Trade-Ideas is a stock scanner created with active day traders in mind. The scanner has become quite famous among day traders for its endless customisation, massive amounts of data and prominence among well known day traders.

One of the platform’s main selling points is it’s artificial intelligence engine nicknamed Holly that identifies trading opportunities in real-time. Holly is constantly scanning the market for stocks hitting support/resistance levels, emerging trends, pullbacks within trends, etc.

According to Trade-Ideas, Holly scans through millions of trading scenarios to identify the most profitable setups and notifies you when they’re occurring.

Trade-Ideas also provides multiple signal types to quickly scan for various stock setups.

In this article we take the software for a spin and see if it provides traders with the tools they’re searching for.

Pricing Plans

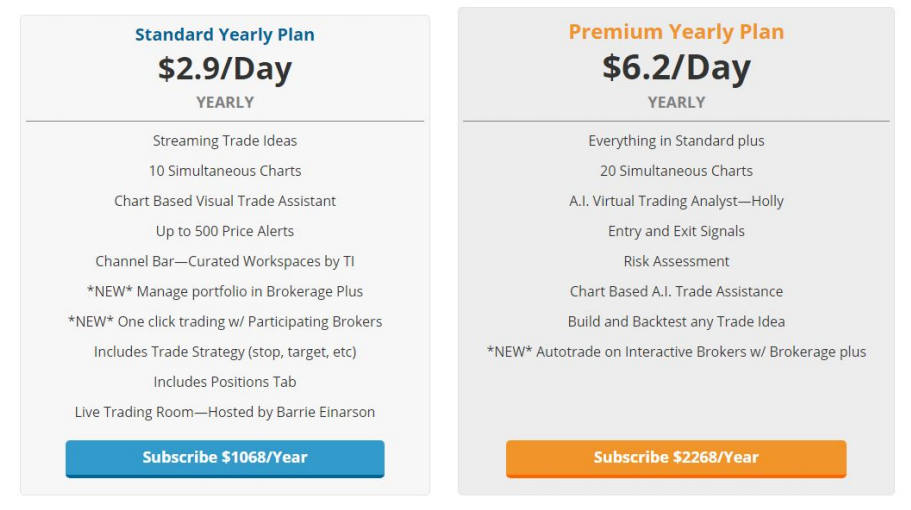

Trade-Ideas has two membership options: standard and premium. You can opt to be billed monthly or yearly, with the yearly pricing being discounted.

The Standard Plan costs either $1,068/year ($89/month) when billed annually, or $1,416/year ($118/month) when billed monthly.

The Premium Plan costs either $2,268/year ($189/month) when billed annually, or $2,736 ($228/month) when billed monthly.

The key difference between the standard and premium plans is the inclusion of Holly AI in the premium plan. But there’s also additional risk analytics, backtesting, and the ability to use (more) charts simultaneously.

Here’s how Trade-Ideas breaks down the difference between their plans:

Trade-Ideas also offers an automated trading service called Brokerage Plus. The service allows you to auto-trade strategies that you create within Trade-Ideas.

I did not look into this but it could be an interesting feature for traders looking to automate trade strategies.

A lifetime license to the service costs $1,100. Interactive Brokers is the only brokerage that currently supports Brokerage Plus.

Trade-Ideas Features

Trade-Ideas is best described as a powerful real-time scanner. But it has plenty of additional features and new tools are being included over time.

1. Oddsmaker: Event-Based Backtesting Tool

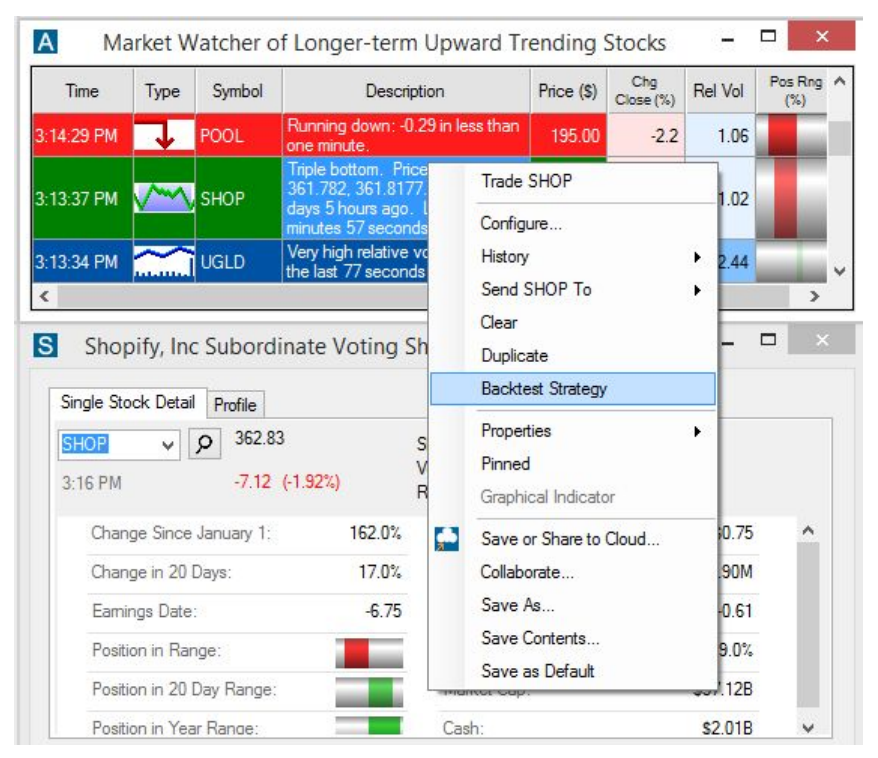

Trade Ideas calls OddsMaker their Event-Based Backtesting Tool. In other words, the tool allows you to establish a set of parameters like a triple bottom or a cross above resistance and test it against the entire market.

