Before you start trading it’s important to be prepared for a long road ahead.

Even if you’re born with a natural talent you will still face a number of obstacles that you will need to overcome to be successful.

1. Do You Have Enough Capital?

Unfortunately the most passionate new traders are often the least capitalized. This is usually a result of having no regular income, as those with capital usually have busy careers.

Nowadays, with discount brokerages you can start trading with any amount of money but this poses problems for more active traders.

Assume you have $25,000 saved up, just enough to bypass FINRA’s pattern-day trader rule and you want to try your hand at trading full-time.

Even in an excellent year, where you return 50%, your gross annual return is only $12,500 which is not enough to live on.

Sure, you can opt to use leverage and take more risk, but keep in mind that traders typically risk less than one percent of their account balance on any given trade.

This is not to say that you can’t build a small account. Most big name traders started with very little capital in an era with more expensive commissions.

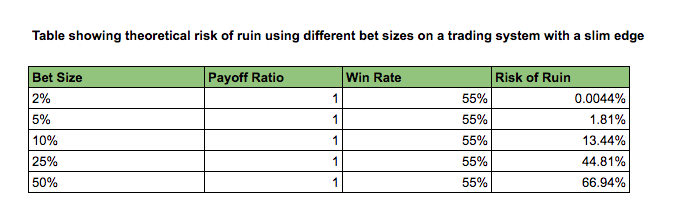

However, going full-time without a large safety net is difficult. In fact, your risk of ruin increases dramatically as you increase the size of your bets:

A small account also limits your ability to deploy certain strategies. If you’re someone with a $2,000 account, you’re pretty much stuck with a broker like Robinhood, who doesn’t allow short selling, has a very limited trading platform, and shoddy execution.

In other words, intraday strategies are off limits.

2. Do You Have a Proven Strategy?

“Sheer will and determination is no substitute for something that actually works.” – Jason Klatt

How do you know your strategy actually works? Most new traders can’t answer this question, if they even have a strategy at all.

Even systematic traders find it difficult to answer this question without live trading, especially for intraday strategies.

Backtesting can give us an idea of how our strategy performs against historical data, but it also has issues such as curve fitting and market impact. Nothing can match the experience of actually interacting with the liquidity in the market.

As Warren Buffett once said “if past history was all that is needed to play the game of money, the richest people would be librarians.”

Of course, that’s not to discredit analyzing the data. You should backtest all of your trading ideas, and do further analysis on anything interesting.

But how do you avoid the pitfalls that so many traders experience, of finding a strategy that backtests beautifully, with a smooth equity curve, only to hemorrhage money when they begin trading it live?

One way is to step away from the data and look at the strategy for what it is. At its core, what is this strategy trying to achieve?

If you can’t answer that question with a rational explanation (ideally based on economic or behavioral logic) it’s more likely to be a curve fit system.

One of the main goals of any trading strategy is to exploit inefficiencies present in the market. Whether those relate to the market micro-structure or the psychology of the market participants, the strategy isn’t necessarily about technical indicators or order flow tendencies, but about what those things mean in a wider context.

So, take a step back and look at your strategy. Is there an inefficiency in the market that you’re exploiting?

3. Are You Mentally Ready?

Trading offers a multitude of mental barriers that have prevented many smart people from getting rich.

Because of this, an entire industry of “trading psychology” seminars, books, and coaching programs have sprouted up.

In trading, hitting a brick wall is inevitable. You’ll do everything right and still lose trade after trade after trade.

While you can know intellectually that this is bound to happen from time to time, being able to cope with it and to continue trading well is a completely different skill.

When speaking about the traps that many traders fall into, I like to compare trading to poker. The two are quite similar, as they both deal with making statistically-driven decisions based on incomplete information.

The best poker players in the world, who have made tens of millions playing the game, sometimes have long periods, lasting months, of consistent losses.

They’re doing everything “correctly” from the standpoint of their strategy, but they bluff when their opponent happens to have it, or they have three-of-a-kind when their opponent makes a straight.

Many traders who approach the market do so with a lot of preparation. They have read a lot about the market, studied other successful traders, and have paper-traded.

However, many fail when they trade live because they’ve not developed mental discipline and learned about the types of hardships traders face from losses and randomness.

4. Do You Have a Contingency Plan?

As we’ve discussed in this article, things can go very wrong when trading and it can be out of your control.

Experienced traders have been through this multiple times in their career and have backup plans to react to a changing market.

