It has long been established that the Kelly Formula provides a powerful equation for calculating the optimum level of risk with which to place a bet in a probabilistic type game. A game like blackjack or sports betting.

Developed by J.L. Kelly, Jr. at Bell Labs in 1956, the Kelly Formula gives the mathematical answer to the question:

“What amount should I bet to maximise my return, given the probabilities of the game?”

Using The Kelly Criterion Formula For Investing

When it comes to investing, it can be more difficult to calculate Kelly because the stock market is not probabilistic in the same way as a game like blackjack.

Nevertheless, the Kelly formula can undoubtedly be used to great effect in investing with famous investors Warren Buffett, Bill Gross and Ed Thorp all upholding it’s benefits.

For our purposes, the Kelly Formula can be described as follows:

Kelly % = WR – [(1 – WR) / PR]

Where:

WR = The probability that any given trade will return a positive amount.

PR = The average profit per trade divided by the average loss per trade (in dollar amounts).

Here, WR is also the win rate (in decimal form) and PR is also the payoff ratio.

Imagine we have a trading system with a win rate of 65%, an average win of $200 and an average loss of $150. WR is written as 0.65 and PR is written as 1.33 giving us a Kelly % of 0.38.

Kelly % = .65 – [(1 – .65) / 1.33]

= 0.38

The Kelly formula shows that our optimal position size is 38%. In order to maximise our return we would bet this amount of our available capital on each bet.

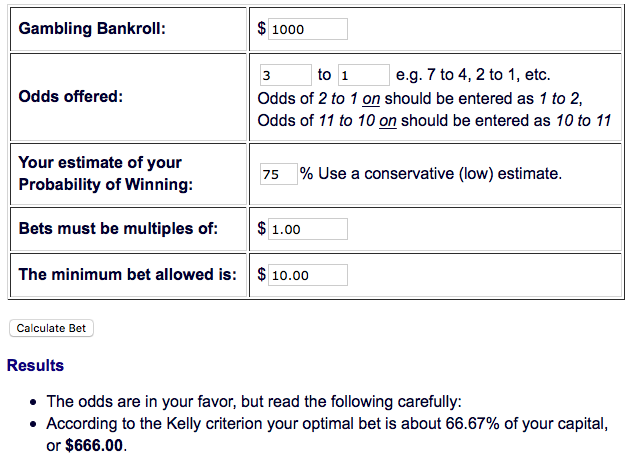

Note: A useful Kelly calculator is provided at Albion Research. The payoff ratio in the example above would be expressed in the calculator as odds of 1.33 to 1.

Practice Makes Perfect

In practice, the Kelly formula is an aggressive method for sizing bets and the end result from the Kelly equation is often halved in order to stay on the safe side.

Since the Kelly formula is optimised for maximum return it also leads to sharp (maximum) drawdowns which many investors find hard to deal with.

This is why many gamblers, traders and investors will not use full Kelly but a smaller percentage of it such as half Kelly.

In financial trading, it is even more important to be conservative because (unlike a casino game) it is not easy to accurately estimate the true win rate or the expected return (payoff). Thus, it is important to use conservative values in the formula as well.

When it comes to system trading, there are some more important implications also.

Using The Kelly Formula With A Trading System

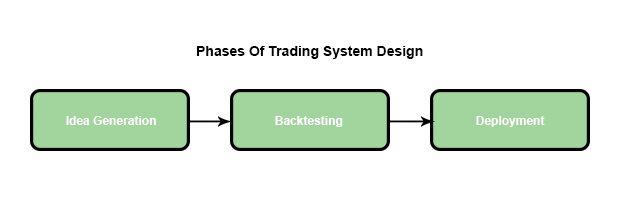

Generally, the process of building a trading system can be split into three parts.

First, you must come up with an idea. Next, you must test the idea. Finally, you deploy the system in the market.

The accepted wisdom when back-testing a trading system is to first run the system with basic, fixed position sizing, devoid of any fancy money management rules.

This is sound advice.

You want to first test the profit potential of the idea. Only when you know you have a decent trading idea should you add money management rules in order to improve performance.

If your trading idea is not good to begin with, even the best money management rules are not going to help it. As the old saying goes ‘you can’t make a silk purse out of a sow’s ear’.

The question is, once you have a trading system, when is the best time to apply a sound money management system, like Kelly or half-Kelly?

When To Calculate The Kelly Formula

The answer is that advanced money management rules should be left right until the final phase of system design – the deployment in the market phase.

The reason for this is that the back-testing process is fraught with so many difficulties that it is hard to accurately calculate the correct inputs to the Kelly formula before going live.

For example, imagine you have a trading system that shows a historical win rate in back-testing of 75% and a payoff ratio of 3:1.

Such a strategy using Kelly would give a large optimal bet size of 66.67%. Even half-Kelly here would give a very aggressive bet size.

As you can imagine, the problem is that trading systems seldom perform exactly as shown in a back-test.

If you start out betting the house based on a back-test there is a chance you could blow your money very quickly.

Issues concerning market impact, curve fitting, slippage etc. can all derail trading system performance almost as soon as it is taken live.

It is impossible to eliminate all bias in a historical backtest and you also have to deal with the fact market conditions change. Market conditions can change so abruptly as to destroy the profitability of a trading system completely.

The Solution

The solution is to use simple money management rules in the backtest and in the initial stages of deployment as well.

When you first deploy the trading system into the market do so with a small amount of capital or on a demo account.

Start off with a simple position size, like fixed risk or 0.5% per trade and see how the trading system gets on live. Make sure the position isn’t so small that it negatively affects the results, however.

After some 30 or so trades, analyse the live performance.

Compare the live performance to the backtest and use those statistics to complete the Kelly formula and determine the optimal position size.

Some common sense will still be needed of course since 30 trades is not a large sample. You will still want to stay conservative every step of the way and take your backtest results into account.

As you gain more data from live trading, you can come up with more accurate values with which to populate the Kelly formula.

This method provides two main advantages.

First, it means you can find the optimal Kelly betting size more accurately and safely.

Second, you do not need to mess around programming sophisticated position sizing rules in the backtesting phase.