The tool is simple to use. If you want to test an existing strategy that is already built into Trade-Ideas, like triple bottoms, it’s as simple as right-clicking on the strategy and clicking backtest:

From there, you can set some additional parameters.

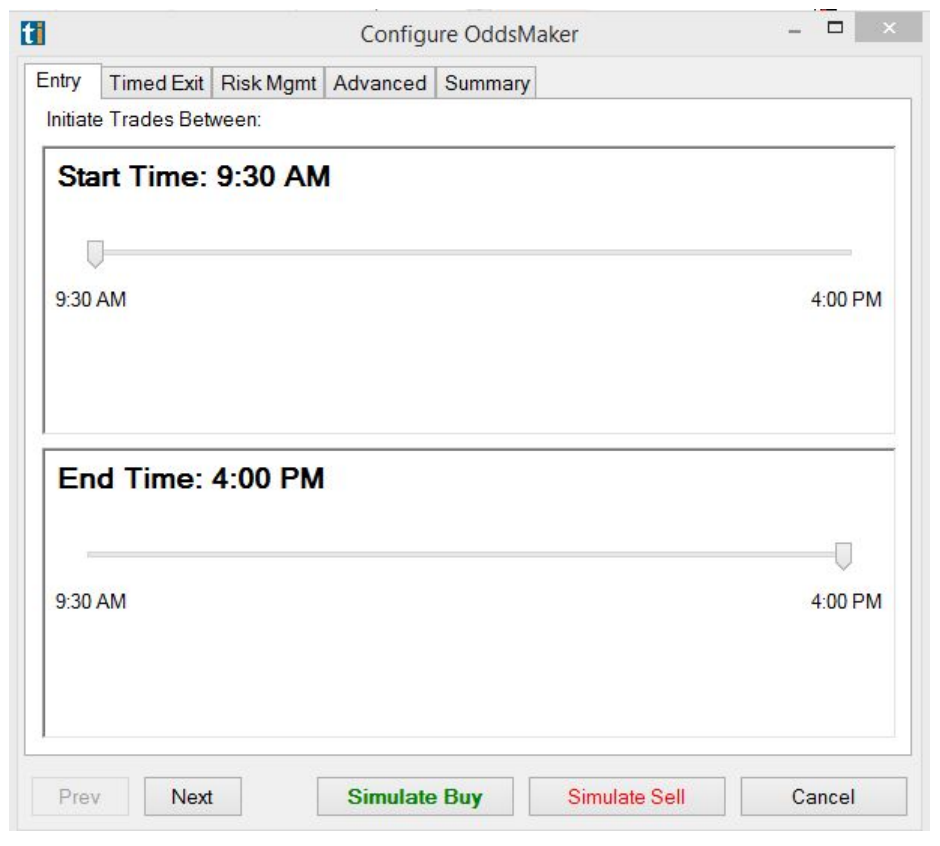

First, you set the time of day that you’d like to take trades during:

Next, you choose some parameters for your trade exit. You can set a few types of exits, whichever happens first is executed. For example:

- Time-based exit

- Trailing stop

- Profit target exit

- Stop loss exit (exit when a fixed percentage or dollar amount is lost).

