It has been already been an interesting start to 2020 with the flaring up of hostilities in Iran. I never imagined the S&P 500 could hold up so well with this kind of news but it just goes to show how strong this bull market is (and also how complacent investors are becoming).

As we move further into 2020, one thing we can be sure of is that 2020 will bring yet more surprises and big changes. Here are five lessons that I feel we should remember as we try to navigate markets for another year:

1. The herd is not always wrong.

A lot of the time we make a big deal about the importance of being contrarian. The best trades and the best investors always seem to be those that go against the crowd.

Myself included, I always like to seek out the consensus view and see if it might be better to bet the other way.

However, it’s also important to remember that the herd is not always wrong. If it was, then contrarian investors would always make money and we know that isn’t the case.

Sometimes the herd are wrong but sometimes they get it right. Success lies in being able to judge when the crowd are correct and when they’re out of touch.

2. Long term is the new short term.

As we move forward in 2020 it’s clear that trading algorithms are becoming more resilient, more powerful and more widespread.

Although some of our intraday trading strategies have actually shown strong performance in 2019, for the majority of short-term traders, trading conditions are getting more difficult.

This is because algorithms are faster and have execution advantages over the average day trader.

One way to compete in 2020 will be to lengthen your investment horizon.

Algorithms excel at short-term holding periods such as 15 minutes or a couple of days. They are much worse at predicting where a stock will trade in six months time.

(This is because there are many more factors that impact a stock price than what most algorithms are able look at.)

Personally, I am evolving my approach in 2020 in order to focus on longer term trades and to think more about the overall portfolio.

Instead of executing strategies as the models dictate, I intend to be more selective, incorporating macro variables and focusing on end-of-year performance rather than weekly or monthly results.

3. Don’t be afraid to take a break.

One thing I can be sure about in 2020 is that there will be plenty of opportunities. But there will also be times when it’s important to take a break.

Recently, I’ve noticed that taking in too much information leaves my brain feeling cluttered and unable to think clearly.

Twitter, for example, is a great resource but I’ve realized that listening to too many voices and views does not correlate well with clear thinking.

It is useful to do research but if that research leaves you feeling muddled and confused then it’s a clear sign that you need to take a break and come back with fresh eyes.

Sometimes all you need is a walk and some fresh air. Sometimes all you need is a chart and no distractions.

4. Forget about alpha.

Every year we hear the same comparisons being made about those trying to seek alpha.

‘This strategy beat the S&P 500 … These famous hedge funds all lost to the market… No-one can beat the market etc. etc.’

Lately I’ve become to realize how unhelpful these comparisons can be.

If you’re an individual investor it shouldn’t matter if you beat the S&P 500 or not.

Sure, it’s nice if you do. But what matters is that you are investing regularly into your portfolio and getting reasonably good market returns over time.

It is your own financial goals that are important and trying to protect or grow your wealth as much as possible.

Trying to keep up with an index could lead to poor long-term decisions particularly if that index has been doing extraordinarily well.

As I mention in the Zero To One Million portfolio, I’m honestly not fussed whether I beat the S&P 500 in a given year.

What’s important is that I have a strategy that involves regularly investing into high quality stocks. If I continue to do that I know I’ll end up doing just fine in the long run.

5. Consider a wide range of possibilities and strategies.

As I said earlier, we know that there will be surprises in 2020 and big changes to the status quo, because there always are.

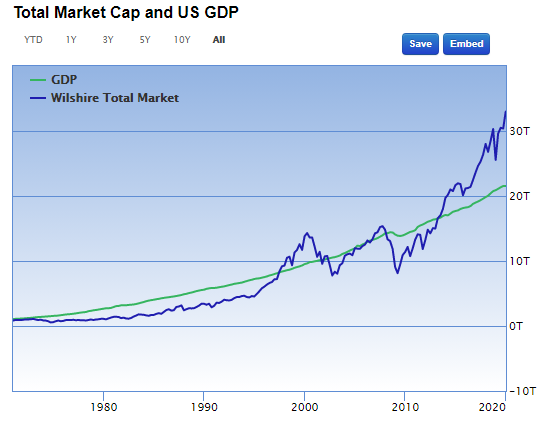

We also know that the US stock market is in unchartered territory and that most indicators (technical, valuation and sentiment) suggest the market is stretched.

Because of this, it makes sense that some of the strategies that worked well in 2019 may not work so well in 2020. Remember that when 2019 started it was on the back of a very poor December in 2018.

One option is to consider what type of year you think 2020 will look like then opt for strategies that performed well in similar years.

If you think 2020 will continue to trend then momentum strategies will be the way to go. If you think markets will be choppy then you may want to incorporate more mean reversion strategies.

Stock markets are seemingly unstoppable at the moment but there are big tests on the horizon, particularly Q1 earnings season and the presidential election.

Whatever happens, I wish you the best of luck in your own investing endeavors.