Conventional wisdom suggests that a reverse stock split is generally bad for a company’s stock. That’s because reverse splits are usually undertaken when a stock is in danger of being delisted.

But is there any actual evidence that reverse stock splits lead to bad investment returns? And if there is, might you be able to make money from shorting reverse split stocks?

That’s the question behind this week’s article. But first, let’s make sure we understand what a stock split and a reverse stock split is.

What Is A Stock Split?

A stock split occurs when a company’s board of directors agree to increase the number of outstanding shares in the marketplace by issuing more shares to current stockholders.

For example, if the board decide on a two-for-one stock split, every shareholder gains an extra share for each one they already own. If there are 50 million shares outstanding before the split, there will be 100 million shares outstanding afterwards.

Since the number of outstanding shares has increased, this also affects the stock price. In a two-for-one split, the number of outstanding shares has doubled, so the share price is halved. Because this only affect the number of shares in circulation this has no impact on market cap or the true value of the company.

Why Do Stocks Split?

A stock split is usually undertaken when a company has seen its share price rise to levels that make it seem too expensive for investors to buy or when compared against the industry it operates in.

Thus, the primary reason why a stock splits is to make it seem more affordable even though the true value of the company has not changed. Because of this, a stock often sees a significant price increase after a stock split event.

Investors see the once expensive stock as now readily affordable so they can enter more easily. Also, the stock split signals to investors that this stock is a strong performer.

What Is A Reverse Stock Split?

While a stock split typically occurs when a company’s share price becomes too high, a reverse stock split can happen when the opposite occurs.

Usually, a reverse stock split will be undertaken by the board because a stock has fallen in value and needs to trade above a certain minimum price level in order to fulfil exchange listing requirements.

For example, one of the New York Stock Exchange listing requirements is a minimum price requirement of $4 per share. So when a stock drops below that level it becomes in danger of being removed from the NYSE. There are similar requirements for other stock exchanges like the Nasdaq which has a limit of $1.

Advantages Of A Reverse Stock Split

The advantages of a reverse stock split for the company are thus to prolong membership to the exchange and give the company more time to attract investment. This is particularly common in speculative industries such as oil or biotech.

A tiny biotech company, for example, may be losing money on a regular basis. But remaining on the exchange for a few more months could give it the time it needs to find a breakthrough.

Further to this, some companies may undertake a reverse stock split so that the stock doesn’t look like a penny stock, which can harm credibility.

Inflating The Share Price

So, a company may undertake a reverse stock split to artificially increase the share price by decreasing the number of shares available. A 1-for-5 reverse split for example will reduce the number of shares available by a factor of 5.

In this scenario, the company value does not change but the stock price is going to jump five fold. So a $1 stock is now going to trade for $5. If a company completes a reverse split leaving an investor holding fewer than one of the new shares, the investor simply receives a cash payment.

Since a reverse stock split is usually undertaken to fulfil listing requirements, there is a stigma attached to completing the action and it highlights how the stock has underperformed.

As a result, a reverse split stock is often looked upon negatively by investors and reverse split stocks will often fall in value after the event has taken place.

Is A Reverse Stock Split Good Or Bad?

So far we have looked at the theory behind reverse stock splits. But is there any actual evidence that reverse stock splits lead to poor investment returns?

To answer this question I opened up my back-testing simulator Amibroker and ran some crude tests on the data.

How To Find Reverse Splits With Unadjusted Stock Data

One of the difficulties with analysing reverse splits is finding them in the first place.

That’s because once a split takes place the data is automatically back-adjusted. That means if you look at a chart, you won’t be able to tell if there was a split at all.