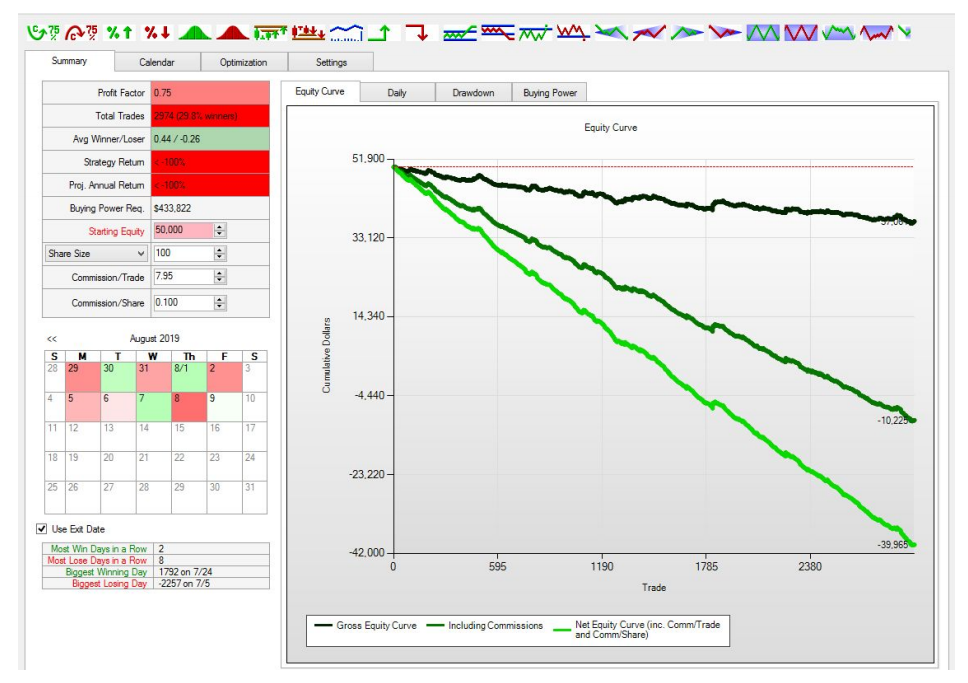

Following is an example backtest I ran on a triple bottom strategy. I kept the parameters simple. A 0.5% trailing stop, and close all trades at market close. Let’s see how the results come out for a long-based strategy:

As you can see OddsMaker provides plenty of analytics to dive into and this triple bottom strategy is a big loser. That’s good to know because if you’d traded it without this knowledge you would have lost money.

OddsMaker has the ability to backtest 100 signals a day, however, a major downside is that backtests only go back one financial quarter.

2. Pre-Configured Scans

The scanner is probably Trade-Ideas’ most powerful feature and it’s abilities stray far beyond the pre-configured scans included with a membership.

However, I do get the sense that a large portion of Trade-Idea’s customers never stray outside of the presets, so it’s important to cover them here.

The most prominent presets are: Social Media and Alpha Predator.

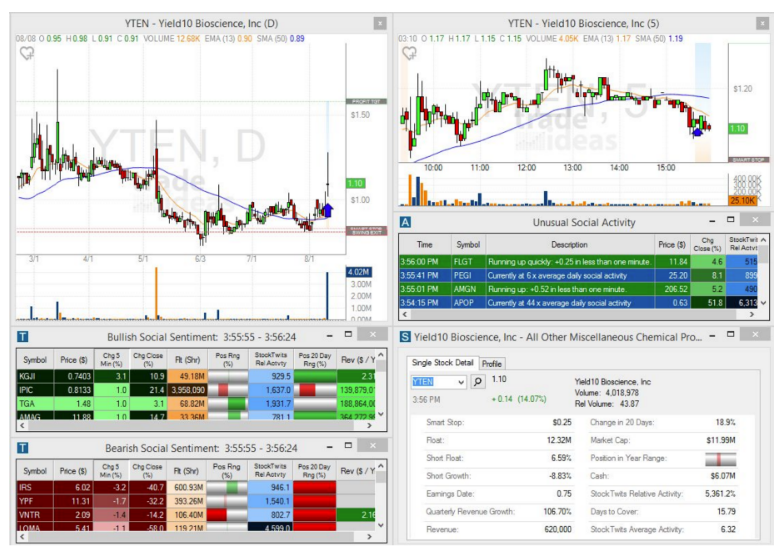

Social Media Scans

This preset scans social media channels like Twitter and StockTwits for unusual activity. The logic is that, if traders are buzzing about a stock on social media, it can sometimes be predictive of future market moves.

The channel has three main windows that provide trade ideas: bullish social sentiment, bearish social sentiment, and unusual social activity.

The sentiment tool scans social media platforms and interprets the sentiment of the chatter. The stocks with the highest ratio of positive to negative comments show up on the bullish social sentiment window, and vice versa for the bearish social sentiment window.

The unusual social activity tool simply keeps track of the average amount of chatter each stock receives on a given day, and there’s an unusually high amount of chatter about a stock, it shows up on the unusual social activity window.

Here’s what the window looks like:

