ownership make good or bad investments?

Using data from Sharadar (available on Nasdaq Data Link), we identify stocks that are most heavily invested in by institutional investors.

Unsurprisingly, these turn out to be just the biggest names in the market today; Microsoft, Apple, Alphabet, Amazon, Meta (Facebook), Visa, or JPMorgan. If we just follow the institutional money flow, we end up buying the largest stocks out there. While we can build profitable strategies based on large cap stocks, we would like to more specifically use the signal that comes from institutional ownership.

So to avoid just picking mega caps, we normalize the percentage of institutional investment per company by the companies’ market caps. At this point we start to discover less common and unknown names.

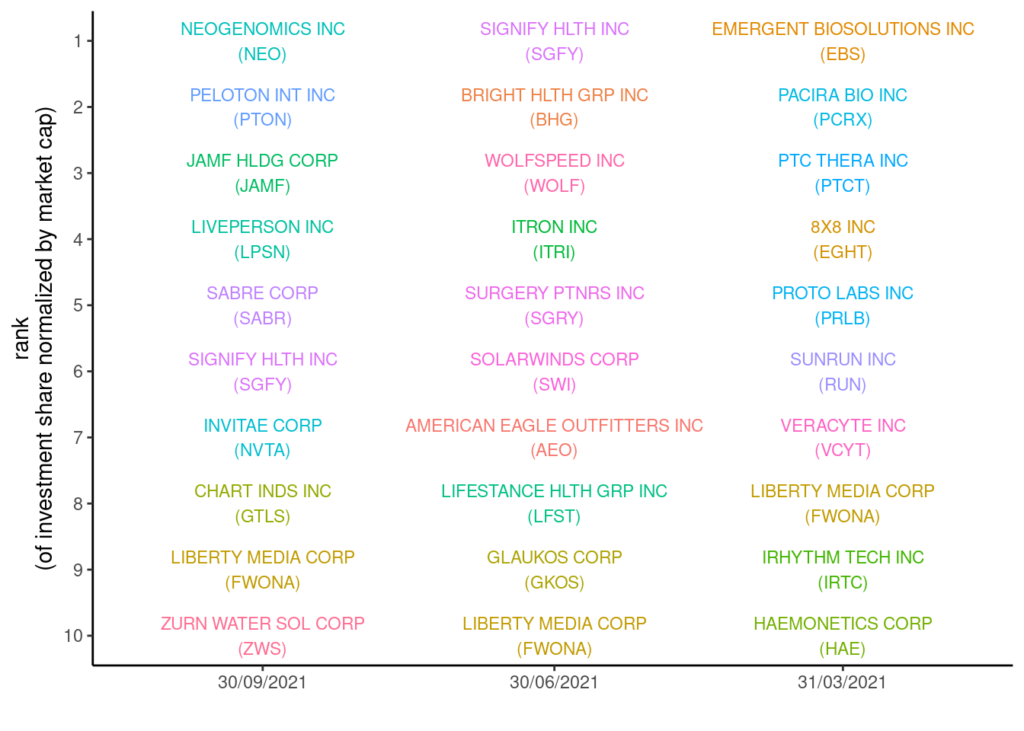

As shown below, you can see the top 10 instutional picks (normalised for market cap) for the first 3 quarters of 2021:

Note that we only include company stocks with a market cap of over 1 billion traded on the NYSE or NASDAQ. We also exclude blank companies (SPAC shells). Actually, before excluding shell companies, these were the ones occupying the top ranks.

So what now?

One idea is to invest in these top-10 stocks (normalised by market cap). To backtest this we need to wait 45 days after the end of each quarter to take into account the final release of the filings. How would we do?

Actually not great at all. As can be seen in the next chart, this trivial approach would have almost completely destroyed your portfolio (-79.2% return since July 2013).

The main reasons why this simple approach failed are:

- A large part of the top-selected stocks are biotechs. These often have an option-like behavior: if a clinical trail succeeds, the price can skyrocket, or otherwise fall massively.