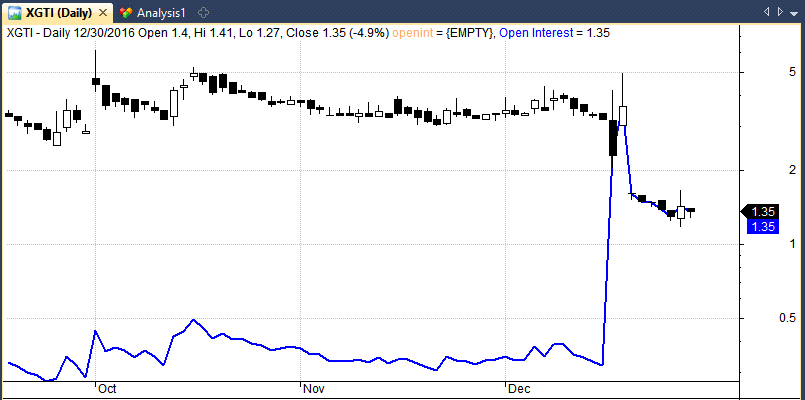

For example, take a look at the following chart of xG Technology Inc. (XGTI):

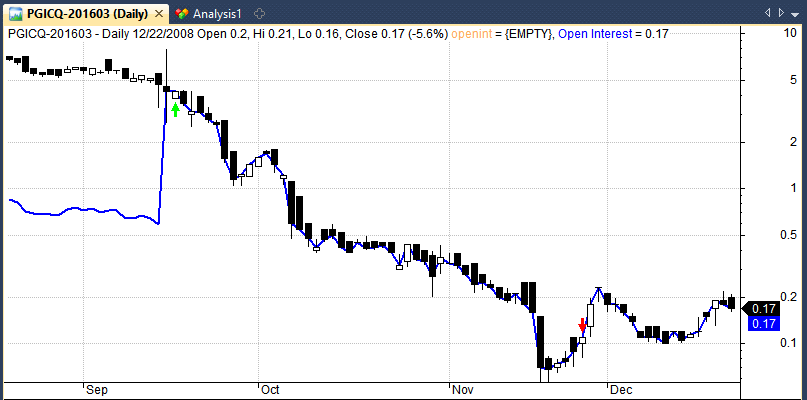

XGTI underwent a 1-for-10 reverse stock split on the 16th December. As you can see from the blue line (which is the unadjusted price), the stock went from a price of around $0.30 to $3 overnight, a ten fold increase at the time.

The candlestick chart, however, presents a much less volatile picture. It shows the stock as trading between $3 and $5 for the last two months. This is the back-adjusted chart after accounting for the 1:10 event. This is what most charting applications and data sources will show, not the blue line.

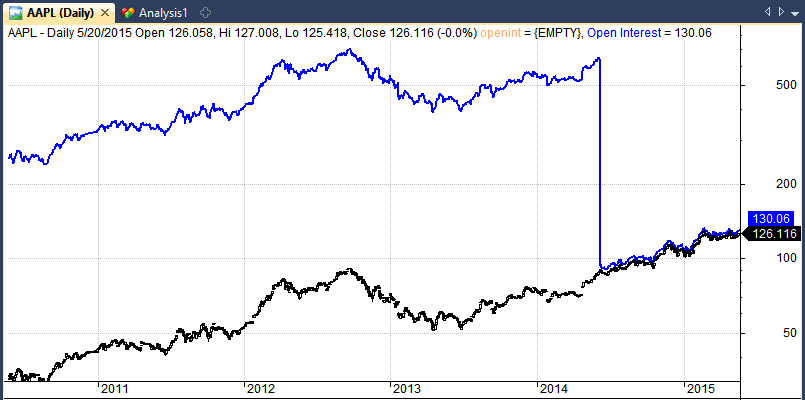

For another example take a look at a chart of Apple (AAPL) from 2014:

The blue line shows the unadjusted price again. It makes it look like Apple stock took an 80% tumble in October 2014. In reality, the stock experienced a 7:1 stock split and it’s real value barely moved in comparison.

Most charting programs show the back-adjusted price which, of course, is how it should be. The back-adjusted price chart is the important one.

If you trade off the unadjusted price chart you might make the mistake of thinking a stock has gone up (or down) thousands of percent when in fact it hasn’t actually moved at all.