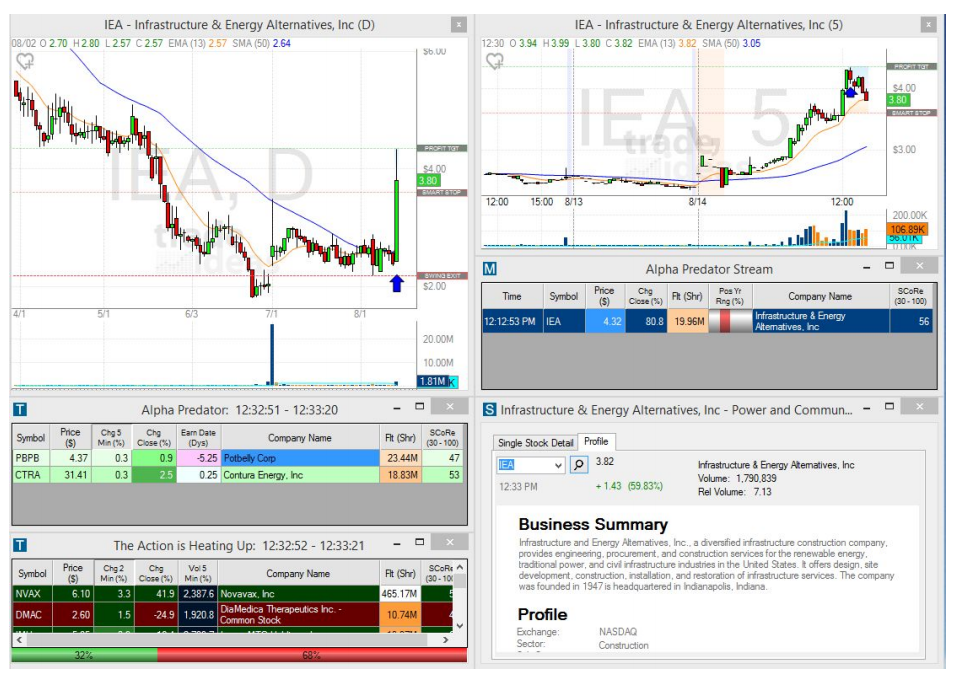

Alpha Predator Scan

Alpha Predator is a momentum-based strategy that looks to buy pullbacks within uptrends of momentum stocks. The exact criteria of the strategy is proprietary but, Trade-Ideas claims the strategy uses several filters like moving average crossovers, price changes, and candlestick patterns.

This channel only features three idea windows: the Alpha Predator Stream, which is where triggered Alpha Predator trades go, Alpha Predator, where highly likely Alpha Predator setups go.

Lastly, there’s The Action is Heating Up, a window that streams momentum stocks to watch for possible Alpha Predator setups.

3. Building Custom Layouts

Trade-Idea’s capabilities go far beyond the pre-built channels in the default layout. If you have specific criteria that you need streaming ideas for you, it’s almost certain that Trade-Idea’s can do the job.

For example, let’s create a very simple new layout revolving around a volume-based trading strategy:

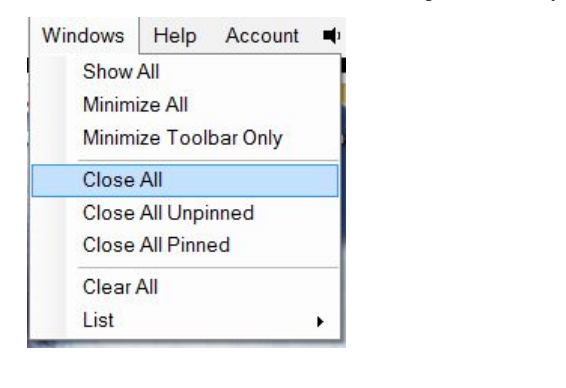

1. First, we’ll click Windows > Close All to get a fresh layout.

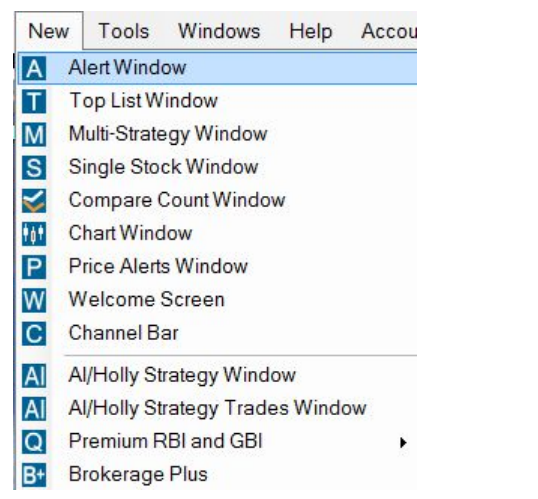

2. Next, create a new Alert Window.

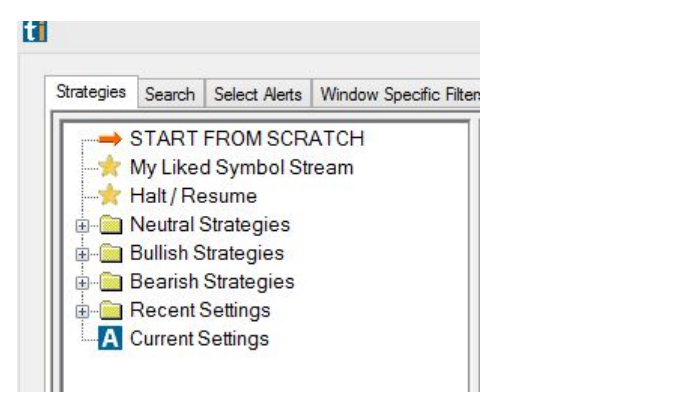

3. Double click the START FROM SCRATCH strategy preset so we can begin a fresh alerts window.

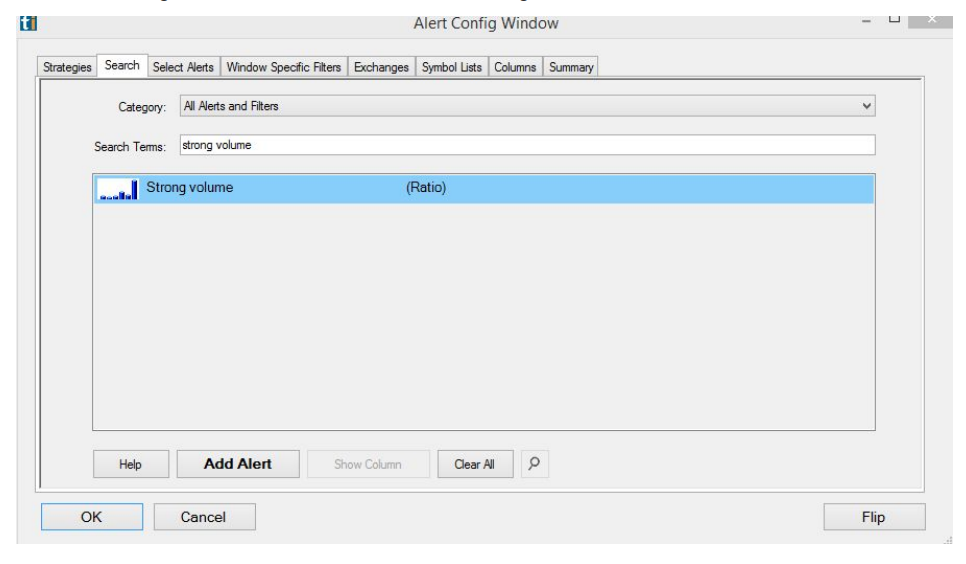

4. Navigate to Search and search for “Strong Volume” and add the alert.

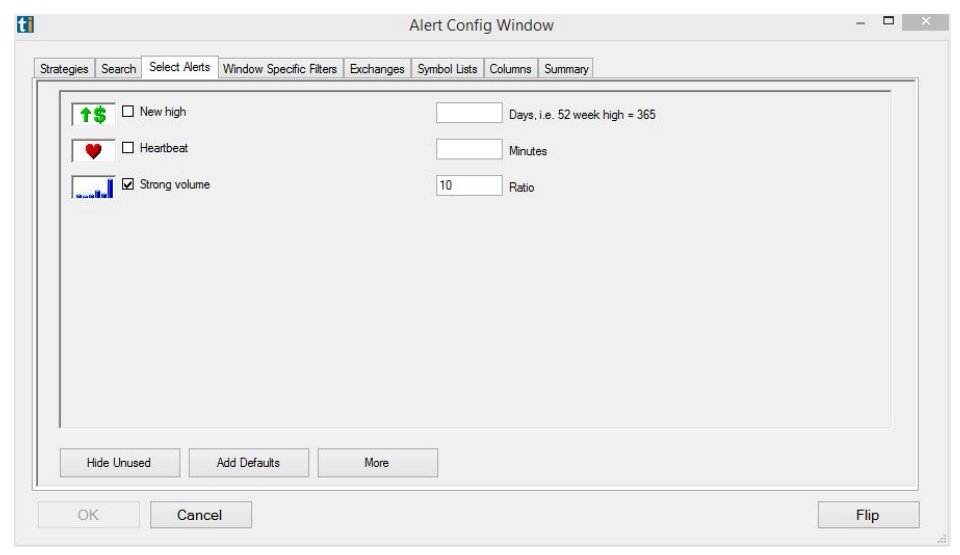

4. On the Select Alerts tab, tick the Strong Volume radio button and enter a 10:1 ratio in the box.

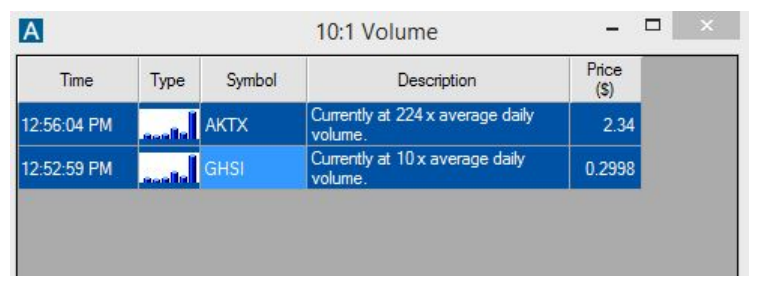

In a few steps, we’ve created our own alerts window that streams stocks trading at 10 x or more their average volume levels:

In addition to creating your own layouts, you can load created layouts from other traders.