- The normalization of the institutional interest by the market cap had some adverse effects, i.e. many stocks with high institutional ownership and low market caps. These are often struggling businesses before a turnaround attempt. These might succeed or fail, so again the stragegy takes on substantial risks.

In summary, the highest institutional interest can be found in large cap stocks. If we normalize the interest by the market cap, we identify smaller and more risky stocks. Investing in these has not turned out to be a good strategy.

What About Active Institutional Investors?

Following the top 10 instutional picks normalised by market cap does not make a great strategy. What if we only focus on active institutional investors and hedge funds?

To understand this logic, consider that most institutional investors do not make active investment decisions. Their objective might be to follow a benchmark such as the S&P500 index.

For example, let’s look at Vanguard Group in comparison to Michael Burry’s hedge fund Scion Asset Management.

In Q3/2021 Vanguard reports positions in 4,453 different stocks, Scion only reports 6 (for the curious, it’s CVS, LMT, GEO, CXW, DNOW, and SCYX). The latter is an active hedge fund that has directional opinions on the stocks held. Vanguard as the provider of many passive index funds holds the usual candidates, AAPL, MSFT, GOOGL, and many more.

Warren Buffett famously called diversification “a protection against ignorance”. According to him, “[diversification] makes little sense if you know what you’re doing.” Assuming undiversified institutional investors actually do know what they are doing, it might be tempting to copy their trading.

The idea is to systematically filter for active funds and see if following their long positions (short positions do not have to be declared in the 13F filings unfortunately, unless one goes short by buying put options) has any potential as a trading strategy.

One could say that an investor with an average position size of at least 10% is likely to take an active stock picking approach. 10% average position translates into a maximum of 10 stock positions held.

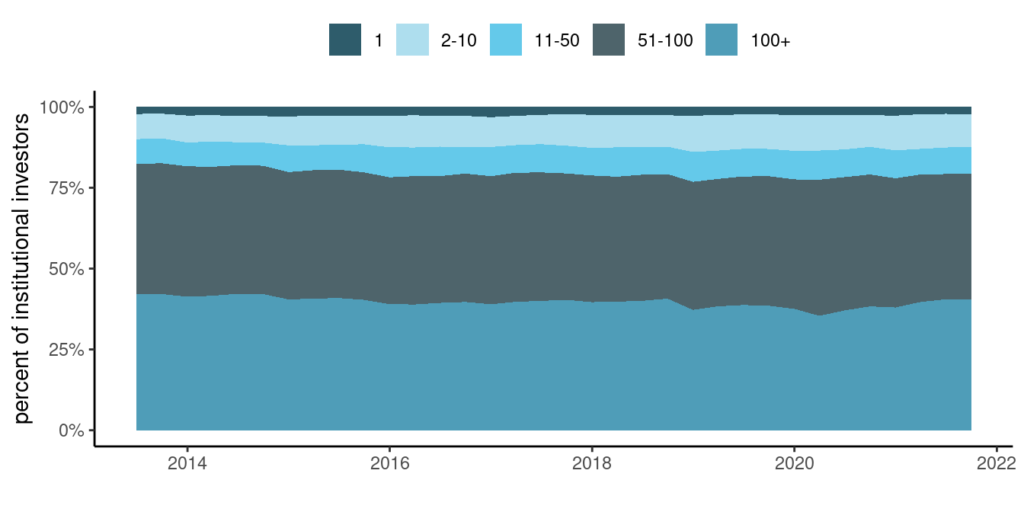

Only about 10% of institutional investors report less than 10 positions and therefore fall under our “active investor” filter. As of Q3/2021 we count 461 active investors according to our selection rule.

Almost half of institutional investor reportings contain more than 100 share positions, as shown in the next plot.

