I don’t know about you but I keep hearing the same story across financial media. Apparently, value investing is no longer relevant. Both the Economist and Washington Post had articles out this week proclaiming that value investing was on its last legs. So is value investing dead or is it simply in hibernation?

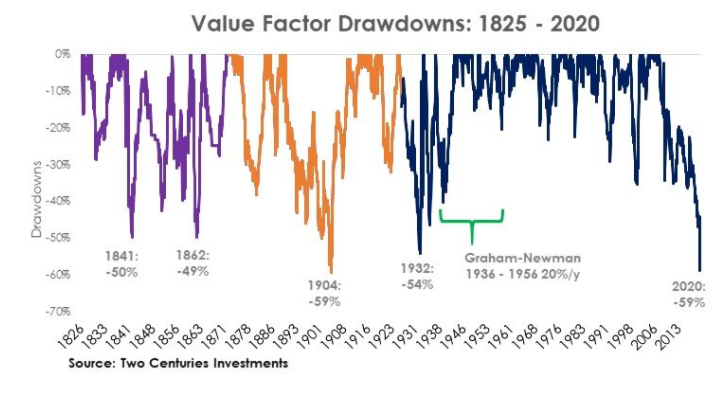

To the Post’s credit, they did suggest the tide could be changing but other commentators have capitulated, suggesting that value investing needs to change in order to stay relevant in the modern world. As the chart below shows (courtesy of Two Centuries Investments) there is some backbone to this narrative. The performance of value stocks is the worst it’s been in nearly 200 years:

However, there is more to this story than this chart would have us believe. And looking at this chart, you certainly wouldn’t bet against seeing some reversion to the mean. As usual, the talking heads on Wall Street are doing their best to confuse us and make simple matters more complex than they need to be.

This Is Factor Investing

The first problem with the chart above is that it doesn’t accurately portray the performance of actual value investors. What we are seeing here (as is annotated on the chart itself) is the performance of the value ‘factor’.

In this case, the value factor is measured using dividend yield between 1825-1871, price-to-earnings between 1871-1938 and book-to-market from 1927-2020.

In other words, the chart portrays a simplistic view of how value stocks have actually performed over the last 200 years. It assumes that value stocks all fit into a neat category and by definition have a low p/e, p/b or high dividend.

As you probably know, there is a big difference between factor investing (which seeks to find small edges from financial indicators) to value investing which generally seeks to buy high quality companies for less than their intrinsic value.

Value And Growth Are Joined At The Hip

The world’s most famous value investor, Warren Buffett, has alluded to this fact on more than one occasion.

He said in the past that value investing and growth investing are ‘joined at the hip’ and that a high price-to-book, high p/e or low dividend yield is in no way inconsistent with a ‘value purchase’.

A high ratio of price to book value, a high price-earnings ratio, and a low dividend yield – are in no way inconsistent with a ‘value’ purchase.”

– Warren Buffett

Back Of The Envelope Example

We only need to do a simple calculation to see that this is true.

For example, consider two companies; stock A and stock B.

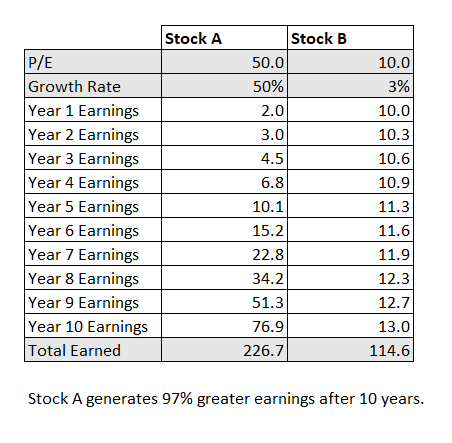

Stock A is a fast growing tech stock that has a valuation of 50 times earnings and an earnings growth rate of 50% while Stock B is a value stock with a 3% growth rate, valued at 10 times earnings.

As you will see from the following table, even though Stock A is 5 times more expensive than stock B in the beginning, stock A is able to generate almost double the amount of earnings over a 10 year period. Stock A thus becomes significantly more valuable:

In fact, if you assume that both stocks finish the 10 year period trading at a 10 x multiple, Stock A would be worth more than five times the value of stock B.

In other words, Stock A is significantly more undervalued in year 1 than stock B even though stock B has a much lower P/E ratio.

This may be an extreme example but it shows the concept that all value investors know.

That’s why no value investor invests in a stock based only on a low p/e (which has flaws anyway) low p/b or whatever metric you happen to think of.

The Performance Of Other Value Investors

Consider, for example, Bill Ackman who is currently enjoying a 44% run in 2020 after a series of well-timed bets.

Although not widely regarded as a classic value investor, Bill said in this podcast that he takes a lot of his investing wisdom from Warren Buffett.

Or what about Pat Dorsey of Dorsey Asset Management who is currently up 110% over the last three years. According to his website, Dorsey utilizes a strategy that purchases businesses at what he believes offers a “reasonable discount to a rational assessment of intrinsic value”.

The point is that value investors are capable of outperforming the market whether or not value stocks (defined by various interpretations of the value factor) go up or down.

What About Factor Investing?

Factor investing, on the other hand, has proven to be effective at generating alpha but at a much lower rate than the most successful value investors.