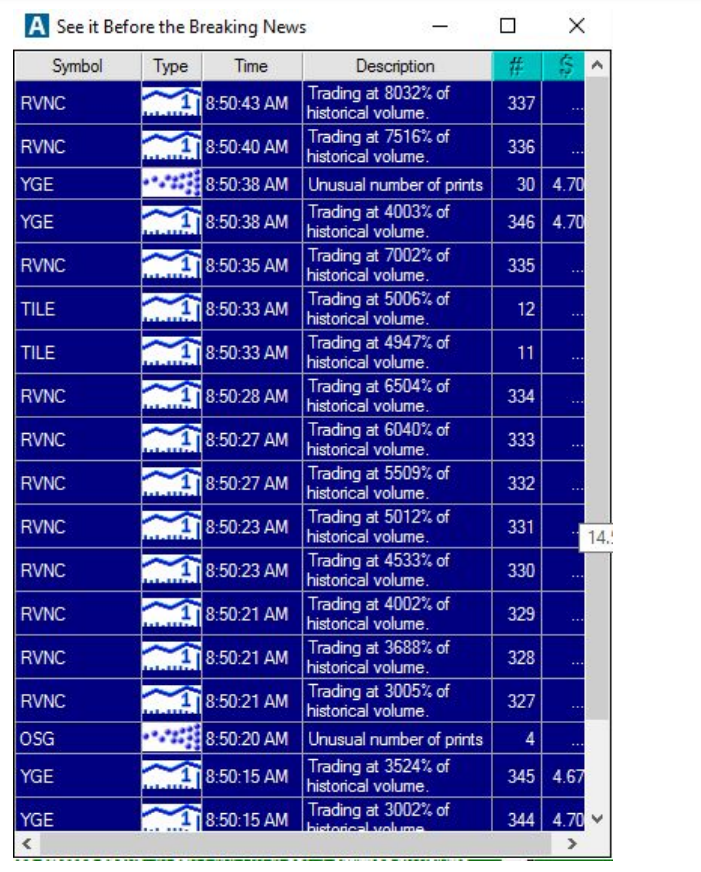

TraderMentality wrote a post with several links to useful layouts and windows, like the See It Before the Breaking News window, for example:

4. Holly AI

Holly is at the forefront of Trade-Ideas’ marketing. It’s clear that they see her as their competitive advantage.

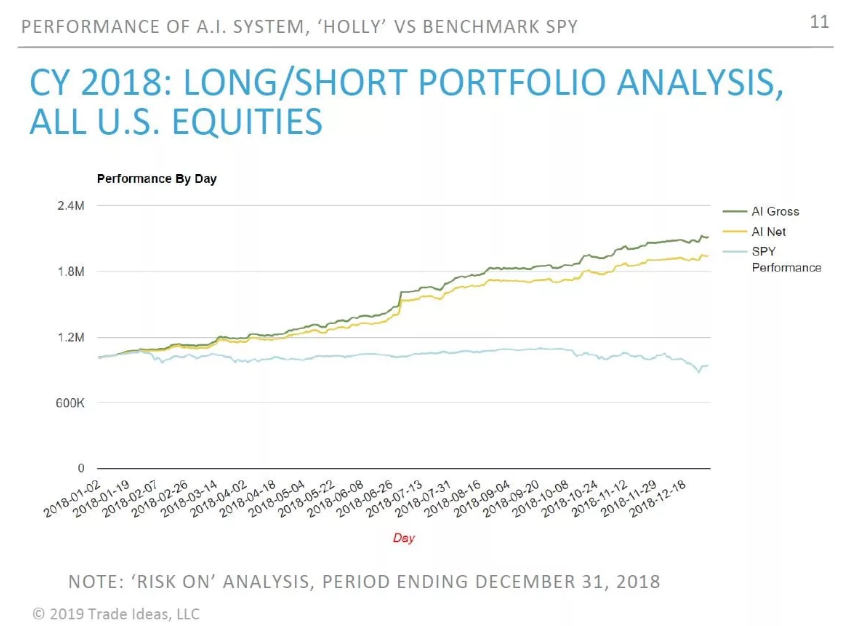

Holly’s trading signals are reported to have made strong returns the last few years. One article states the AI returned 94.1% in 2018 in “risk-on” mode, and 32% in “risk-off” mode. (We will look more closely at Holly’s results in a second).

Holly looks at 35 different concepts to generate trade signals, including fundamentals, social, technicals, volume, valuation, etc.

“I take these 35 strategies and look at all the special Trade-Ideas filters to decide what I should modify to improve the outcome. After the initial Optimization process, I then teleport to Monte Carlo and redo everything again. Only then I know I am not fooling myself.”

– Trade-Ideas Website

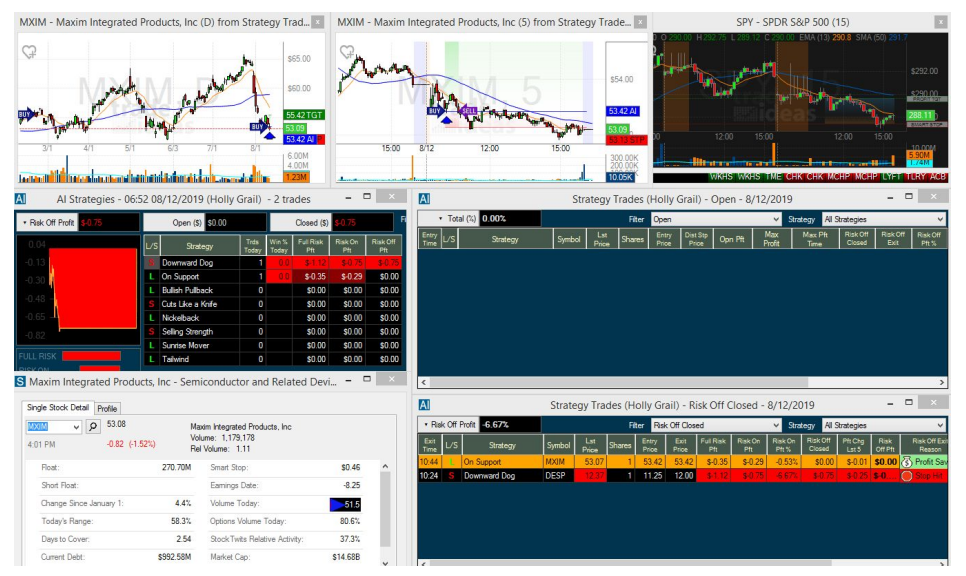

Premium members get three versions of Holly: the original Holly, aka the “Holy Grail,” Holly 2, a more aggressive version of the original Holly, and Holly Neo, which uses techniques still in development by TI.