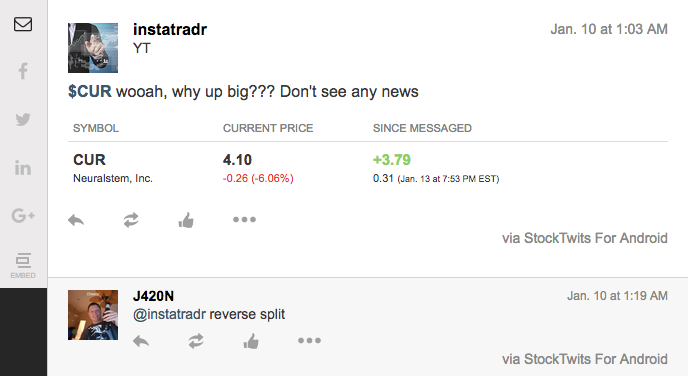

This can be a real problem when the charts aren’t updated quickly enough. Naive investors have been known to jump into stocks not realising that the move they are seeing on their screens is an imaginary one.

For historical analysis and also for building trading strategies it is important to take both the adjusted price and unadjusted price into consideration.

In the case of reverse stock splits, we need the unadjusted price available so that we can find them and analyse what effect these actions have.

Thankfully, the historical data from Norgate Premium includes the adjusted and the unadjusted price so we can do such analysis. The unadjusted (close) price can be found in the open interest field of the database ready to be referenced using Amibroker.

Formula For Finding Reverse Stock Splits

Now that we know where to find the unadjusted stock price we can create a strategy that finds reverse stock splits. Then we can see how those stocks go on to perform.

To do so, I created the following code in Amibroker to identify reverse stock splits:

RealChange = C/Ref(C,-1); UnadjustedChange = OpenInt/Ref(OpenInt,-1); ReverseSplit = RealChange < 1.999 and UnadjustedChange > 1.999;

This code compares the daily price change between the adjusted data and the unadjusted data. If the unadjusted data more than doubles but the back-adjusted data does not, then it’s clear we have a reverse split on our hands.

(The only problem will be is if a stock doubles at the same time as it undergoes a reverse stock split but this is going to be a very rare occurrence).

Trading Reverse Stock Splits – Test Results

Now that we know how to find reverse stock splits in the data, we can see what type of performance can be expected after the reverse split takes place.

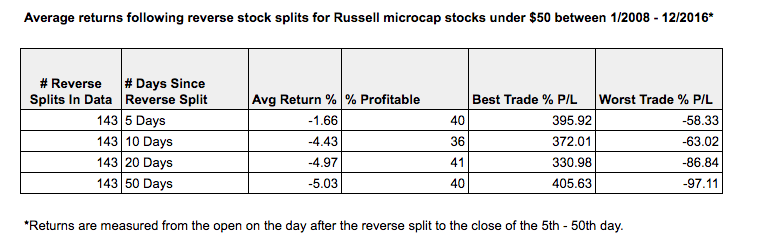

Using the aforementioned code, I analysed the performance of stocks after reverse stock splits over four different timeframes. I focussed my research on the Russell MicroCap universe between 1/2008 – 12/2016 and I filtered out any stocks trading over $50. The analysis also includes delisted securities but commissions are ignored at this stage:

As you can see from the table above, investment returns following a reverse stock split are generally negative.

The average 5 day return following a reverse stock split was a loss of -1.66% with only 40% of stocks giving a positive return over that time frame. Over 10 days, the average return was even worse at -4.43% with a 36% win rate.

Over 20 days, the average return was a loss of -4.97% with a 41% win rate. And over 50 days, the average return following a reverse stock split was a loss of -5.03% with a 40% win rate.

Although the majority of cases saw negative returns, a handful of companies went on to triple digit gains. These were the exceptions to the norm.