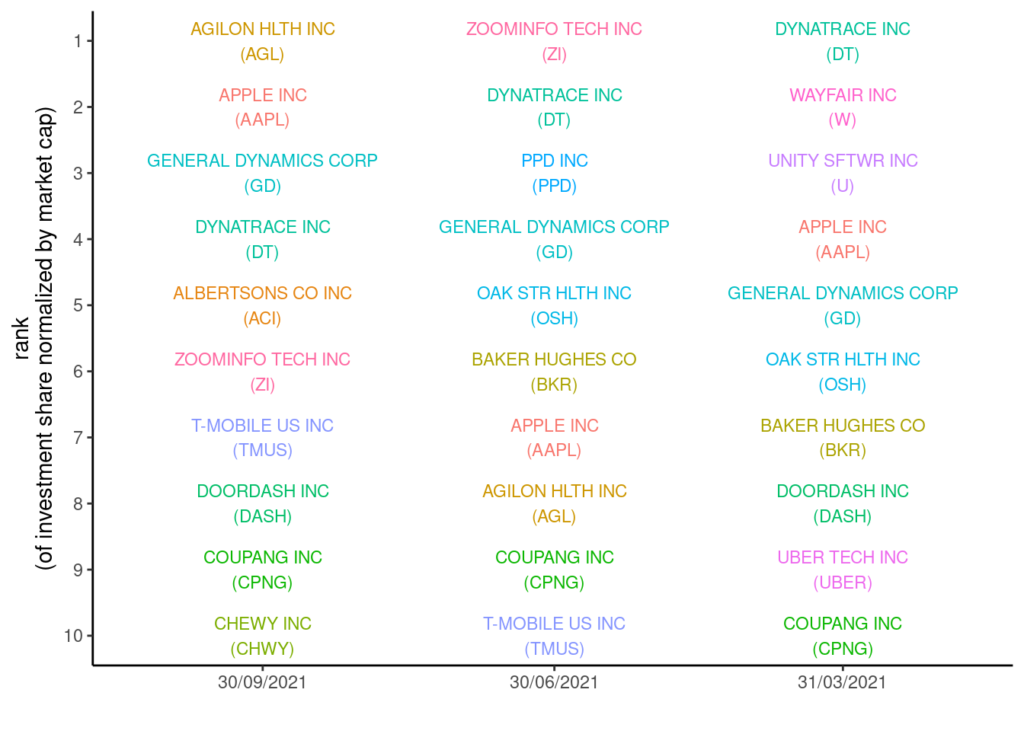

What are the favorite stocks of these active investors? We see the top-10 active investor picks in the following table. In this part we don’t need to normalize by the market-cap. We simply identify the top-invested companies by institutionals with no more than 10 open positions.

With General Dynamics (GD), Dynatrace (DT), Doordash (DASH), and some other tech names, there is somewhat of a sector preference. And in hindsight of course we know that tech has been outperforming the market over the past few years.

Using these top-10 stock picks for each quarter, we build a strategy and test it using the available data history back to 2013.

While the performance has not been overly exciting until 2020 (overall +107.6% since July 2013 but not before falling to a low of -58.4% on the initial investment, see the next chart), we see that active investors have made some successful stock picks. Especially their bet on the tech sector rebound during 2020.

Of course, as previously explained, the filings are released to the public with a 45-day delay (which we incorporate in both backtests), so the information is somewhat outdated by the time we start placing trades. If there was a way to follow institutionals more quickly than this, our results would likely improve.

Final Thoughts

In conclusion, you can see that our investigation into institutional data wasn’t a total success. Big institutions buy mostly large caps so there’s no point in following these institutional funds.

Furthermore, when controlling for size, there is still too much noise in the data to build a profitable strategy. There is also the issue of waiting 45 days to receive the SEC filings.

The signal does get stronger when we analyse active investors, i.e. those who are picking stocks and hold less than 10 positions. This area is worth further research.

In a future article we will see if there are any particular funds that are worth following.

I enjoy reading joe’s articles. He makes me think about other possibilities. He is very knowledgeable and each article is a new learning experience for me. So keep up the good work Joe and look forward to your next article.

Glad you you find them valuable. Cheers!

Hi Joe,

Is there a way to contact you via email?

I am using the same dataset of sharadar like you, but I have drastically different outcomes / results which are suggesting that it might be a very valid strategy to run. Would you mind exchanging our python codes that we used for our backtests?

Best,

Jacques

joe[@]stocksoftresearch.com However, the backtests were not run in python.