Holly implements several different trading strategies, like the 5 day bounce, the alpha predator, strong stock pulling back, and volume doesn’t lie. You can view the entire list of strategies here.

Here is what the Holy Grail screen looks like:

The screens for both Holly 2.0 and Holly Neo are similar.

Each AI system has a risk-on and risk-off mode. Risk-on is essentially a more aggressive system, often staying in positions longer than the trade rules dictate.

Here are some performance metrics for the AI system from the first half of 2018:

- Total trades, Q1 & Q2 2018: 1,811

- % Winning Trades: 44.9%

- Profit Factor: 1.77

- Sharpe Ratio: 5.92

- Benchmark Return, SPY: 3.0%

Our Analysis of Holly’s Trades

While Holly reports excellent trading results, it’s always prudent to approach such claims with a healthy dose of skepticism.

After all, if the results are as good as they say then Trade-Ideas and it’s customers would be keeping quiet about all the profits they’re making.

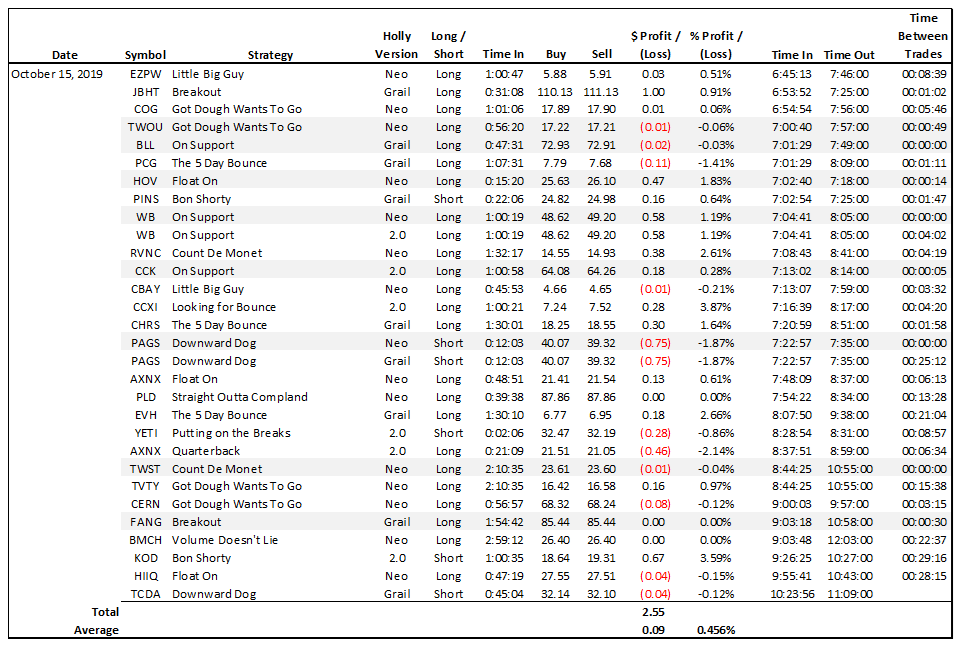

To investigate, we ran an experiment over two weeks and recorded every trade from each of the Holly algorithms.

Summary Of Results

Based on a short, two-week study we came to the conclusion that Holly is a useful companion for day traders.

However, we feel that the average retail trader would probably not be able to duplicate the algorithm’s results.

1. Can You Duplicate The Results?

The reason we believe it would be difficult, if not impossible, to duplicate the algorithm’s results are that a human being operates in the physical world. A computer run by software does not.

While the computer can execute trades in the blink of an eye (or faster), a human being cannot.

As a result, a retail trader following the signals would be reacting to them after the computer has already executed them.

That time gap would create price risk (or opportunity) for the retail trader. Therefore, it is highly unlikely that he or she would receive the same execution as the computer. This is especially the case when trade recommendations virtually overlap one another.

The table above highlights (in grey) the number of instances (on this one day) where trade recommendations were generated less than one minute apart. This was a common occurrence during our study. It happened frequently every day.

The volume of trade recommendations generated by the algorithm, the speed at which they were generated, the time required for a person to execute trades, and the number of instances where trade recommendations overlapped each other leads us to the conclusion it would be impossible for a retail trader to duplicate the results generated by the algorithm.

If a trader is able to auto-trade the signals via an API then the story may change, however, this is not a given and there are still big question marks over slippage since we are mostly dealing with low float stocks.

2. Can You Profit From the Recommendations?

Even if a retail trader were able to closely approximate the average results of the algorithm, based on what we observed, it seems unlikely that the endeavour would be very profitable.