Reverse Stock Split Examples

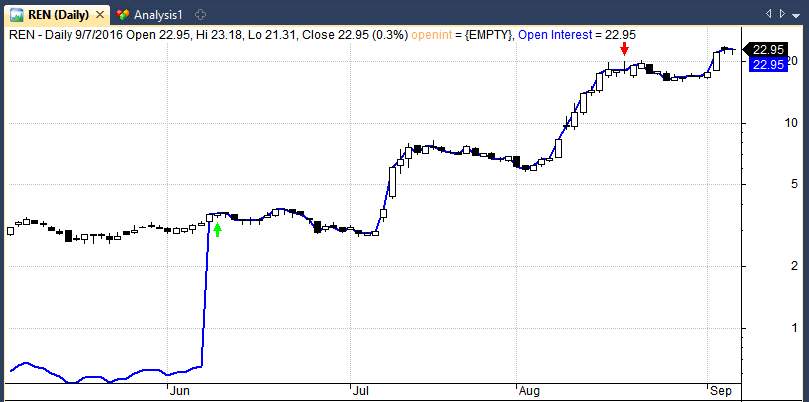

Following are some of the trade examples taken from the analysis conducted above:

Building A Trading Strategy For Reverse Stock Splits

The analysis shown so far suggests that buying stocks after a reverse stock split is a poor choice and investors would have more success by going short. That is, short the stock after the reverse stock split takes place and then buy it back some days later.

This strategy, therefore, relies on listening to announcements and reading the news every day so that you don’t miss a reverse split announcement.

Use Alerts

One option to do this effectively would be to use a breaking news service like Accern. By using the term ‘reverse split’ as a filter, it should be possible to find and get alerted to these opportunities before other investors.

Another option would be to set up Google Alerts and use a similar search term to scan the news daily.

Limitations Of Shorting

Although the analysis so far shows a compelling reason to avoid reverse split stocks and go short, we should also consider some of the limitations of this method.

The major one is that short strategies are notoriously risky. If you are short a stock and have no stop loss in place you could incur a loss with no theoretical ceiling. And even if you have a stop in place, it will not get filled if a large move takes place overnight.

Furthermore, if you are short an illiquid stock, the stock can gap above your stop loss.

Short strategies are also difficult to simulate. Shorting a reverse split stock from the microcap universe may generate a 10-day average return of 4.43% in the back-test but that assumes we were able to find shares to short in the first place.

In reality, many microcap stocks are not easily shortable and in a back-test we have no way of knowing which ones we can and can’t short.

Furthermore, the analysis so far does not include slippage and commissions yet, which can be substantial for low priced stocks. This is the logical next step in the analysis.

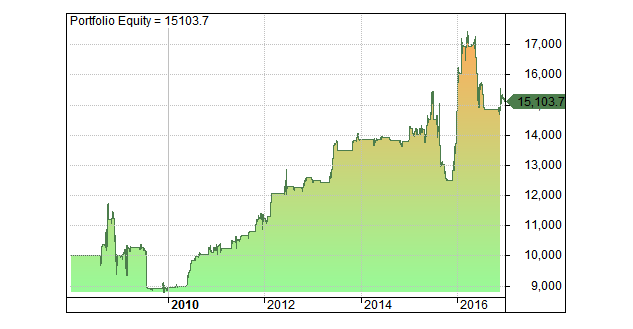

However, I did conduct a back-test using commissions of $0.05 per share and I recorded an average profit of 3.52% from shorting – still good:

The fact is that back-testing these securities is problematic so extra caution is advised. Shorting stocks can be very risky in low priced and low float securities. These stocks can run up fast on surges of volume and manipulation so a good dose of discretion must always be used.

Indeed, this happened just recently in the case of ETRM. Historically, such sharp moves after a reverse split have been extremely rare – but you never know how the future will unfold. So bets must be kept small and stop losses should be used in order to avoid a dreaded margin call.

Conclusions

Our analysis shows that investment returns following reverse stock splits are generally negative. Thus, the data indicates that the conventional wisdom regarding reverse stock splits is correct!

Investors are right to be dubious about companies undergoing such events and should generally try and avoid them. Furthermore, if you own a stock that goes through such a process it could be a bad omen.

The information suggests that a short selling strategy following reverse stock splits could be effective. However, traders should also remember the risks of shorting low priced companies and keep their bets small.