Factor investing works because it is passive and quantitative. It’s never going to be able to achieve the mouth watering returns that ordinary investors crave.

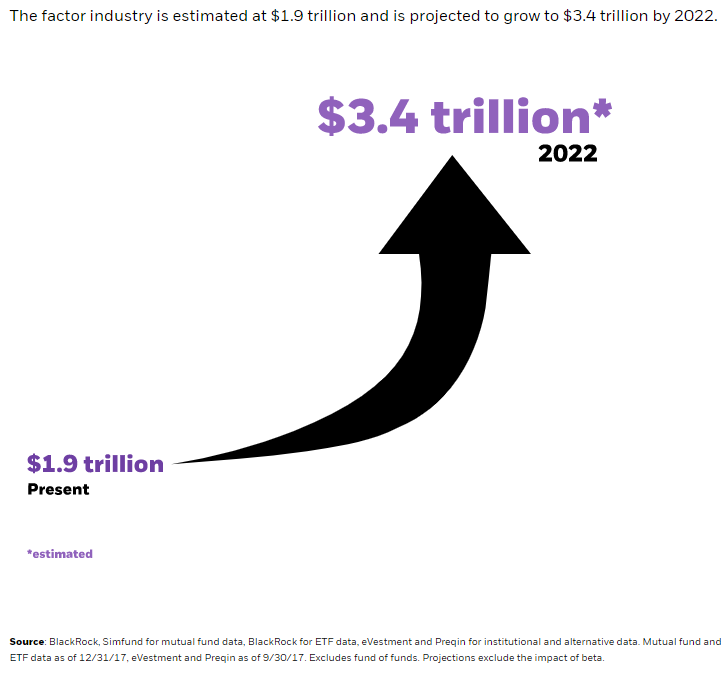

Actually, the fact that factor investing has grown to be so large (accounting for $1.9 trillion of the market according to Blackrock) leaves an opening for investors who are able to spend the time and resources to analyze stocks in more depth.

Think of it like this – if a simplistic factor-based approach can generate alpha, how much better can an ordinary investor do with a more sophisticated and rigorous approach?

Looking For An Edge

For my own part, I’ve never been a huge fan of factor investing; whether it’s growth, value, momentum or volatility. It just doesn’t make a lot of sense to me unless you want a purely passive approach.

Value investing on the other hand does appeal and I have tested strategies in the past that have performed reasonably well, despite the overwhelming narrative that value is dead.

For example, I recently backtested a strategy that buys 25 small cap stocks with the lowest EV/EBITDA each year.

As you can see from the equity curve below, this strategy put in a strong performance over the last 20 years generating an annualized return over 16% per annum. Albeit, performance since 2018 has been trending down:

What it boils down to is that we need to consider more than just one metric when deciding on what stock to buy.

I am more than happy to buy a stock with a low p/e or low ev/ebitda because our research shows this entry rule has a positive expectancy. (This gives us an excellent backstop to support our trade and any further analysis that we wish to take).

However, I’m also happy to buy a stock with a high p/e if it fits other quantitative or qualitative criteria.

2020 Is Different

Returning to the original question, which is whether value investing is dead or whether we are ready for a bounce, it’s essential to look at the bigger picture.

2020 is simply not a normal year and so we cannot expect a normal reaction from the stock market.

Airlines, energy stocks, restaurants and banks have been obliterated this year and for good reason. The pandemic has brought huge drops in business for these industries.

As a result, stocks like Exxon Mobil, Berkshire Hathaway, and JP Morgan have become prime value candidates based on multiples like price-to-book.

Meanwhile, growth stocks like Zoom Technologies, Shopify and Peloton have increased in value so much their price to sales multiples are in some cases reaching triple digits.

However, there is no reason for value stocks like JP Morgan to rebound simply because the value factor is stretched. Just like there is no reason for growth stocks to come down just because they are historically over-priced.

The Vaccine Trade

It all comes down to what happens over the next couple of years.

As vaccines are rolled out and financial stimulus is absorbed, it’s only natural that some beaten down stocks will recover as the world returns to normal.

Likewise, tech stocks that have benefited from lockdowns will surely come under pressure.

The mistake Wall Street pundits make is believing that this move is as clear cut as buying value and selling growth.

I’d be happy to make a bet that plenty of growth stocks will have a fine 2021, and plenty of value stocks will too.

What do I think?

Putting stocks into neat baskets of value versus growth is not helpful in my mind. What matters is to find businesses with the characteristics that are going to do well over the next 12-18 months.

Saying that value investing needs to change is also foolish since value investing does not need to be a rigid investment approach based on ‘factors’.

As we’ve already seen, value investors can do perfectly well even if so called value stocks stall. The simple narrative preached to us by Wall Street simply doesn’t apply.

For what it’s worth, I do think that we are going to see a strong rebound in 2021 as vaccines begin to turn the key and financial stimulus supports the economy.

As a result, I am bullish on travel and many of the so called ‘value’ stocks. But that doesn’t mean I am bearish on ‘growth’ stocks.

Quality growth stocks can still put in a strong performance at the same time as value stocks make their long-awaited comeback.

It’s all about the individual business, not the category it belongs to.

Notes/ Disclosure

Long PTON, JPM, BRK.A, short ZM.

Backtests in this article made in Amibroker using data from Sharadar.