The volume of recommendations would expose the trader to significant transaction and slippage costs.

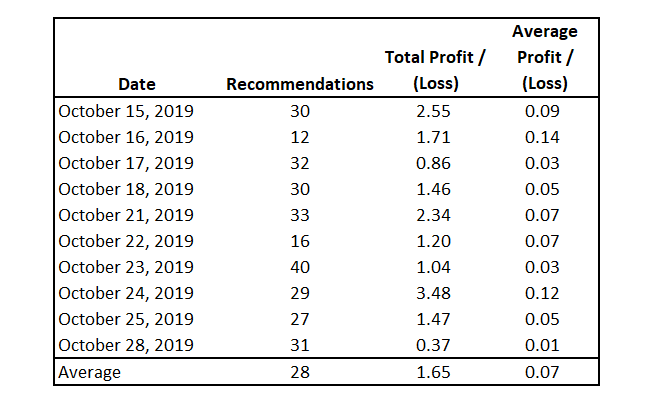

For each recommendation there is a buy order and a sell order. The table below illustrates the number of recommendations we observed:

In this two-week period, the algorithm generated 280 recommendations. That represents 560 separate trades; 280 buy orders and 280 sell orders.

During this time the algorithms generated an average profit of 0.30% or $0.07 per trade.

Assuming that a retail trader would be able to execute trades for just $4.95 (common among US discount brokers), it would not be possible for him or her to make a profit unless the number of shares traded was approximately 150.

Assuming an average share price of $34.61, a position size of approximately $10,000 would be needed to generate an average daily profit of less than $2.00 without leverage.

A trader would therefore need a broker that provides significant margin (more than the 50% available with Interactive Brokers).

Overall, it seems unlikely that any significant profits would be made due to the slippage that would no doubt take place on many of the trades.

Bear in mind that this is a very short study and there is the possibility that the AI is more profitable than shown here.

One possibility for future analysis is that trade profits seem to be larger when all three algorithms line up together.

The following link will take you to a Google Sheet containing a record of all trades reported in our study:

Trade Ideas Performance Google Sheet

Positives And Negatives

In my experience, and having used dozens of different stock screeners and scanners, Trade-Ideas is the one of the best and most comprehensive scanners available to retail traders.

The preset channels, backtest capabilities and hundreds of filters mean traders have almost infinite possibilities for scanning technical trade setups.

There are not many scanners that are able to provide such functionality within the small cap niche which is why it has become so popular among small cap and penny stock traders.

Furtheremore, Brokerage Plus looks like it will give traders the ability to automate trade setups without complex programming required.

However, another reason for Trade-Ideas popularity stems from an attractive affiliate program available for online promoters.

Another negative for Trade-Ideas is the backtest history in the OddsMaker which extends to only one financial quarter.

Personally I am not against short backtest histories if you can get a large enough sample size (and you can get a large sample given 100 potential trades a day) but one quarter is likely to be too short for most traders.

Lastly, in our opinion the Holly AI is unlikely to provide significant profits for real traders after the effects of execution lag and slippage in small cap stocks.

Final Thoughts

What it comes down to is that Trade-Ideas is not a holy grail software or trade signal service. Trade-Ideas is simply a powerful scanner tool for short-term traders.

Like any tool to get the most out of Trade-Ideas requires some time learning and working with the software and making it your own.

Trade-Ideas is not cheap but it does bring tools that will be worth it for certain types of traders. Day traders operating in the small cap niche will no doubt get a lot of value out of the service because the product serves their needs well.

Is it right for you?

The only way to find out is to take Trade-Ideas for a test drive and see for yourself.

We give it 4/5.

Nice review! I’ve always been intrigued by the value proposition of Trade Ideas, but never took the plunge to evaluate. Thanks for doing this and sharing your results!

Thanks. I took the demo then TI extended it for a couple of weeks so I could write this review.

I have TI. The real power is in developing a manual scan, validating the scan candidates and then taking the trades. No AI is going to trade for you automatically at least at the price that TI lease the product.

The problem is in developing a scan that can spew good candidates and for that you need to be able to think like a profitable trader and use criteria that will work in the market.

Thanks for your input.

Amazing review. But from the perspective of someone who connected Brokerage Plus to Holly’s live trading for several months, it did nothing but bleed money and I almost lost my account over it. It would choose ghost town stocks and I’d lose up to 50% or $500 at a time on slippage. They are very dishonest to benchmarket to SPY which has no slippage, and then factor out slippage. This might work if you take their very top strategy picks each day, but just going live with everything will wreck, your account, but you’d never know that from all the affiliate marketers who never even tried it!

You would need their 5k/month professional package to add filters to the AI strategy so it doesn’t put you in zero volume stuff. Zero volume! Holly’s edge is in picking stocks that have no reality like an abstract game. Over a third of them are untradeable and it will throw you in stocks with a float under 500k. But what you could do is let it do that and then give you a chance to scale the positions. This worked ok for me. The stocks would also usually lose for the first 5 minutes, which tells me there is big money trading against this.

Thanks for your valuable input. Let’s hope more people realize the problem with this algorithm.