One of my favourite websites now is Quora which lets you ask and respond to questions on virtually anything.

Since I answered quite a few questions myself this week I thought it might be a nice idea to compile all the answers together in a new weekly segment that I will now call ‘Q&A Friday’!

Hopefully, you’ll find it useful. Let’s go…

Q&A Friday

How do financial traders read the news?

Different traders have different ways of monitoring the news.

Some traders try to avoid the news and they take their positions off whenever a news event or economic report is coming out.

Some traders use algorithms and pay almost no attention to news.

Some traders listen to the news constantly and actively trade off breaking news reports. They will use news feeds and squawk services so that they stay up to date at all time. Some traders will also use Twitter and investor chat rooms for this.

Personally, I like to stay up to date with the main events but I will not pay too much attention to news unless it is a major upcoming event like Brexit or non-farm payrolls or an FOMC meeting.

A lot of news is just noise and can actually cause information overload and hurt your trading decisions.

As well, there are usually traders who get access to the news before you.

How did George Soros and Jim Rogers’ fund, the Quantum Fund, earn 33% annualized returns for 30+ years?

Interestingly, Soros and Rogers do not trade the same way and they often have different opinions on where a market might be headed.

This might be why they were a good partnership, since this dynamic allows both men to see the other side of the argument.

Soros came up with a theory which he calls reflexivity. He believes market dynamics are self-reinforcing. As an example, the effect of rising or falling prices can reinforce investor sentiment and that can cause prices to keep on going in that direction more than anticipated, instead of coming back.

Rogers, on the other hand tends to look for markets that are extremely over-priced or under-priced. He’s a long-term trader and can hold investments for years waiting for the market to come back to what he thinks is the proper value.

Overall, both were macro traders who placed long-term directional trades based on fundamental analysis and events.

They studied economic fundamentals and evaluated potential scenarios to find opportunities where the reward outweighed the risk and the probabilities were in their favour.

This allowed them to make profitable macro trades on currencies, commodities, stocks and all types of investments where they believed the market was mis-priced.

How do interest rates affect stock prices?

A lot of the answers presented reflect the economic theory – that when interest rates go up, cash is more expensive etc. and stocks prices should go down. This all sounds good in theory, however, the reality is never so simple.

History shows us that stock prices can keep on going up even as interest rates rise. You only need to look back a few years to see this in action.

Interest rates went up several times between 2004 and 2007 and the US stock market made its way to new record highs. The same scenario was seen in the early 1990s and many times before it. The chart shows the comparison clearly:

It’s important to remember that interest rate hikes typically occur during favourable economic conditions and interest rate cuts usually occur when the economic outlook deteriorates. (After all, interest rates are used as a tool to inject life into the economy).

As a result, perhaps the best time to buy stocks is when interest rates have hit a trough and are about to move higher. And the best time to sell stocks is when interest rates have peaked and are about to go lower.

img source: econedlink.org

What’s the best way to learn Python as applied to finance and trading?

Definitely consider Quantopian. Quantopian allows you to create trading algorithms in python and then back-test them on historical data.

There are also many algorithm templates (already written in python) that you can clone and learn from.

Why do people (day) trade if they can’t beat the market?

It is not impossible to beat the market. A lot of traders lose but there are also many great traders out there making a living.

The people you mention are backing themselves. Whether or not they make it, they want to give it a go.

What trading system works best? Personal strategies, automatic trading or following the classical trading strategies from books/education sites?

The trading system that works best is the one that you have personally developed upon years of learning that best suits your temperament, risk profile and personality.

Occasionally, you will come across profitable trading systems online and in books but most traders will still struggle to follow them.

This is because they do not have the confidence that comes from the process of building and trading the system. As soon as they experience a run of losses they will usually say that the trading system is broken.

Bruce Lee sums it up best when he said:

“Adapt what is useful, reject what is useless, and add what is specifically your own.”

What are some upcoming events which will have a similar affect on stock markets as Brexit?

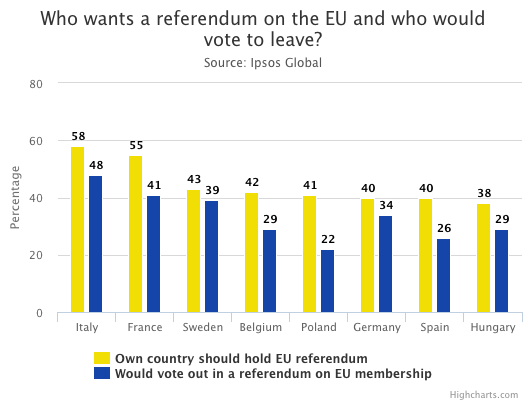

It’s likely that we will have more European referendums in the near future although I do not think any have been organised yet.

Lots of politicians, from Netherlands, France, Spain, Italy, Austria are now calling for their own referendums and the effect would be similar to Brexit since each exit is a disaster for the EU and the euro.

There are also general elections coming up (such as France in April) that could have similar effects.

There are also general elections coming up (such as France in April) that could have similar effects.

However, I believe these events will pale in comparison to the US Presidential Election in November. This could cause some upheaval to financial markets and a lot of volatility if polls show Trump leading the race.

For day traders, is trading forex really harder than trading stocks?

Stocks are not necessarily that good for day trading because many stocks have low volume and do not move enough in a day to cover trading costs.

Forex trading, however, has the opposite problem. The market is highly liquid and there are low barriers to entry. This means the market is more efficient and difficult to beat.

In my view, there are more inefficiencies (and therefore more opportunities) in stocks though I don’t recommend trading in and out all day.

Do finance professors teach technical analysis in the classroom?

They tend not to.

Most college courses do not go into the details of financial trading. They tend to be about economics, corporate finance, behavioural finance, valuations etc.

However, one professor I do know is Aswath Damodaran from the Stern School of Business at New York University.

Damodaran is more of a value investor but he is also ‘agnostic’ about technical analysis. He talks about some elements of TA in his course Investment Philosophies, which is available free online.

If I had 1000$, should I invest it in penny stocks or play the lottery?

The odds of winning at either are slim but you probably knew that already.

In my opinion you have more chance winning in penny stocks. At least with penny stocks you can do some research and improve your chances.

Do most stocks that get delisted go there because they are bankrupt?

No, there is voluntary delisting and involuntary delisting.

Many stocks are delisted after choosing to go private or after being acquired by another company.

Also, some stocks are not technically bankrupt but they can be delisted because they no longer meet the exchange rules. For example, trading under a certain price, usually $1.

What are the best stock indicators?

In my experience the best indicators (in order) are:

Volume – To measure the strength and conviction of a move

RSI – To find mean reversion setups

ATR – To estimate risk and profit potential

Moving Averages – To see the long-term trend

Bollinger Bands – To find over-reactions

Good insights, JB. I particularly liked Soros’ lecture on “reflexivity”; has similar views as those actually empirically tested in “Thinking, Fast and Slow”.

I think a lot of academics were skeptical of Soros’ reflexivity theory at first. It wasn’t given much credit but it seems like it’s come full circle.

And who can argue with someone who has a track record like Soros?

Cheers