Recently a study called Bitcoin Speculation or Value Creation was published looking at how individual stocks react to the news that their firm is investing in blockchain technology.

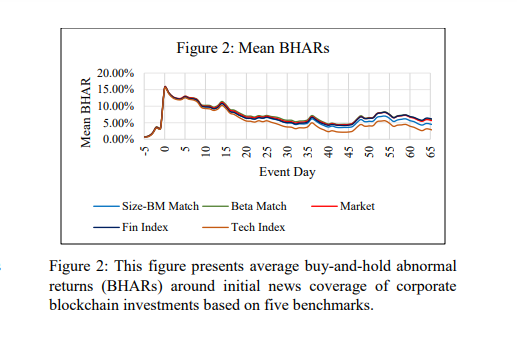

The authors found an average price gain of nearly 15% after the first announcement but this is typically followed by a price reversal over the following three months.

The reaction in price was also found to differ based on the credibility of the company.

In general, market reactions are higher for firms associated with ‘lottery-type’ stocks.

These stocks have higher investor attention and sentiment. However, these stocks also suffered from the largest reversals.

In contrast, blockchain announcements that come at an advanced stage or confirmed in subsequent financial statements are associated with high initial reactions which tend to be permanent. In other words, these stocks appear to suffer little or no reversal afterwards.

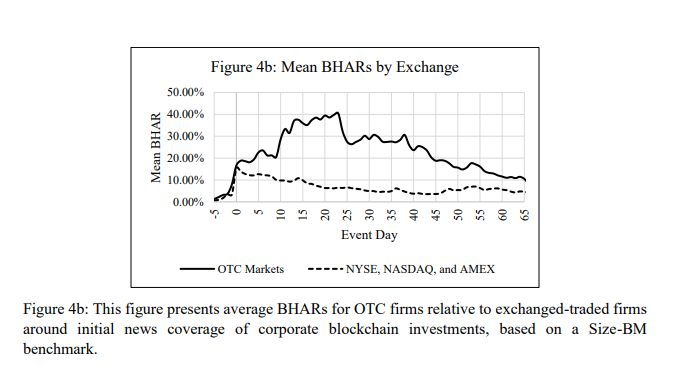

Similar findings were found for OTC stocks though the reaction was more delayed and the reversals larger.

As well, once a company announced a blockchain initiative, that stock went on to experience a higher correlation to the price moves of bitcoin.

Let’s look at this research in a little more detail.

1. Data Collection

To collect enough data for this study the authors searched the Dow Jones Factiva global news database for all news articles containing the word ‘blockchain”.

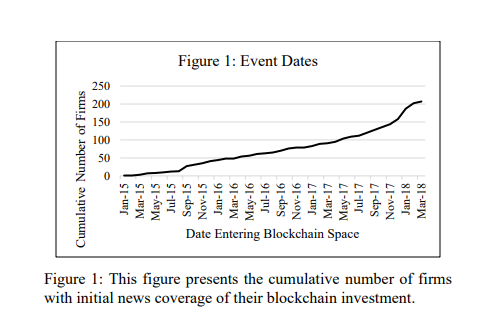

Through October 2008 to March 2018 they found over 47,000 news articles mentioning a total of 584 NYSE or Nasdaq listed stocks.

Out of those 584, the authors found that 217 firms could be linked to a blockchain investment and 207 had enough data for reliable analysis.

The first blockchain article date for each firm was used as the announcement/ event date and investment returns were calculated for each of the 207 firms.

The authors also provided a supplementary analysis of 220 OTC-listed stocks that are typically smaller, less liquid and more difficult to trade.

2. Methodology

To get a reliable analysis the authors calculated buy and hold abnormal returns (BHARs) over several different windows, from initial reaction to three months out.

The following three types of windows were considered, with event day 0 defined as the announcement date:

- The initial reaction (-1, +1) and (-5, +5)

- The post-announcement reaction (+6, +22) and (+6, +65)

- Combined window (-5, +22) and (-5, +65)

The buy and hold abnormal return (BHAR) is the firm’s return during the window period minus a benchmark’s return. The authors used five different benchmarks:

- Portfolios matched on size to and book-to-market

- Portfolios matched on beta

- The CRSP value-weighted index as a proxy for the overall market

- The iShares financials ETF (IXG)

- The iShares global tech ETF (IXN)

The authors also decided on three variables to identify which announcements were more likely to be subject to speculative trading.

- Lottery-type features. (low prices, high volatility and positive skew).

- Bitcoin sentiment.

- Whether the news is covered by a major media outlet.

In other words, these factors are analysed to see their contribution to the price reaction.

The analysis was also partitioned into two different measures of information revelation: “Preliminary” v.s. “Advanced” and “FinStatement” v.s. “not mentioned in FinStatement”.

The authors also controlled for various firm attributes and time fixed effects using a process called Multivariate OLS.

In other words, they wanted to make sure that the price reaction was due to the blockchain announcement and not some other factor.

3. Summary And Implications

As mentioned earlier, the authors found an initial price reaction to blockchain annoucements of up to +15%:

Judging from this analysis there is a large and immediate stock price reaction to announcements of blockchain investments.

Most of the movement takes place on the day of the announcement which then dwindles over the following forty days.

The price reaction is large enough to give day traders some hope, however, because of the speed of the reaction, they may also find it difficult to compete with news reading algorithms.

OTC firms may represent a better opportunity for retail traders since the price reaction appears more delayed than for exchange-listed firms:

Long-term returns, however, depend on the credibility of the firm’s investment and whether the firm is a likely target of speculative, sentiment driven traders.

Announcements of blockchain investments where the firm subsequently mentions blockchain in financial statements produces stronger initial reactions and no significant reversals over the following three months.

But announcements associated with lottery features or high sentiment firms sees high initial reactions but more severe three month reversals.

In other words, the price reaction is more sustained for higher quality, more credible firms.

4. Final Thoughts

Any research into blockchain or bitcoin will contain some biases due to the newness of the technology.

The first blockchain investment that could be linked to a firm that was mentioned in an article was in January 2015. Therefore, the number of firms (207) and the data period (4 years) is relatively small.

There is also the possibility that price reactions will weaken as blockchain technology becomes more common.

The findings do support the view that blockchain as a disruptive new technology can create value for shareholders.

But at the same time, blockchain announcements can also produce significant overreactions.

Text-driven algorithms probably react to blockchain news stories and bid prices higher. Equally it’s clear that blockchain announcements do get some investors excited.

There are many positive benefits associated with blockchain technology but not all firms that make blockchain investments will reap the rewards.

Therefore investors need to weed out the firms actually creating value rather than those who simply seek to ride the speculative wave.

Firms building real value provide better investing prospects while the rest present shorting opportunities.

You shared an important info.