You might be doing well right now but things could go downhill quickly if market conditions deteriorate or the market regime changes.

Interestingly, some traders make the mistake of assuming one type of strategy (such as short selling) is bound to work in a different type of market (such as a bear market).

However, careful analysis of numerous trading strategies shows that this isn’t always the case.

For example, some short selling strategies actually did poorly in the 2008 bear market because they failed to take profits quickly enough.

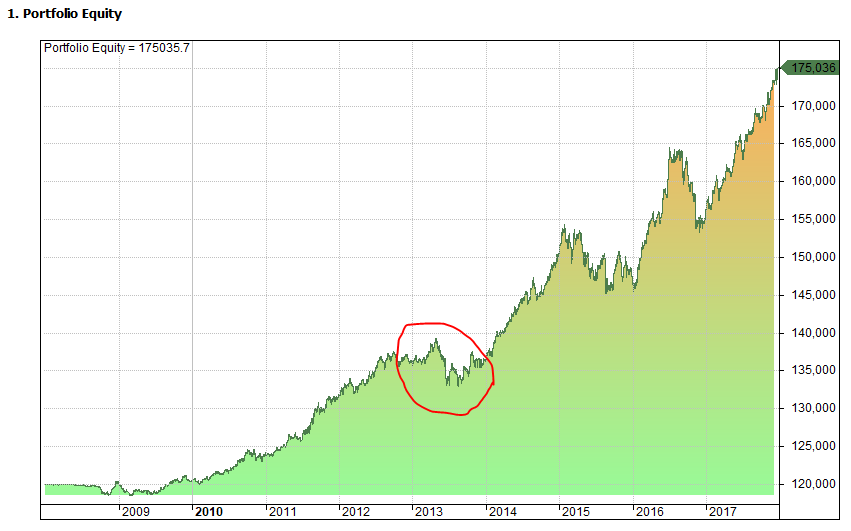

And some long only strategies did poorly in strong bull years like 2013.

The most effective traders have different strategies for different regimes and they will apply several together at the same time because they can’t predict the type of market they’re moving into.

As well, a disciplined trader knows there’s a time for aggressive capital accumulation, and a time for capital protection.

Those that have never experienced a recession or wiped out an account might be too green to truly grasp this concept.

5. Are You Fully Aware of The Risks?

Anything can happen in markets. Events like Enron, Black Monday, and the Great Recession come around every few years to remind us of this.

However, it is easy to get tunnel vision, forget about the past and lose track of the bigger picture.

At any given time, the asset you’re trading can take a dive and you can lose all of your investment, even more if you use leverage.

On the short side, the asset you’re trading can multiply 1000 times against you and still keep going. Take the tale of a trader who had $37,000 in his account on Wednesday, only to owe $106,445 in margin debt on Thursday morning.

“I was holding KBIO short overnight for what I thought was a nice $2.00 fade coming,”

This was his worst case scenario, and he ended up liquidating retirement funds to pay for it.

Every time you put on a trade, know that it could end up catastrophic like this if you do not respect the market and have an adequate plan for risk.

It doesn’t just happen to retail small-cap traders either as the case of Long-Term Capital Management exemplifies.

As Buffett likes to say “risk comes from not knowing what you’re doing” and to succeed in trading you need to know what you’re doing.

Hi Joe,

I am considering writing a related piece on this trading topic. I have had experiences that you describe here…almost all of them. I really wish I had known/or considered some of these points prior to starting my trading journey.

The piece I’m considering doing is related to the content this article but with a twist. I am hoping that you will give me permission to reference back to your article and/or provide your URL in my article. My piece will focus on the solutions that I employed to overcome some of these issues when they presented themselves as obstacles to my trading.

Anyway, I hope you will consider my request either way whatever you decide thank you for such a well written and informative article that I am sure your readers will benefit from. I’d be more than willing to share the article with you prior to publishing.

Thanks,

Jason

https://thetradingmatrix.wordpress.com/

Sure, that’s fine.

Hello Joe,

reading on your site I see that you work with Amibroker and also that one of your broker is IG.

Currently I trade by IG and I use PROREALTIME for code some trading system, but I’m thinking to purchase and use Amibroker.

Do you know if it is possible connect Amibroker with IG data feed?

Thanks,

Antonio

I have never seen it done and not sure how you could do it. You might like to ask IG Support as they are normally quite helpful. Please let us know if you find a solution as that would be quite cool.