Popular brokerages like TD Ameritrade and Schwab have cut their trading commissions to zero and more brokers are following suit.

A reader asked about the impact of zero commissions on trading so I thought I would share my thoughts below.

Mixed Feelings

My first impressions of this news are mixed.

It’s great to have zero commissions but it’s important to retain some skepticism.

Brokers need to make money so if they can’t do it through commissions how will they do it?

In this case, it seems brokerages will gain additional income from selling order flow.

Thomas Peterffy (head of Interactive Brokers) said it best in the following quote:

So brokers are paying for zero commissions by selling our order flow to high frequency traders.

That’s not great news at all and means traders could be even worse off than before.

In fact, this is nothing new and is how Robinhood has been operating for years.

(Historically, when a broker doesn’t charge commissions it’s because they make up for it selling order flow or with a wider spread.)

Selling retail order flow opens up the door for front running and poor price fills.

The decrease in transparency will also make it harder to backtest strategies since we can’t be sure of the slippage we’re going to get.

However, it should also be said that some of this is conjecture. We are yet to see how the new model plays out so there could be some benefits after all.

Silver Lining

If there is a silver lining to this news, it’s that commissions are likely to come down across the board, not just at the brokers who sell order flow.

In fact, Interactive Brokers (who have promised to never sell retail orders to HFT firms) have recently opened up their own commission-free service called IB Lite.

This is welcome news and has the potential to help system traders turn small edges into much larger ones.

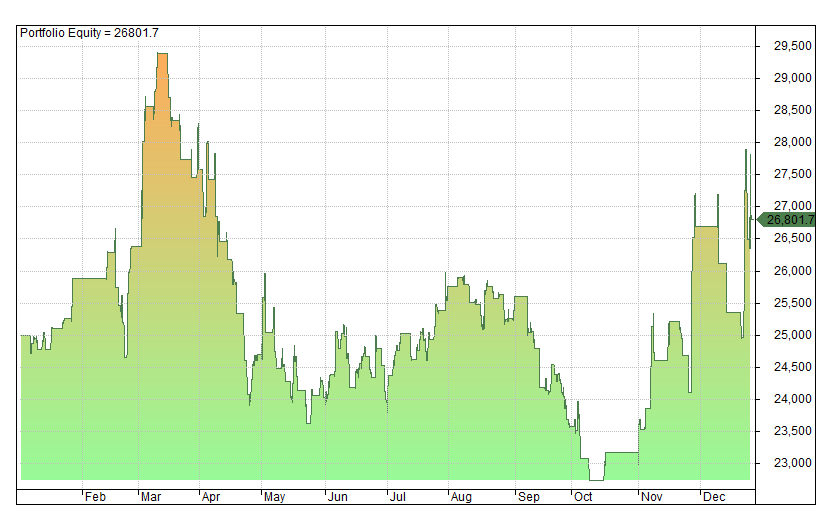

For example, our Morning Trend system produced a return of 7.2% in 2018 using a commission structure of $8 per trade:

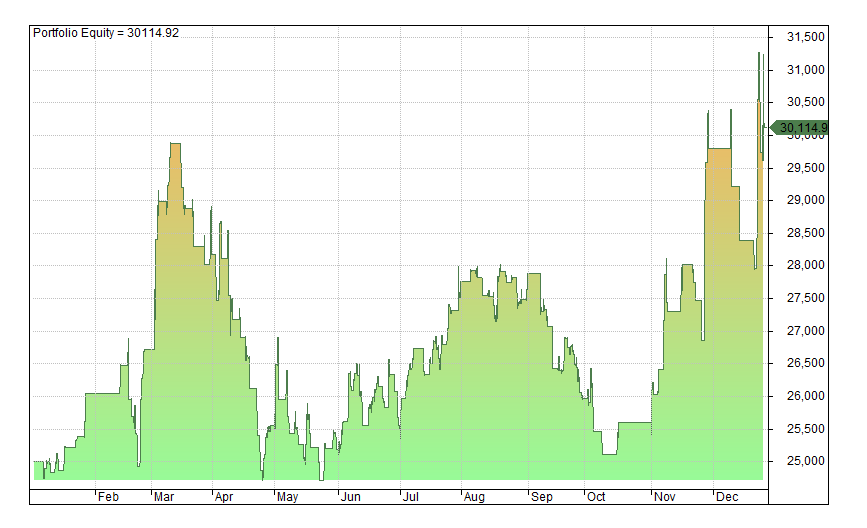

However, cut those fees to zero and the return jumps to 20.5%:

In fact, this may not be the best example since there are plenty of short-term trading systems that will benefit even more from a reduction in costs.

Good For Long-Term Investors

The other silver lining is that long-term investors are likely to be unaffected by brokers selling order flow.

A few cents slippage is everything to a day trader but it’s unimportant to an investor who is holding for five, ten, twenty years.

So long term investors are likely to see higher returns from the reduction in trading fees.

TD Ameritrade Is Cheap?

As it happens, TD Ameritrade and Charles Schwab both reacted negatively to the news of zero commissions with AMTD stock falling as much as 28%.

The issue is that the zero commission model will result in a race to the bottom that will inevitably force some brokerages out of business.

However, it could equally provide a short-term boost.

TD Ameritrade have reported a 49% increase in new accounts since the announcement which means the stock now looks relatively cheap trading at three times yearly revenue and ten times earnings.

If news of new accounts is true then TD Ameritrade appears well priced.

(Meanwhile Interactive Brokers stock is trading at 10 times revenue and 20 times earnings albeit at a 2-year low of $46 a share).

However, the brokerage sector is also extremely competitive. Schwab, E*Trade, Ally Invest, Robinhood, Fidelity and more are all vying for business and will have their own plans of action.

Plus, once investors realise the truth about zero commissions their satisfaction over zero fees may turn sour.

Final Thoughts

Personally, I’m open minded about this news and I look forward to seeing the effects that zero commissions has on trading.

The industry needs more innovation and I’m excited to build strategies that will work with lower costs.

As for brokers, I will continue to trade with IB.

IB have promised to never sell my orders to a middle man and that transparency is important.

With costs coming down across the board it could prove to be an exciting time to be a trader.

So those are my thoughts on the new pricing model happening on Wall Street. What do you think of zero commissions?